Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

One day up, the other day down. How to make sense of the recent movements in oil? Have the bulls stopped the bearish onslaught yesterday or is there more downside to come? Any geopolitical news on the horizon that could spike the price? Time to turn to the charts instead and present you the odds of the next move.

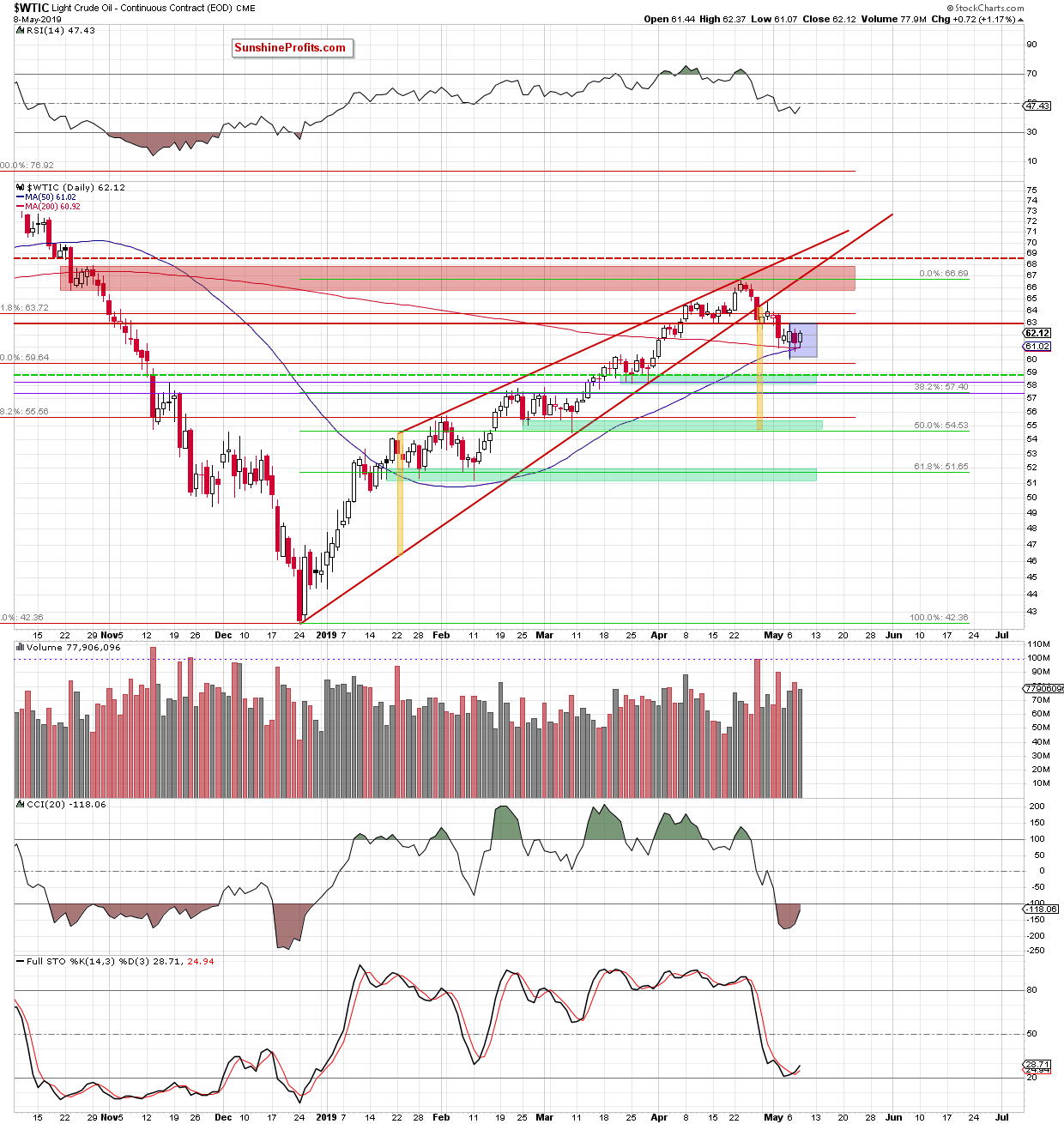

Let's take a closer look at the chart below (chart courtesy of http://stockcharts.com).

The daily chart shows that crude oil is still bidding its time and remains stuck inside the blue consolidation between the previously-broken mid-April lows and the 200- and 50-days moving averages. Again favoring the bears, the volume of yesterday's upswing was a bit lower than that of the preceding decline.

Let's quote our yesterday's observations that remain up-to-date also today:

(...) Monday's upswing looks like a verification of the breakdown below the red horizontal resistance line that is based on mid-April lows.

The first half of the below quotation ... has proved spot on and the other half remains up-to-date also today:

(...) if oil moves down from here, we'll likely see another test of the 200- and 50-day moving averages. Such a test would then be likely followed by a drop to the first green support zone or even the 38.2% Fibonacci retracement.

Summing up, the outlook for oil remains bearish. Monday and yesterday's reversals have been erased and the bears look to be holding the upper hand. This view is confirmed by the volume comparison between recent upswings and downswings. This is what happens after verifying a breakdown - and we have had a verification of the breakdown below the red horizontal resistance line that's based on mid-April lows. The price still trades well below it. The short position continues to be justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist