Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. In other words, our short position was closed, and we took profits off the table.

The oil bulls eventually proved their mettle yesterday, leading black gold over important resistances just ahead. The short-term outlook appears to have shifted and the daily indicators have a thing or two to add on that matter. Let's explore the full technical picture.

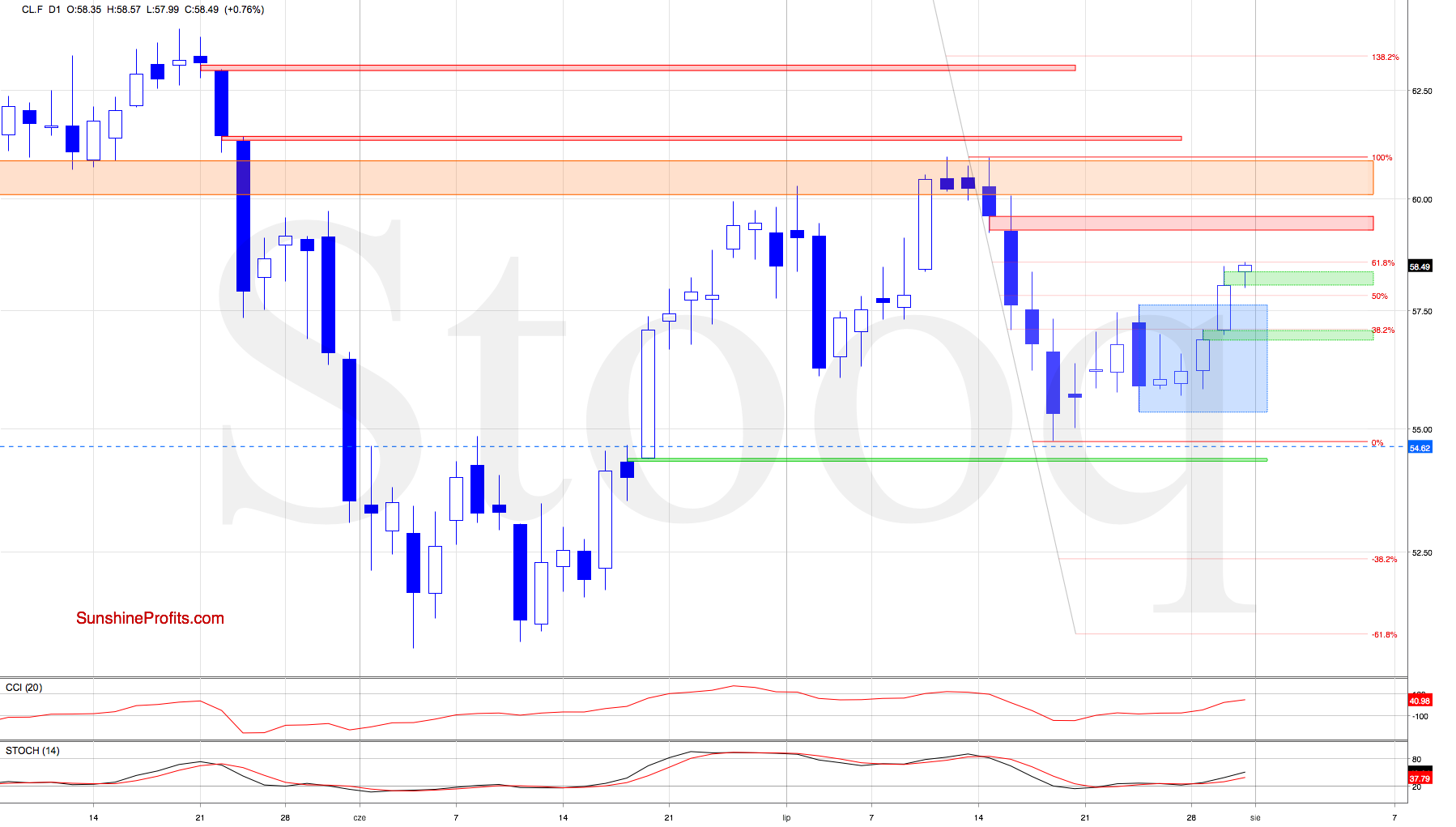

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ).

Yesterday's session took crude oil futures above the upper border of the blue consolidation, which is a positive development for the bulls. The bulls earlier today took the baton and opened the day with another green gap, extending gains to the 61.8% Fibonacci retracement.

Today's upswing means that the oil futures reached our stop loss order closing our short positions with a profit (as a reminder, we opened them on July 12 when crude oil was trading at around $60.30).

What's next for black gold?

Taking into account yesterday's breakout above the consolidation and buy signals generated by the daily indicators, further improvement aiming to test the red gap (between $59.26 and $59.58) as a minimum, looks probable in the coming day(s).

Summing up, the bulls overcame their nearby resistances yesterday, and are building upon their gains earlier today. That upswing resulted in profitable closing of our open positions automatically. The bulls can look to test the red gap created on July 16 next - such a move would be supported by the daily indicators.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist