Trading position (short-term; our opinion): Short positions in crude oil (100% size of the regular trading position) are justified from the risk to reward point of view with $11.22 as the binding profit-take level, and with $33.78 as the stop-loss level. We might adjust this target in the following Alerts.

Yesterday's oil rebound has fizzled out, but what about today? Will oil bulls fare any better?

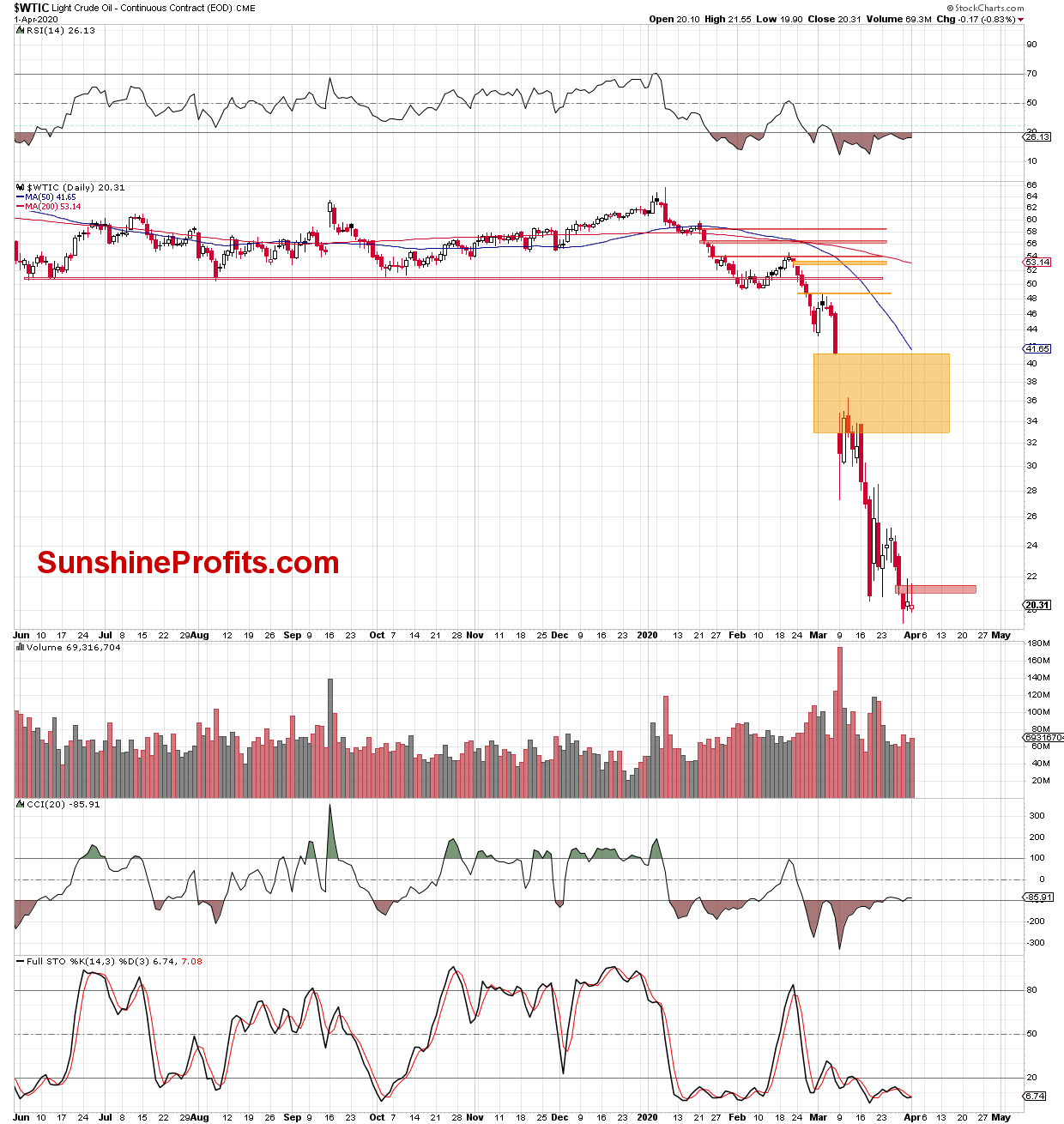

Let's start today's analysis looking at the long-term (chart courtesy of http://stockcharts.com and www.stooq.com ).

The first thing that catches the eye on crude oil's daily chart, is another unsuccessful attempt to close the red gap. Although the bulls were strong enough to push the commodity above $21.50, the very short-term resistance stopped them. A pullback followed, which confirms the involvement of bears in the area of the above-mentioned red gap.

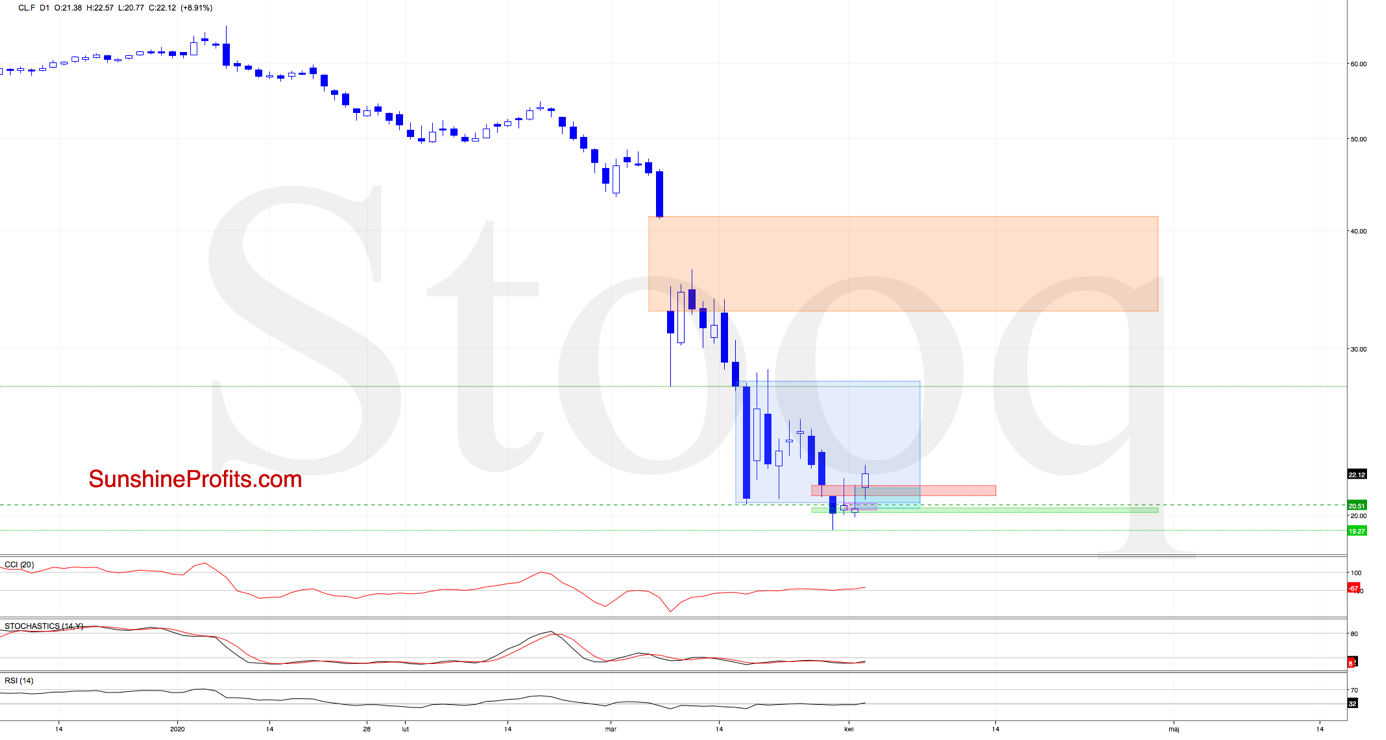

How did this price action affect investors before today's market open? Let's take a closer look at the current situation in crude oil futures.

Looking at the above chart, we see that they opened Thursday with a quite big green gap (mostly caused by rumors about China's plans to increase its oil stockpiles), which resulted in an invalidation of the breakdown below the lower border of the blue consolidation and a test of the upper border of the red resistance gap.

These positive events encouraged the bulls to fight and crude oil futures moved above the gap. Is this a positive event? Yes, but only at first sight.

Why? Because, in our opinion, as long as there is no daily close above the gap, we can't take premarket trading developments for granted.

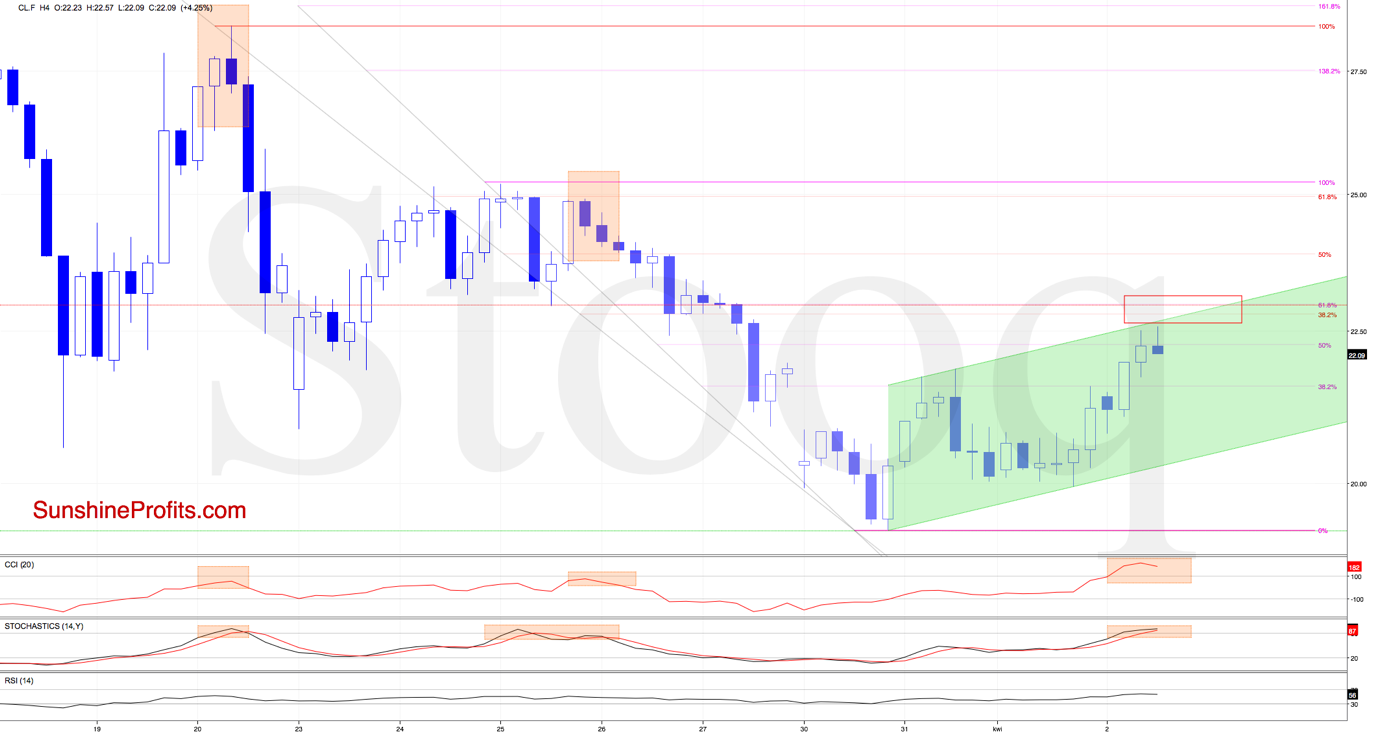

Additionally, the 4-hour chart shows several factors, which the bears can take advantage of later in the day. What do we mean by that? Let's focus on the chart below.

From this perspective, we see that the recent price action took crude oil futures to the upper border of the green rising trend channel, which serves as the nearest resistance.

Additionally, there are two important Fibonacci retracements slightly above it: the 38.2% and the 61.8% retracements based on the previous moves to the downside, which reinforce the nearest resistance area around $22.67-$22.97 (we marked it with the red rectangle on the above chart).

Therefore, even if the bulls try to push the futures higher, it seems that the above-mentioned resistance area would be strong enough to stop them and trigger a reversal.

On top of that, the CCI and the Stochastic Oscillator rose to their overbought areas, which could translate into sell signals in the following hours and encourage the bears to show up once again.

At this point, it is worth noting that in all previous cases, such high reading of the indicators (or even lower) were enough to activate the sellers. This time, they are also other factors on their side, which suggests that another reversal and lower prices of the futures may be just around the corner.

If this is the case, the first target for the bears would be the lower border of the green channel (currently around $20.30), however, if it is broken, the way to the recent lows will be open.

Summing up, even though crude oil showed some strength in today's early trading, it's too early to say that the outlook changed. If crude oil closes the price gap today (a close at or above $21.51 would be necessary), we will probably (temporarily) close the short position, taking profits off the table. However, we are not doing so at this time, as it seems that today's rally could be a bull trap.

Trading position (short-term; our opinion): Trading position (short-term; our opinion): Short positions in crude oil (100% size of the regular trading position) are justified from the risk to reward point of view with $11.22 as the binding profit-take level, and with $33.78 as the stop-loss level. We might adjust this target in the following Alerts.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager