Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the initial upside target at $73.47) are justified from the risk/reward perspective. We are moving the initial upside target higher.

One can say what they want about September, but they have to admit that it had a very interesting beginning. Silver just declined to new lows, USD rallied strongly, and crude oil is soaring above August highs. The short-term outlook was already bullish previously, but given such positive confirmation, we can expect even more strength in the upcoming days. How high can the price of the black gold go?

Today’s Oil Trading Alert is going to be short, as basically everything is developing as we had indicated it previously and our long position is becoming more profitable.

In fact, the previous comments are so up-to-date that this Alert will be a quote of our previous analysis with changes made only when its necessary. Let’s start with crude oil’s short-term chart (chart courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

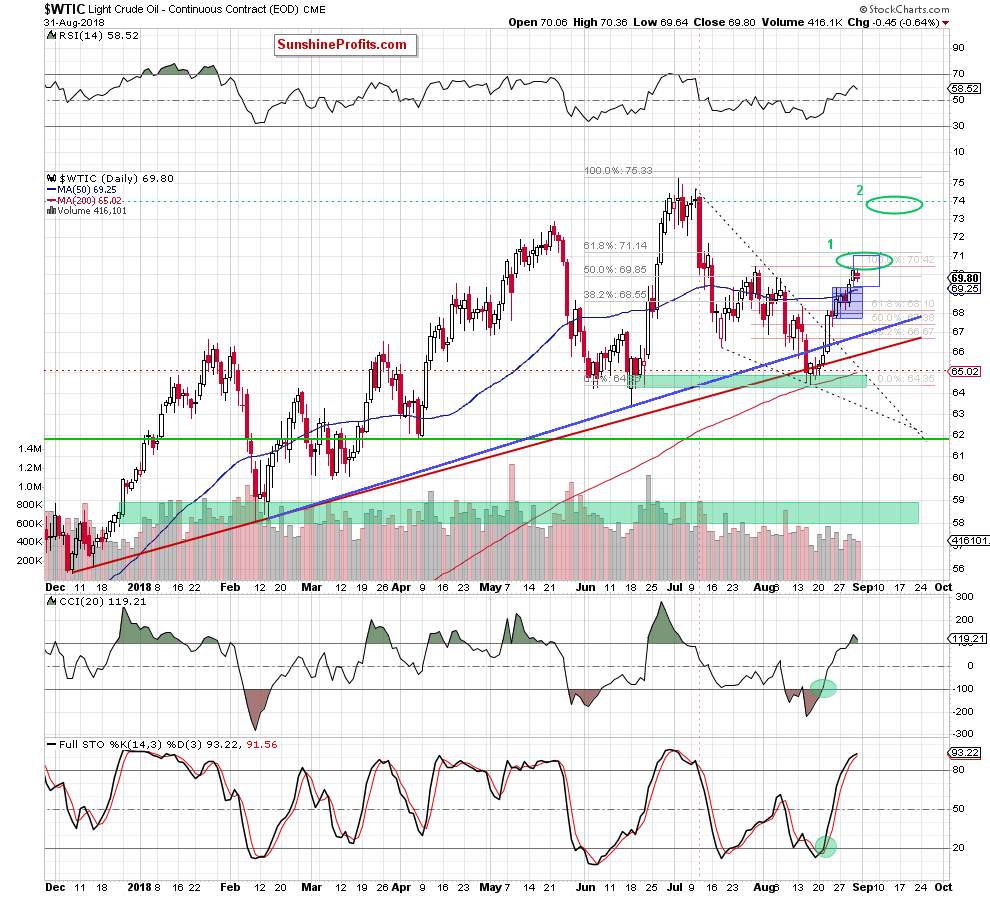

Thanks to this upswing, the commodity broke above the upper border of the very short-term blue consolidation, which suggested further improvement and an initial upward move to around $70.84, where the size of increase would correspond to the height of the above-mentioned consolidation.

We have already seen this price action and light crude hit our initial upside target (the first green ellipse). It also hit 61.8% Fibonacci retracement at the upper border of our first target area.

What’s interesting, in this area is also one more target, which could attract the buyers like a magnet. Let’s take a look at the chart below.

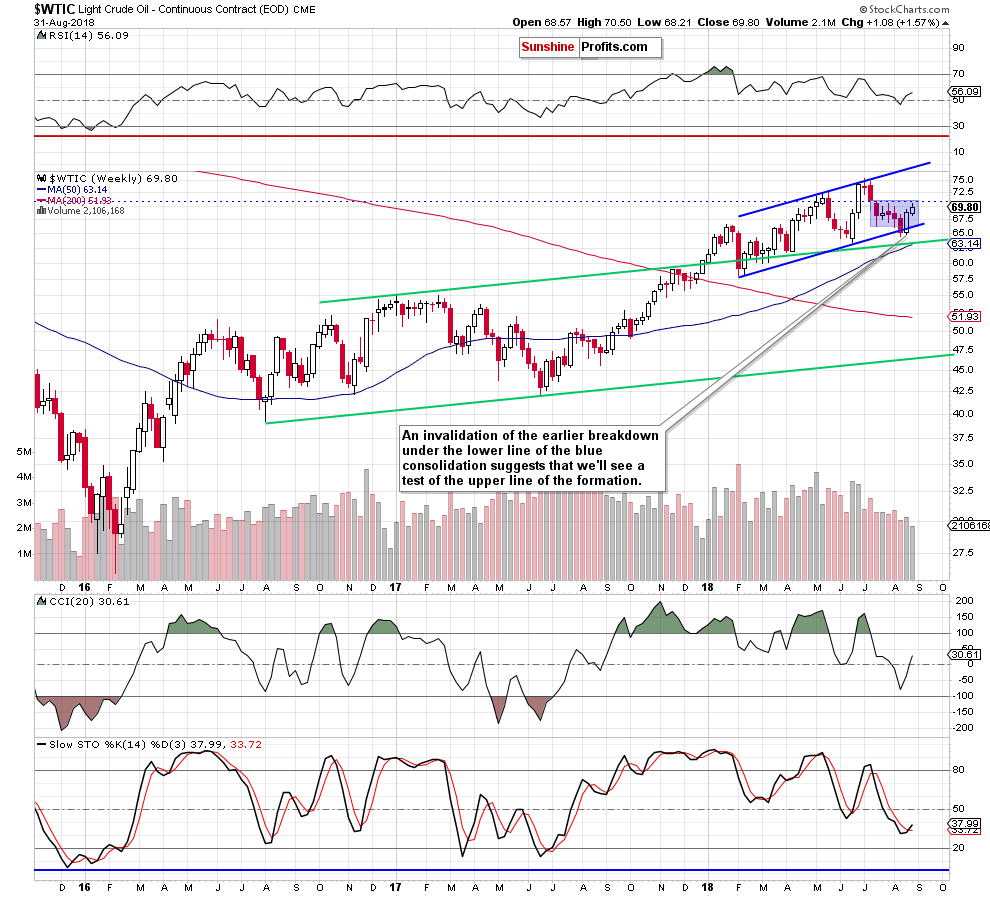

Looking at the medium-term chart, we see that the previous week’s invalidation of the earlier breakdown under the lower border of the blue rising trend channel and the lower line of the blue consolidation encouraged oil bulls to act in recent days.

Additionally, the Stochastic Oscillator generated a buy signal, giving the buyers one more reason to act. Taking these facts into account, we were expecting crude oil to test the upper border of the blue consolidation (around $70.43-$70.87) in the coming week(s).

We also wrote that if this quite solid resistance zone is broken, oil price could climb even to around $74, where the price was very often at the turn of June and July (the upper green ellipse seen on the daily chart). Since the above-mentioned resistance was already broken and the price of crude oil moved above $71, the $74 level is our current price target for the price of the black gold.

Intermarket Links

Please note that today’s move higher in crude oil is taking place along with an increase in the value of the USD Index and a decline in the precious metals. Since both price moves are in tune with their respective trends, and likely to be continued by similar price action in the following days, it’s more likely than not that the current direction in the price of crude oil will also persist. Since oil just rallied over $1 today, it seems that it could easily climb to about $74 shortly.

Summary

Summing up, long positions continue to be justified as crude oil extended gains and broke above the upper line of the very short-term consolidation. It’s likely that we’ll see further improvement and a climb to our upside target in the very near future.

Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the initial upside target at $73.47) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On a personal note, Przemyslaw and I would like to thank everyone, who sent their congratulations and best wishes to us for our wedding that took place this Saturday. We really appreciate it. Your kind words made this amazing day even better.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts