Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective.

Earlier today, the black gold rebounded sharply and broke above the upper border of the trend channel. Will we see further rally?

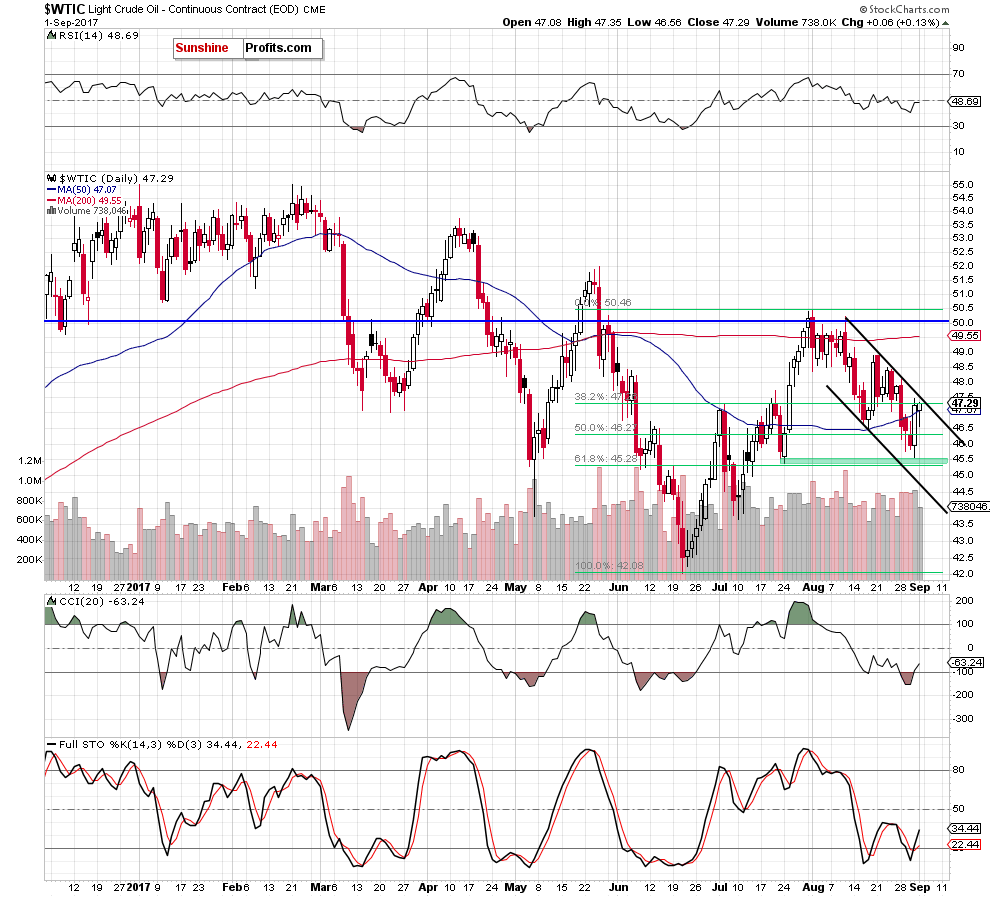

Crude Oil’s Technical Picture

Let’s take a closer look at the chart below (charts courtesy of http://stockcharts.com).

Based only on Friday’s price action, we could write that the situation hasn’t changed much as light crude remains in the black declining trend channel.

However, earlier today, the commodity moved sharply higher and broke above the upper border of the black declining trend channel. Although this is a positive event, we should keep in mind that Friday’s move materialized on smaller volume than earlier declines - similarly to what we saw on August 18. Back then, the sharp increase wasn’t confirmed by volume, which resulted in a reversal and later declines.

Therefore, it seems justified to wait for today’s closing price and check the size of volume, which will accompany today’s upswing.

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts