Trading position (short-term; our opinion): Short positions with a stop-loss order at $70.96 and the initial downside target at $63.64 are justified from the risk/reward perspective.

Tuesday’s session took crude oil almost 2% below Monday’s closing price, which approached black gold to the previously-broken early 2018 peak. Will oil bears seize the opportunity to plunge their opponents and take control of this area, transforming it into a resistance zone?

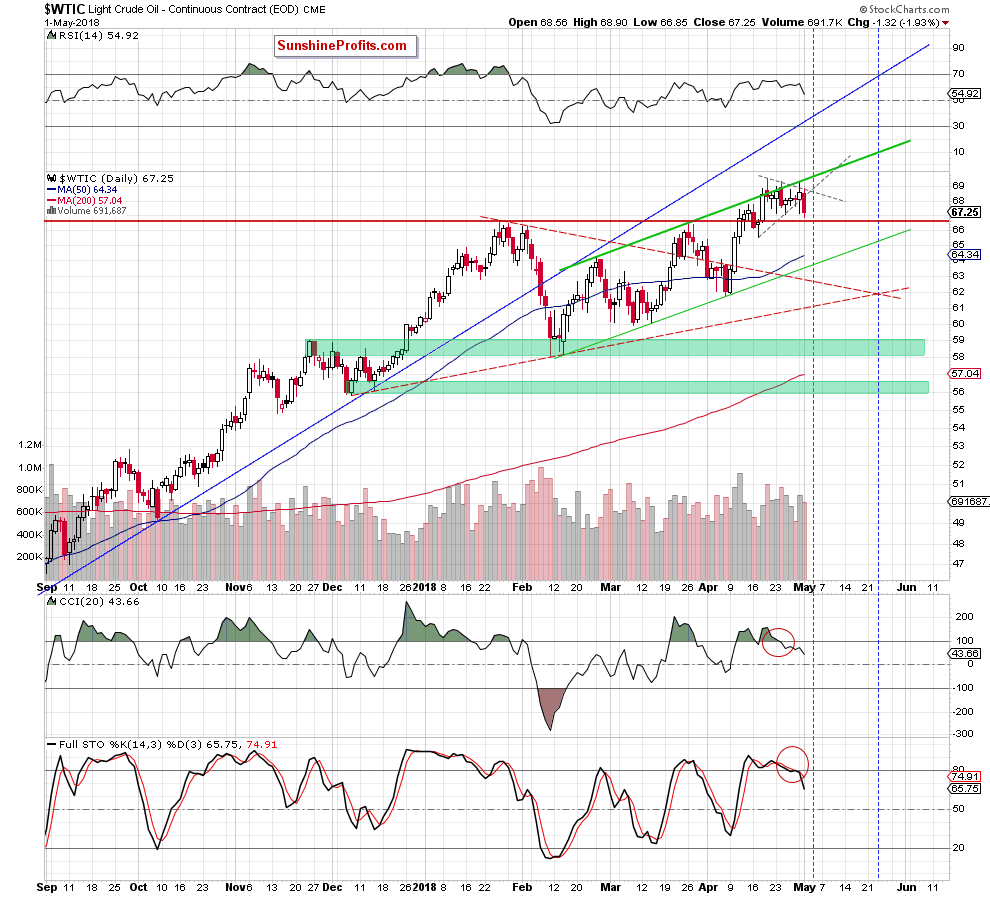

Let's take a look at the daily chart below (charts courtesy of http://stockcharts.com).

After the closure of yesterday's session, we thought that oil bears finally read our alert and took the lead. Looking at the daily chart, we see that they didn’t give their opponents too much chances after the session’s opening and quickly erased their efforts, triggering a decline. Thanks to their attack black gold not only broke, but also closed the day under the grey dashed line based on the previous lows, approaching the early 2018 peaks.

What’s next? Taking into account all bearish factors about we wrote yesterday (as a reminder, the upper border of the green rising trend channel continues to block the way to the north, the sell signals generated by the daily indicators remain in the cards, the long-term picture of light crude and the current situation in the non-USD chart of crude oil), we think that the sellers will finally took the commodity lower.

If this is the case, and the bears extends losses from here, black gold could (at least) test the lower border of the green rising trend channel (currently around $63.64) in the coming week.

Summing up, we continue to believe that short-positions are justified from the risk/reward perspective as the space for gains is very limited and lower prices of black gold are just a matter of time. As always, we’ll keep you - our subscribers - informed should anything change.

Trading position (short-term; our opinion): Short positions with a stop-loss order at $70.96 and the initial downside target at $63.64 are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts