Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Wednesday’s session brought 1% rebound in the price of black gold, but did it change anything in the very short term?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

Today’s alert will be quite short as basically not much changed. Although crude oil bounced off Wednesday’s low during yesterday’s session, the commodity is still trading not far from it, which means that our last comments remain up-to-date:

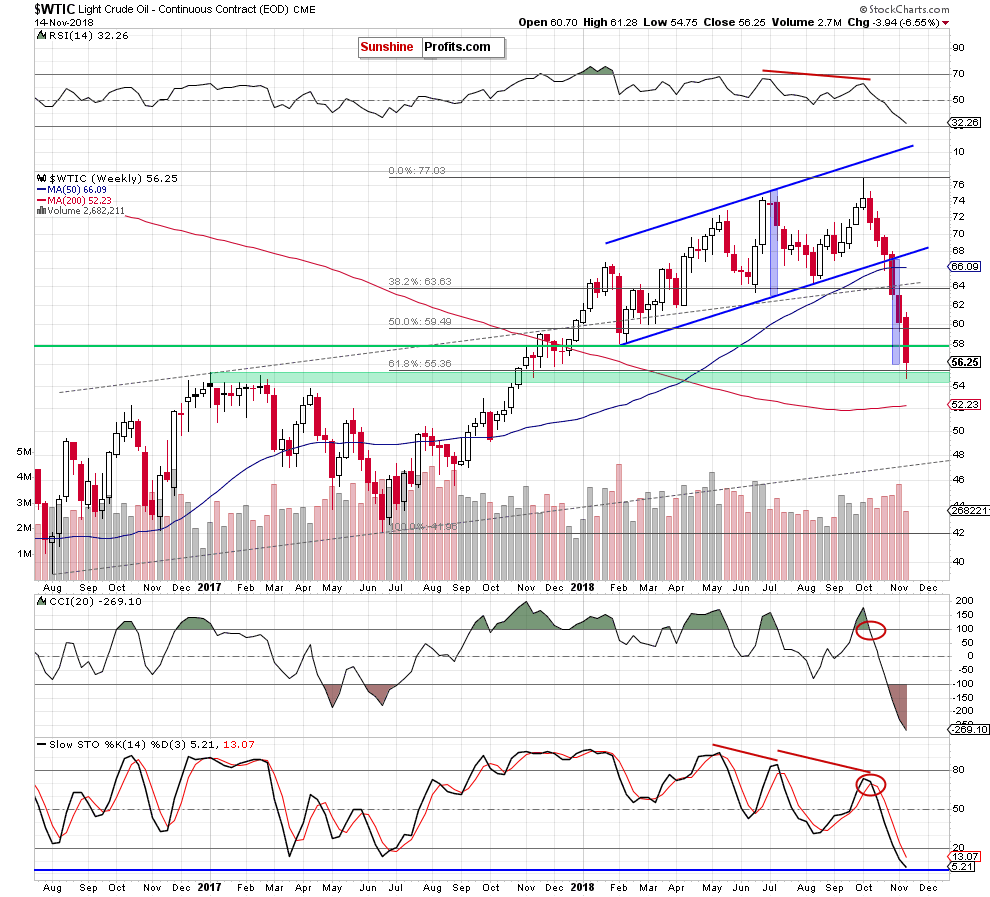

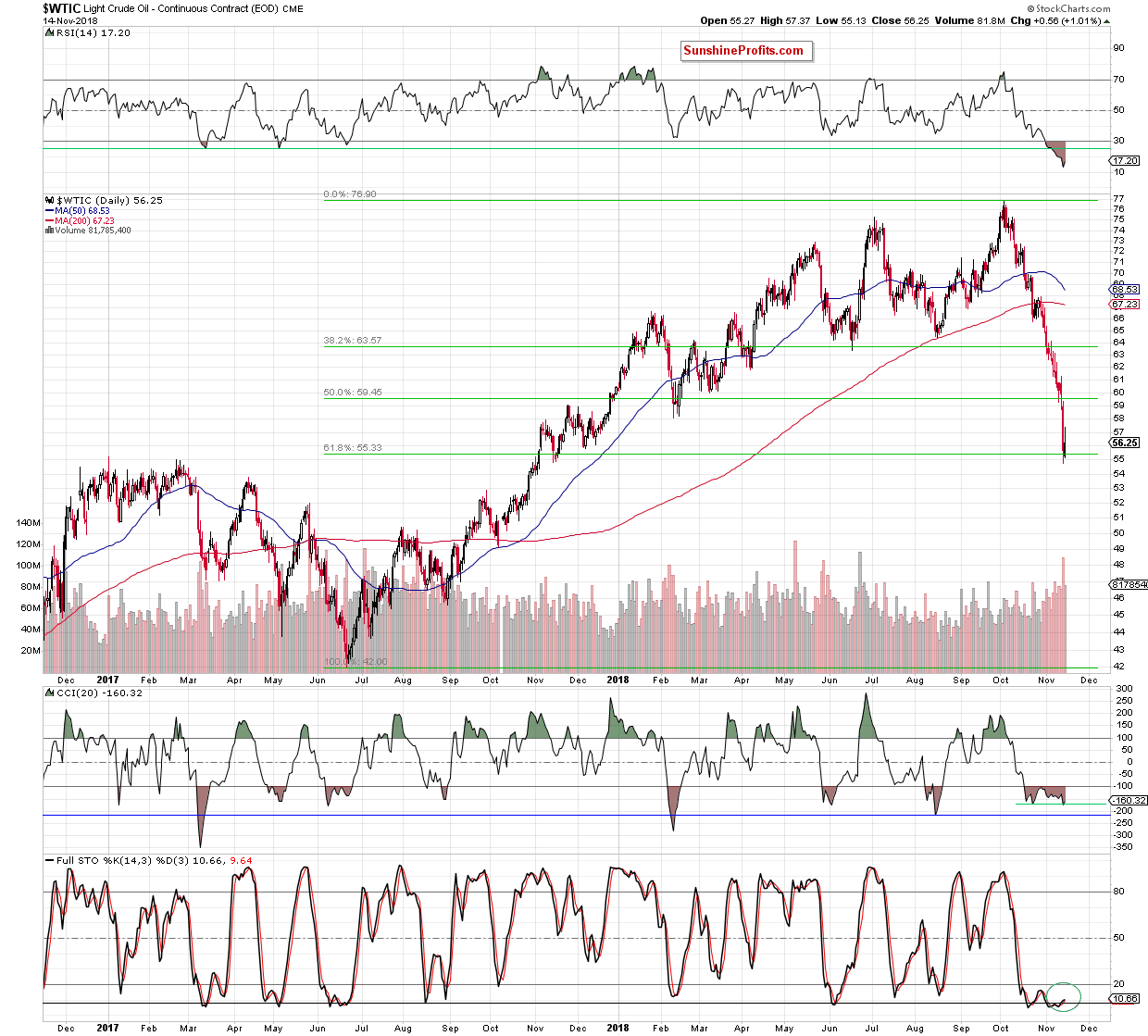

(….) crude oil slipped to the green support zone created by the 61.8% Fibonacci retracement and the early 2017 highs.

Although the bears managed to take the commodity even a bit below this area, oil bulls closed their ranks and triggered a tiny (compared to the earlier decline) rebound, which invalidated the earlier breakdown under these supports.

This positive event triggered further improvement after today’s market open, which suggests that we may see a rebound from November lows in the coming days – especially when we factor in the current position of the daily indicators.

Nevertheless, as long as there are no more reliable factors that could confirm oil bulls’ strength waiting at the sidelines seems justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts