Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

We got a reversal day in oil yesterday. Is that the start of a downswing? Or another false dawn before another leg higher? Let’s not be played for a fool and assess the situation objectively instead. We’re ready for the market to show us its intentions and act on that opportunity.

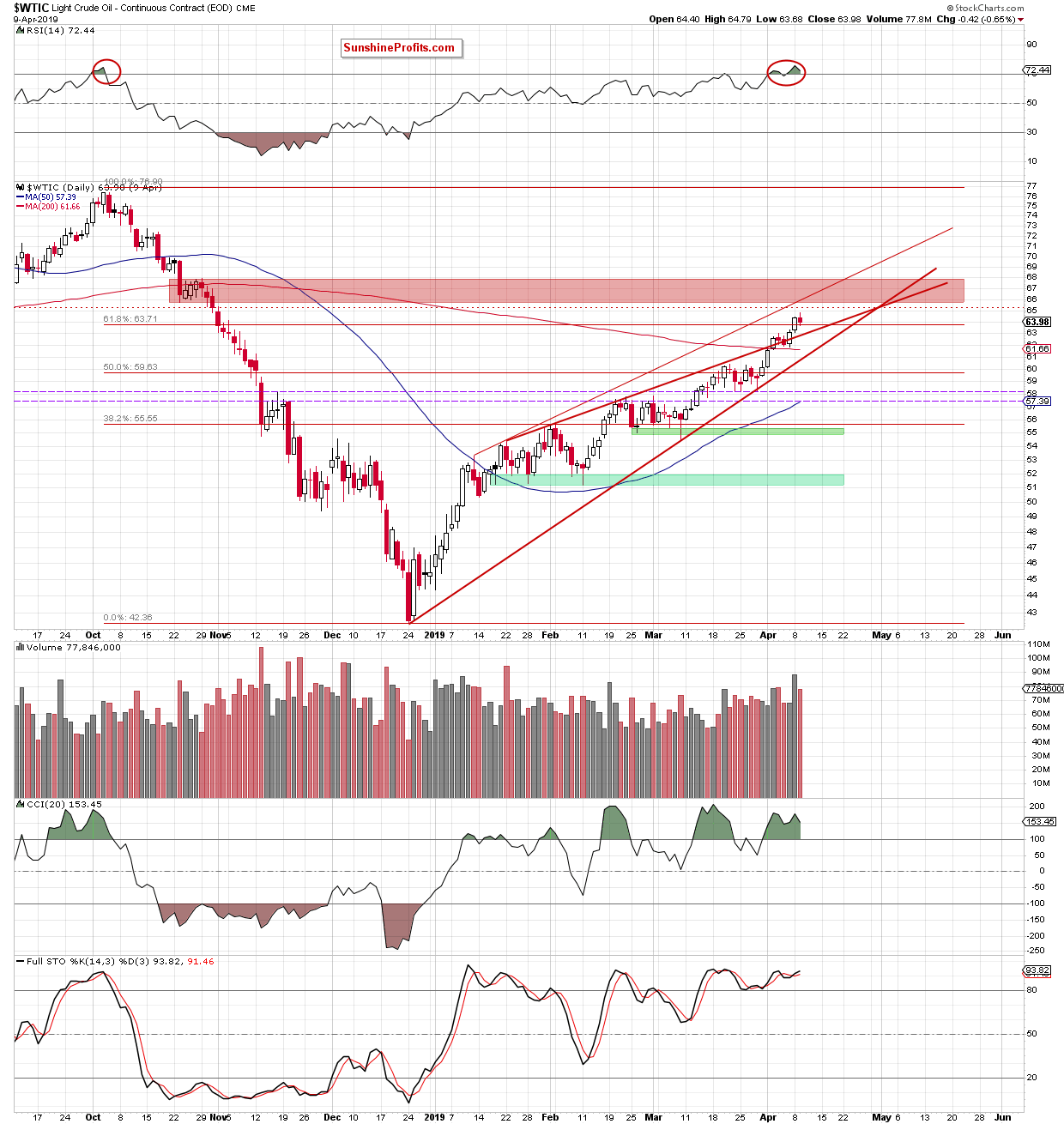

Let’s take a closer look at the chart below (chart courtesy of http://stockcharts.com).

After Monday’s show of bullish force, the oil market experienced a calmer session yesterday. Though we’ve seen a downswing, yesterday’s action looks like verification of the earlier breakout above the 61.8% Fibonacci retracement. Yesterday’s volume doesn’t really show the bears out in full force.

Crude oil remains trapped between the upper border of the red rising wedge and the red resistance zone (that’s the area between roughly $63 and $66).

If we have indeed seen a breakout verification yesterday, a test of yesterday’s intraday peak or even the above-mentioned red resistance zone wouldn’t surprise us in the least in the coming day(s).

Summing up, one more upswing remains probable before we see any reversal. The prudent course of action is to stay on the sidelines and let the market show us when it’s ready to take that tradable move.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist