Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

It seems that after Friday's bloodbath, the oil bulls are attempting to repair the damage. Let's judge objectively their headwinds and tailwinds. Hold on, have we just said tailwinds? Raise your hands who just thought of the Venezuela situation and Saudi Arabian comments. No treats apart from praising on you. But seriously, do the bulls have the power to carry oil higher still?

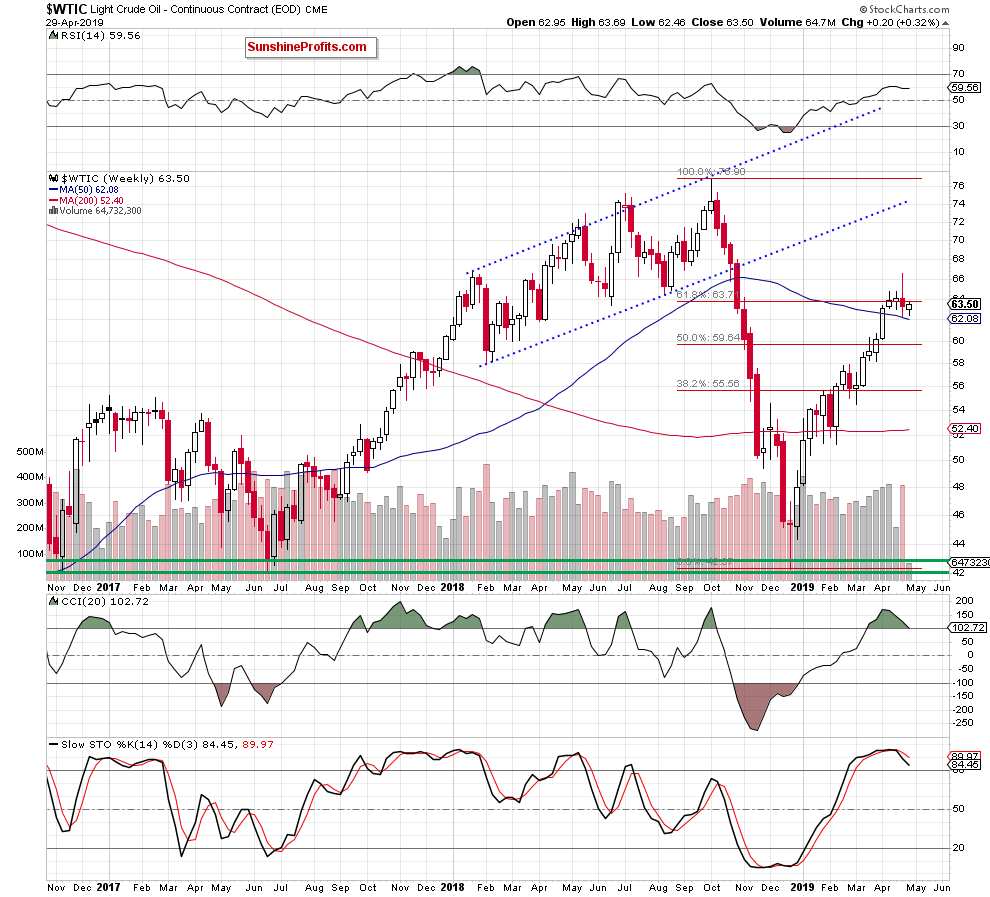

Let's take a closer look at the chart below (charts courtesy of http://stockcharts.com).

The weekly perspective shows that crude oil has moved up so far this week. Despite this upswing however, the overall situation remains almost unchanged. The commodity is still trading below the previously-broken 61.8% Fibonacci retracement.

The current upswing looks like a verification of the breakdown below the 61.8% Fibonacci retracement. If this is indeed the case, we'll likely see a reversal and another attempt to move lower in the coming days.

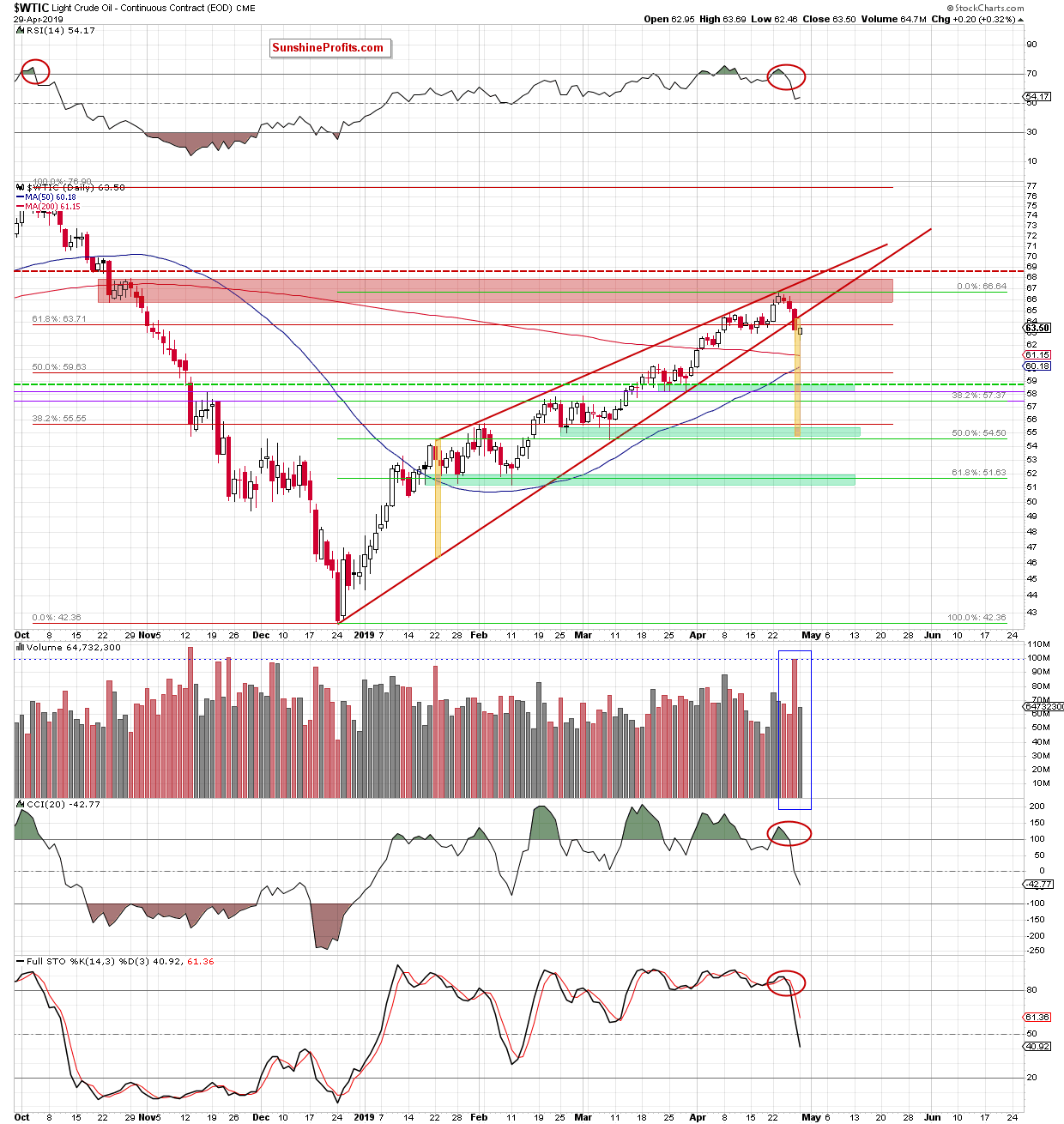

The daily chart reveals that crude oil remains not only below the above-mentioned 61.8% Fibonacci retracement, but also below the previously-broken lower border of the red rising wedge.

Earlier today, the oil bulls are attempting another upswing and black gold changes hands at around $64.20 at the moment of writing these words. The sizable upper knot however points to possibly waning power of the bulls (the daily high so far was $64.75).

Anyway, the current price of $64.20 would mean overcoming the 61.8% Fibonacci retracement ($63.71 on the weekly chart) but not the previously-broken lower border of the red rising wedge. Let's see first where today's session ends exactly and then interpret the full picture.

The daily indicators however continue to support the bears. Also the volume of yesterday's upswing was markedly lower than the volume of the preceding downswing. This is a clue doubting the commitment and strength of the bulls.

Let's discuss the targets of this oil downswing. What we wrote yesterday remains up-to-date also today:

(...) Taking into account the shape of the current decline, black gold could move even lower than the first green support zone. It could visit the second green support zone because there the size of the decline would correspond to the height of the wedge that the oil price has broken down from.

Nevertheless, before we see such price action, an attempt to move higher and a verification of the breakdown below the rising red wedge should not surprise us.

Summing up, today's attempted upswing notwithstanding, the outlook remains bearish. Oil is still trading below the rising red wedge it broke down from. The volume of yesterday's modest upswing was much lower than that of the preceding downswing. The daily indicators are on sell signals. The bearish divergences are in place and the short position remains justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist