Trading position (short-term; our opinion): Short positions (150% of the regular size of the position) with the stop-loss order at $68.15 and the initial downside target at $58.10 are justified from the risk/reward perspective.

Another invalidation of the tiny breakout was enough to trigger a sharp decline on Friday. What were the consequences of this movement and where did it lead the priceof black gold?

Technical Analysis of Crude Oil

Let's examine the charts below (charts courtesy of http://stockcharts.com).

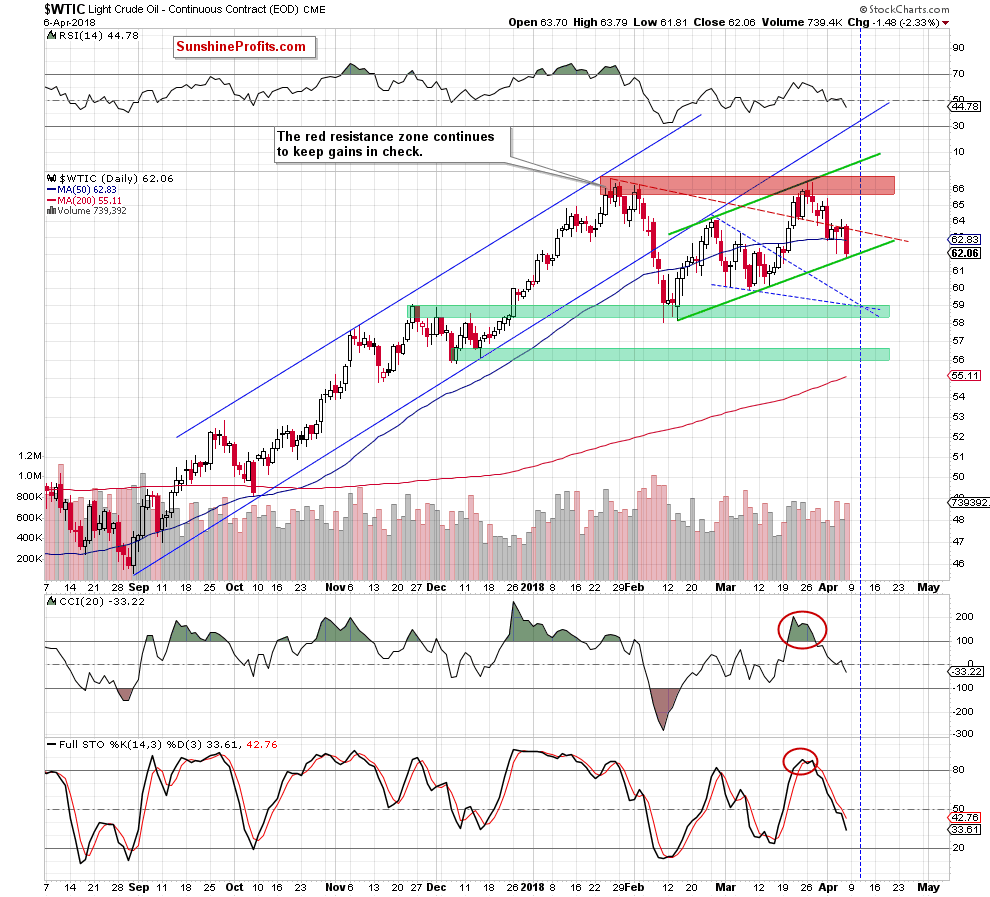

From today’s point of view, we see that although oil bulls pushed crude oil a bit higher after Friday’s market’s open, this improvement was very temporary. As it turned out, their opponents took control very quickly and took black gold under the red declining dashed line based on the January and February peaks once again, invalidated the earlier tiny breakout.

This show of the buyers’ weakness triggered a sharp decline, which resulted in a comeback under the 50-day moving average. In this way, the sellers invalidated also this breakout, which deepened Friday’s downswing and took light crude to the lower border of the green rising trend channel.

What’s next for the commodity?

Taking into account the importance of this short-term support line, it seems that oil bulls could trigger a rebound from here and verify the breakdown under the 50-day moving average in the coming day(s).

Nevertheless, considering Friday’s price action (the above-mentioned invalidations of the earlier breakouts), the sell signals generated by the indicators (they continue to support oil bears) and the volume, which accompanied Friday’s decline (it was significantly higher than a day earlier), we think that another attempt to move lower is still ahead of us. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): Short positions (150% of the regular size of the position) with the stop-loss order at $68.15 and the initial downside target at $58.10 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts