Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Crude Oil [CLX21] We project the $69.09-70.11 as a new (long-term) support onto which prices could rebound, so we would go long after a dip around that area with a stop just below $66.92 and with targets around $74.24 (TP1) and $78.33 (TP2);

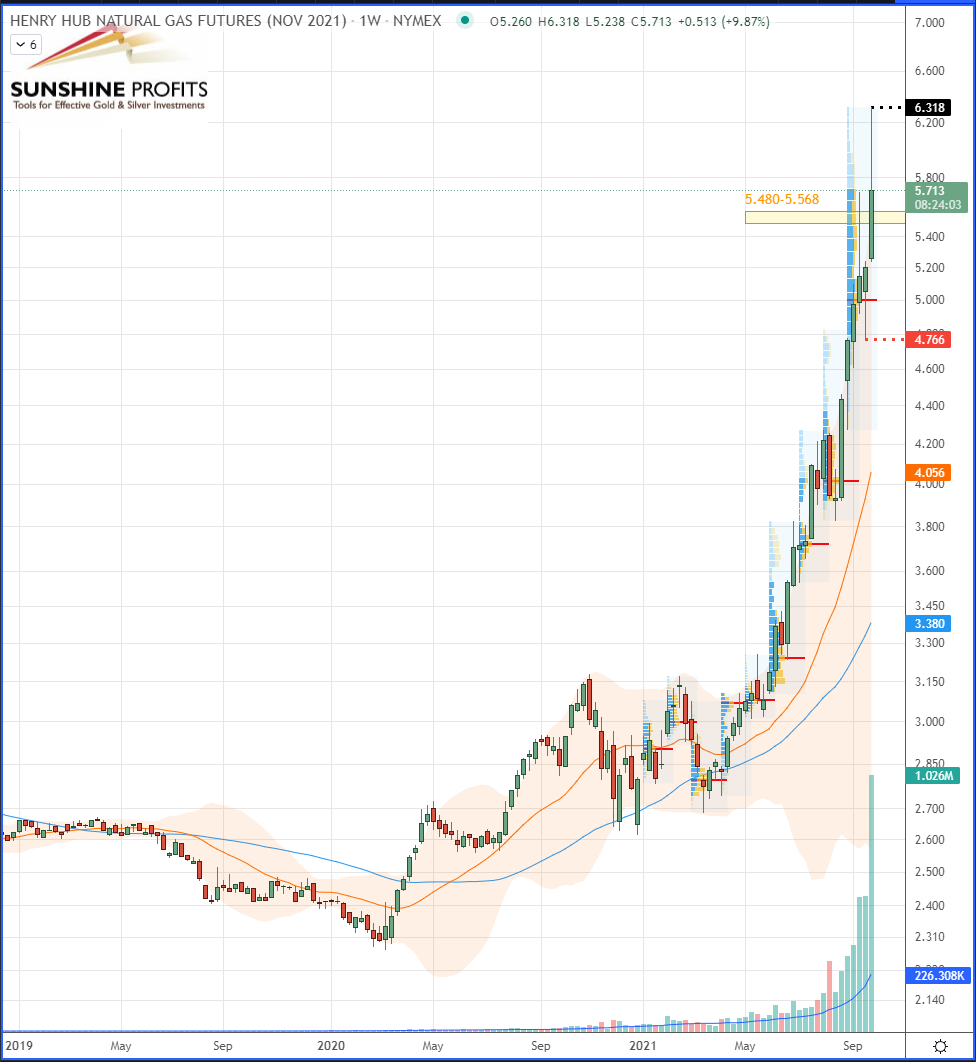

- Natural Gas [NGX21] Long around $5.480-5.568 with stop below $4.766 (previous swing low) and targets at $6.63 (TP1) and $7.79 (TP2) – Entry triggered!

What’s happening in the natural gas markets? Prices are surging like crazy. The answer may be complex, and I’m here to provide it. But first, let’s look at how our position is developing.

Trade Analysis

On Wednesday, the gas market triggered our entry around $5.480-5.568 (yellow rectangle) just before it rebounded higher on Thursday. Gas prices are currently trading around $5.750, and our stop loss was initially placed just below $4.766 (previous swing low) – See Figure 1. So, we will consider lifting our stop once Nat-Gas has pierced its current $6.318 high.

Figure 1 – Henry Hub Natural Gas (NGX21) Futures (November contract, daily chart, logarithmic scale)

Figure 2 – Henry Hub Natural Gas (NGX21) Futures (November contract, weekly chart, logarithmic scale)

Figure 3 – WTI Crude Oil (CLX21) Futures (November contract, daily chart, logarithmic scale)

Market Analysis

Today, we expect the market to be accumulating since the U.S. Energy Information Administration (EIA) on Thursday reported an injection of 88 billion cubic feet (Bcf) of natural gas into storage for the week ending on Sept. 24. This could indeed be explained by warmer temperatures and entering the month of October.

New Futures Market in Turkey

For those interested in watching foreign energy markets, please note that today marks the start of the Turkish Natural Gas Futures Market (NFM), a new milestone in the Nat-Gas trade.

(Source: Turkey Energy Outlook)

European Gas

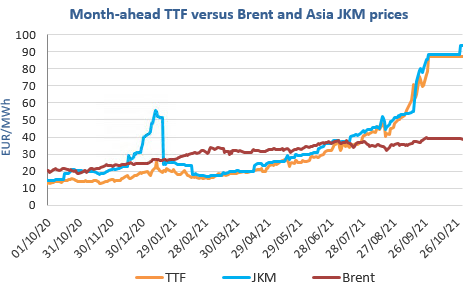

Gas prices are still fuelled by supply concerns in Europe, where inventories are recording multi-year lows. FYI, we also talked about this in a previous edition of Oil Trading Alerts.

(Source: EnergyScan)

The sudden spike in Asia JKM November 2021 prices could be explained by the fact that European buyers are forced to keep competing aggressively with their Asian counterparts to attract LNG cargoes (Liquefied Natural Gas Transportation).

Figure 1 – Henry Hub Natural Gas (NGX21) Futures (November contract, daily, logarithmic scale)

Figure 2 – Henry Hub Natural Gas (NGV21) Futures (October contract, weekly chart, logarithmic scale)

In brief, today we provided you with some recent updates regarding the market developments for various natural gas markets in order to get a wider view of what’s happening in them.

Have a nice weekend!

As always, we’ll keep you, our subscribers, well-informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Crude Oil [CLX21] We project the $69.09-70.11 as a new (long-term) support onto which prices could rebound, so we would go long after a dip around that area with a stop just below $66.92 and with targets around $74.24 (TP1) and $78.33 (TP2);

- Natural Gas [NGX21] Long around $5.480-5.568 with stop below $4.766 (previous swing low) and targets at $6.63 (TP1) and $7.79 (TP2) – Entry triggered!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist