Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Crude oil rallied on Friday and it moved higher in today’s pre-market trading as well. Will we see a breakout to new 2018 highs shortly?

In short, it’s still doubtful. Crude oil is higher than it was in the previous days, but it is still not above the June and July highs, even in terms of the daily closing prices. This means that there was no major breakout and thus that the outlook didn’t really improve.

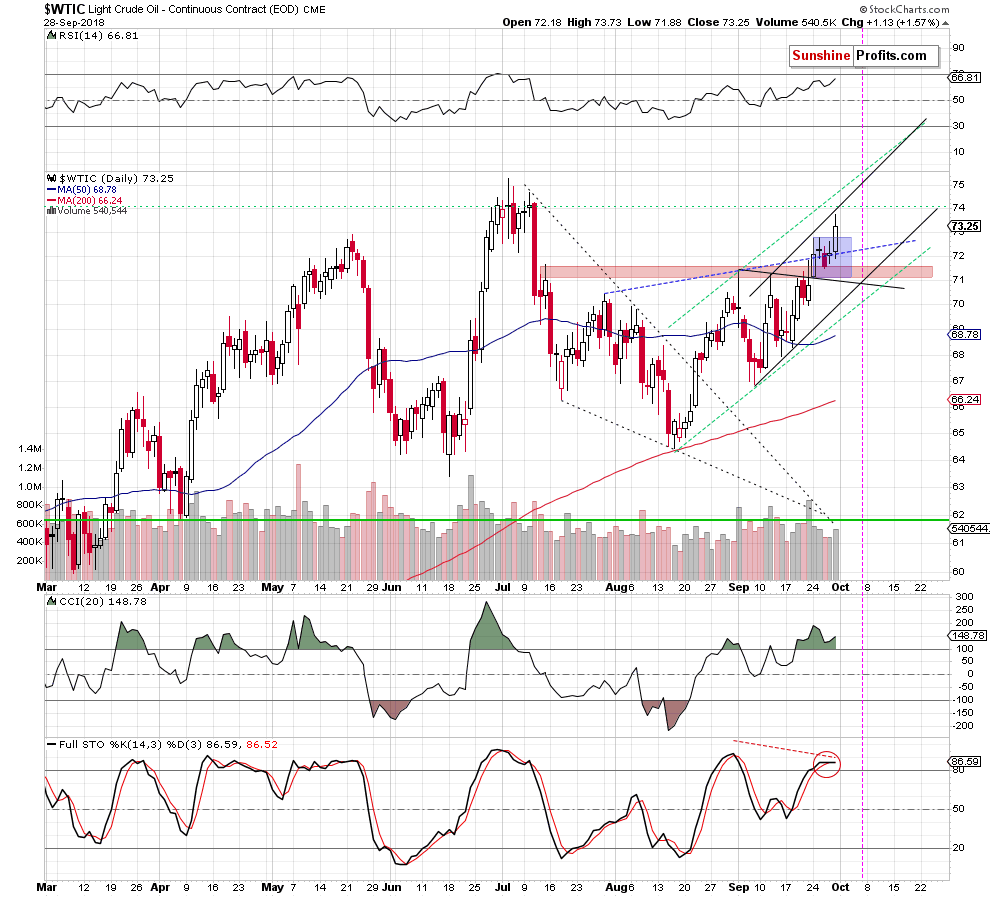

Let’s take a look at the daily chart below (charts courtesy of http://stockcharts.com).

Crude oil remains not only below the previous highs, but also below the upper borders for both rising trend channels: the black and green ones.

Moreover, the volume that accompanied Friday’s rally was nothing to call home about. It was not very low, but not high enough to confirm the existence of a strong bull market.

The indicators that we included on the above chart point to the likelihood of a near-term downswing as CCI is overbought, RSI is very close to the 70 level and the Stochastic indicator is about to flash a sell signal – only a little more weakness, or a decent decline in the pace of growth is necessary.

Overall, it seems that given both: bullish (after all, crude oil moved higher on volume that was not low and it ended the week above the previous daily highs), and bearish (as discussed above) factors, it’s still best to wait on the sidelines. Crude oil is now higher than it was when we cashed out our profits on the long positions, but please note that the current risk associated with such position is much greater than it was previously.

Summing up, in our opinion, it's worth to be patient for a moment and wait for additional confirmations before entering a trading position in crude oil as there are both: bullish and bearish signals present. As always, we will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts