Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

Yesterday, oil bears not only tested the barrier of $60, but also hit a fresh March low. Will black gold remain on the course to lower levels in the coming days?

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com).

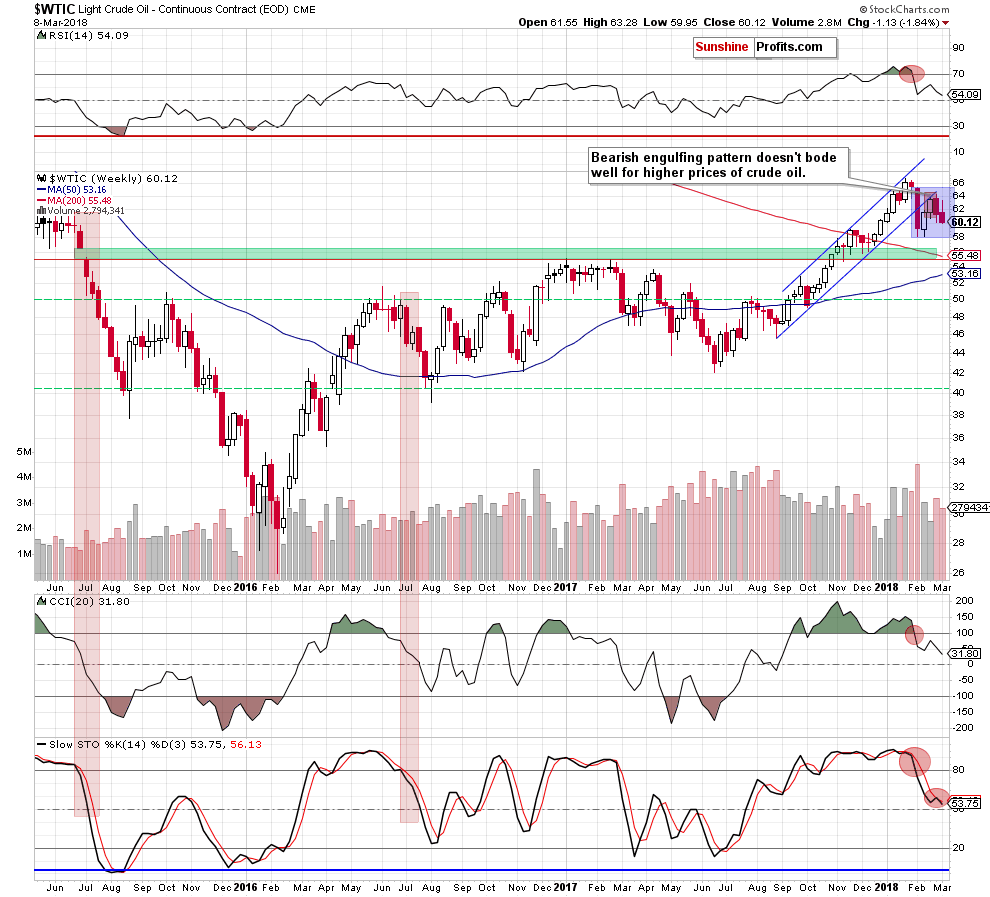

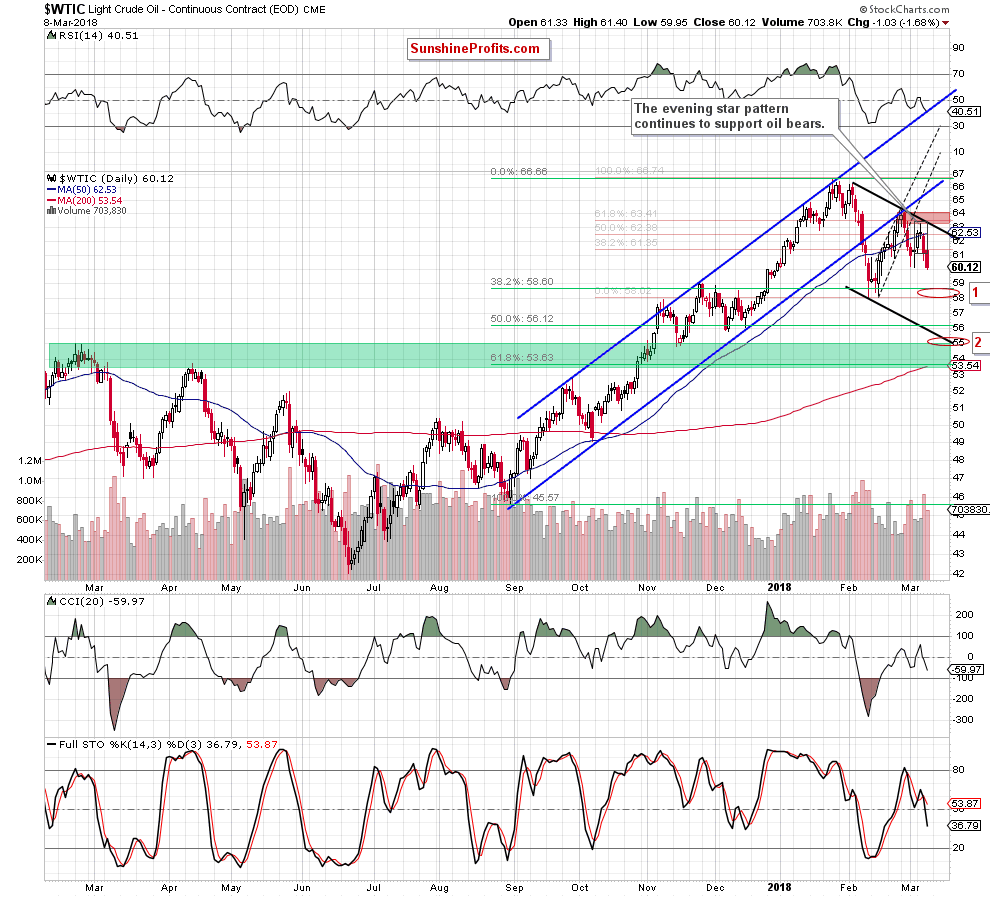

Today’s Oil Trading Alert will be quite short, as crude oil extended losses and closed the day not only below the previously-broken 38.2% Fibonacci retracement and the 50-day moving average, but also under the early march lows, making our short positions even more profitable.

Additionally, the sell signals generated by the indicators and the fundamental picture of black gold continue to support oil bears and lower prices of the commodity, which means that light crude remains on its way to our first downside target around $58.20-$59 (we marked it with the red ellipse on the daily chart).

Earlier today, we haven’t seen any important development, which could change the overall situation. Therefore, if you haven’t had the chance to read yesterday’s alert, we encourage you to do so today - it’s up-to-date:

$10 Move in Crude Oil in Just 1 Month? Impossible vs. “I’m Possible”

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts