Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

This is what the market is telling us. What can we infer about their staying power? Have they managed to change the outlook actually? At least the short-term one? It looks so and we invite you to our most up-to-date assessment and what it means for us going forward.

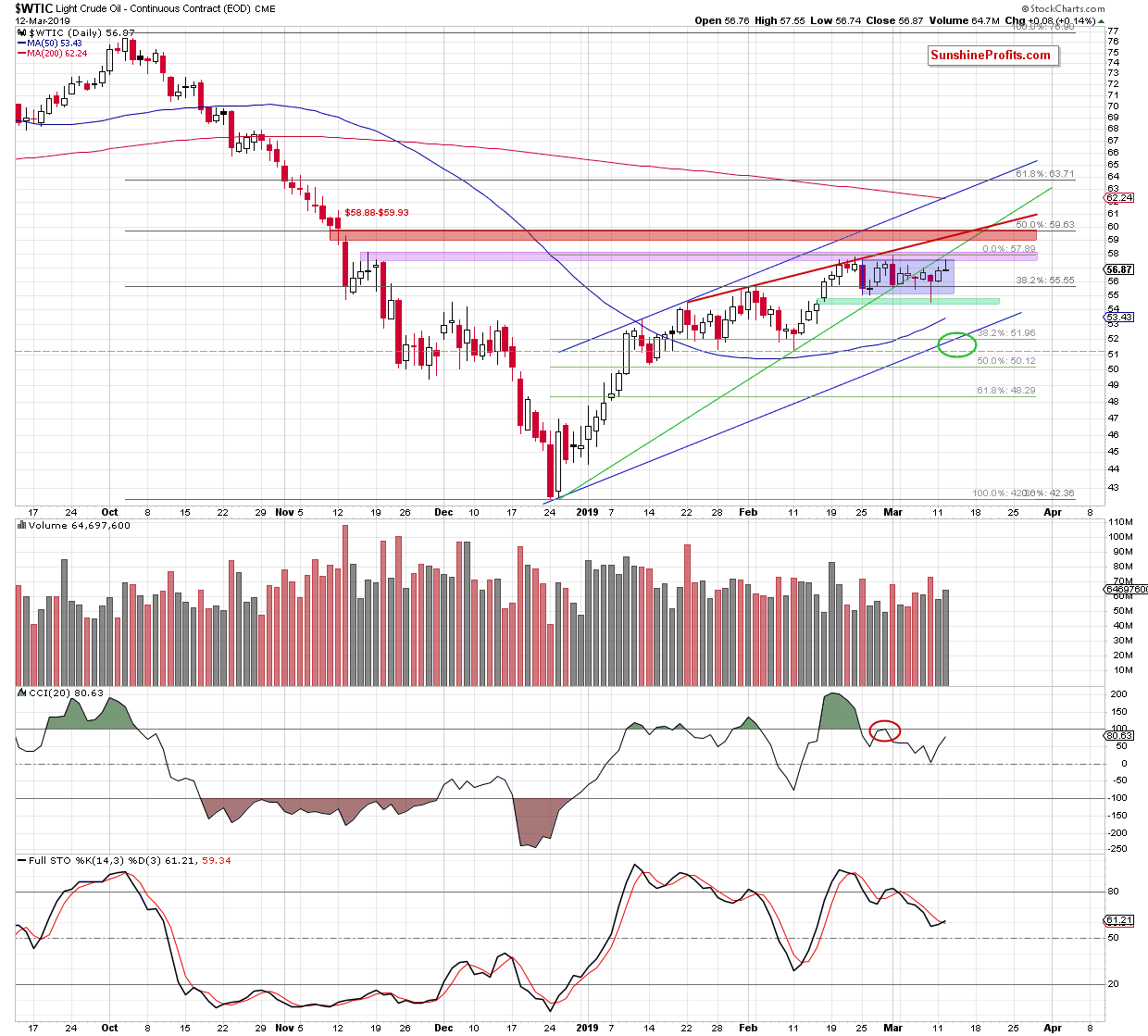

Let’s take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Yesterday, we wrote the following about the green support zone:

(…) it suggests that the oil bulls will be active in this zone and we can’t rule out yet another move higher. One more verification of the breakdown below the rising green support line isn’t out of the question. Indeed, at the moment of writing these words, crude oil is trading at around $57.40.

Yes, the oil bulls fought hard for higher prices. They came within spitting distance of the previously broken rising green support (now resistance) line and also the purple resistance zone marking the Nov 2018 oil peaks, only to give up most of their daily gains. It shows in the chart as the bearishly looking candlestick with a long upper knot.

There was simply no breakout. Yesterday’s session was also marked by higher volume but we’re of the opinion that this is still in line with what can be expected within an upward correction since the unsuccessful attempt to break above both resistances: the rising green support line and the purple resistance zone.

Earlier today, the bulls have set their sights high as the black gold changes hands at around $57.70 at the moment of writing these words. Stochastics invalidated its earlier sell signal and cautiously issued a buy one. This could translate into one more push higher targeting the above mentioned resistances before the bears get their chance to take the oil price lower again.

Summing up, our downside target marked with the green circle remains in play. The oil bears still have the following factors on their side – the late-Feb tiny breakout invalidations, price trading beneath important nearby resistances and the confirmed breakdown below the rising green support line. Current positioning of the daily indicators however doesn’t exclude another push higher from happening first.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist