Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Oil bulls haven't had their day yesterday. A tireless species, they haven't given up and are attempting yet another comeback today. The price hasn't moved much overall. That should mean not much worthwhile has happened in the market. Wrong! The mounting technical clues have made us take action right now.

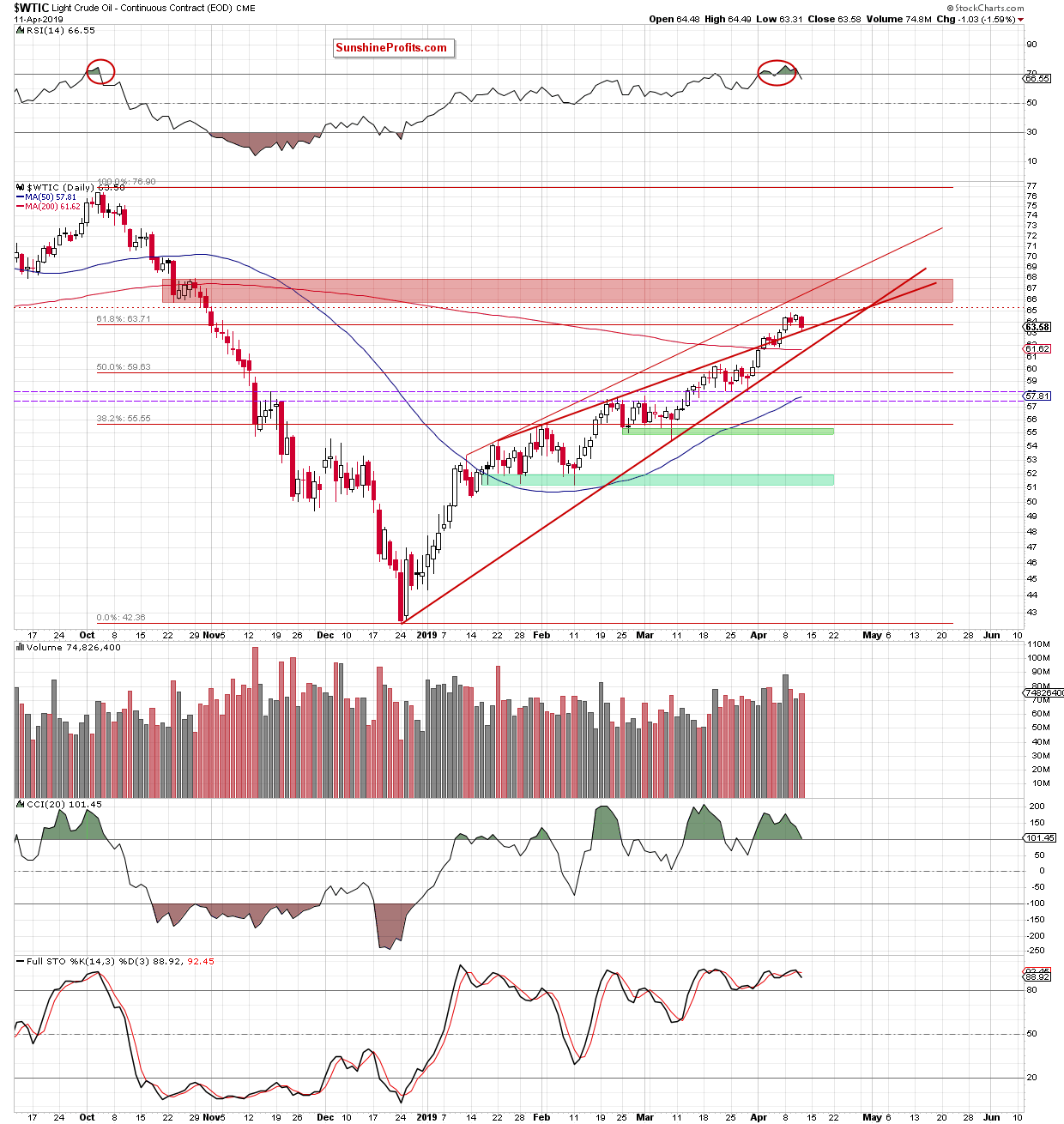

Let's take a closer look at the chart below (chart courtesy of http://stockcharts.com).

We wrote these words yesterday:

(...) On the daily chart, we also see a candlestick with a longer upper shadow. It shows that oil bears are becoming more active in the area of recent highs. The volume of the mostly failed Friday's upswing was also visibly lower than during Thursday's decline.

Additionally, the sell signals generated by the daily indicators support the sellers. Therefore, should we see a daily close below the 61.8% Fibonacci retracement and the upper border of the red rising wedge, we'll likely open short positions.

The situation has developed in tune with the above scenario. Crude oil has closed Monday's session below both supports, invalidating the earlier breakouts. All the sell signals from the daily indicators remain on the cards, supporting the sellers and further deterioration.

Taking all the above into account, we think that opening short position is justified from the risk/reward perspective. All details are just below.

Summing up, the valid question marks over the bullish case for oil have received their bearish answers. They have made us open short positions.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist