Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective.

Although crude oil wavered between small gains and losses, “gaining” 0.04% yesterday, oil bears showed their claws and pushed the price of the commodity lower earlier today. What could it mean for light crude?

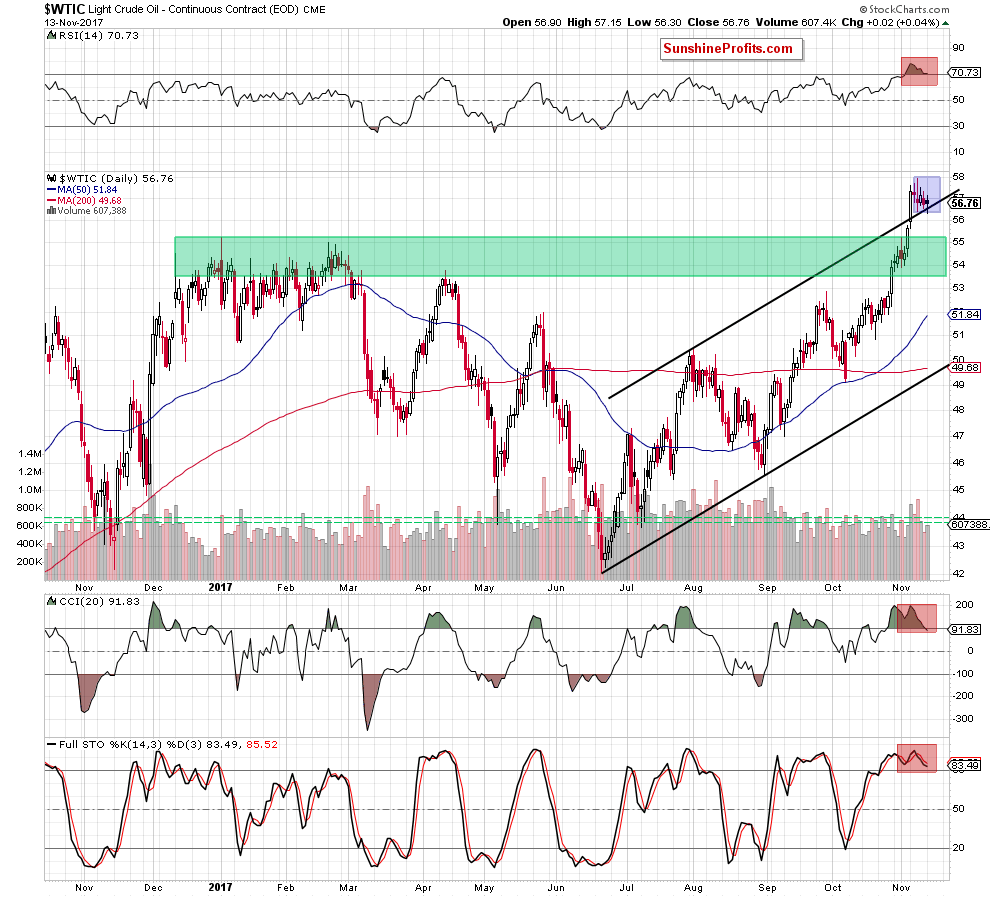

Crude Oil’s Technical Picture

Let’s examine the technical picture of the commodity (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we clearly see that nothing really happened as crude oil wavered in the blue consolidation yesterday.

However, earlier today, currency bears pushed black gold quite sharply lower, which resulted in an invalidation of the breakout above the black rising trend channel. In this way, light crude dropped under $56, making our short position more profitable.

This is a very negative development, which will turn into bearish if the commodity closes today’s session under the above-mentioned line. Is it possible? In our opinion, it is very likely, because the RSI approached the level of 70, the CCI and the Stochastic Oscillator generated the sell signals, which together suggests that a bigger move to the downside is just around the corner.

We will provide you with a bigger update and more downside targets tomorrow, once we get the daily closing prices.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts