Trading position (short-term; our opinion): Profitable short position with a stop-loss order at $58.57 and the exit target at $54.60 is justified from the risk/reward perspective.

Yesterday, we have seen another day of higher oil prices. While that sounds bullish, it's important to go beneath the surface. Have the bulls overcome any important resistances? How does the balance of forces actually look right now? What does the enigmatic "until" from the title mean actually?

Let's take a closer look at the charts below charts courtesy of http://stockcharts.com and www.stooq.com ).

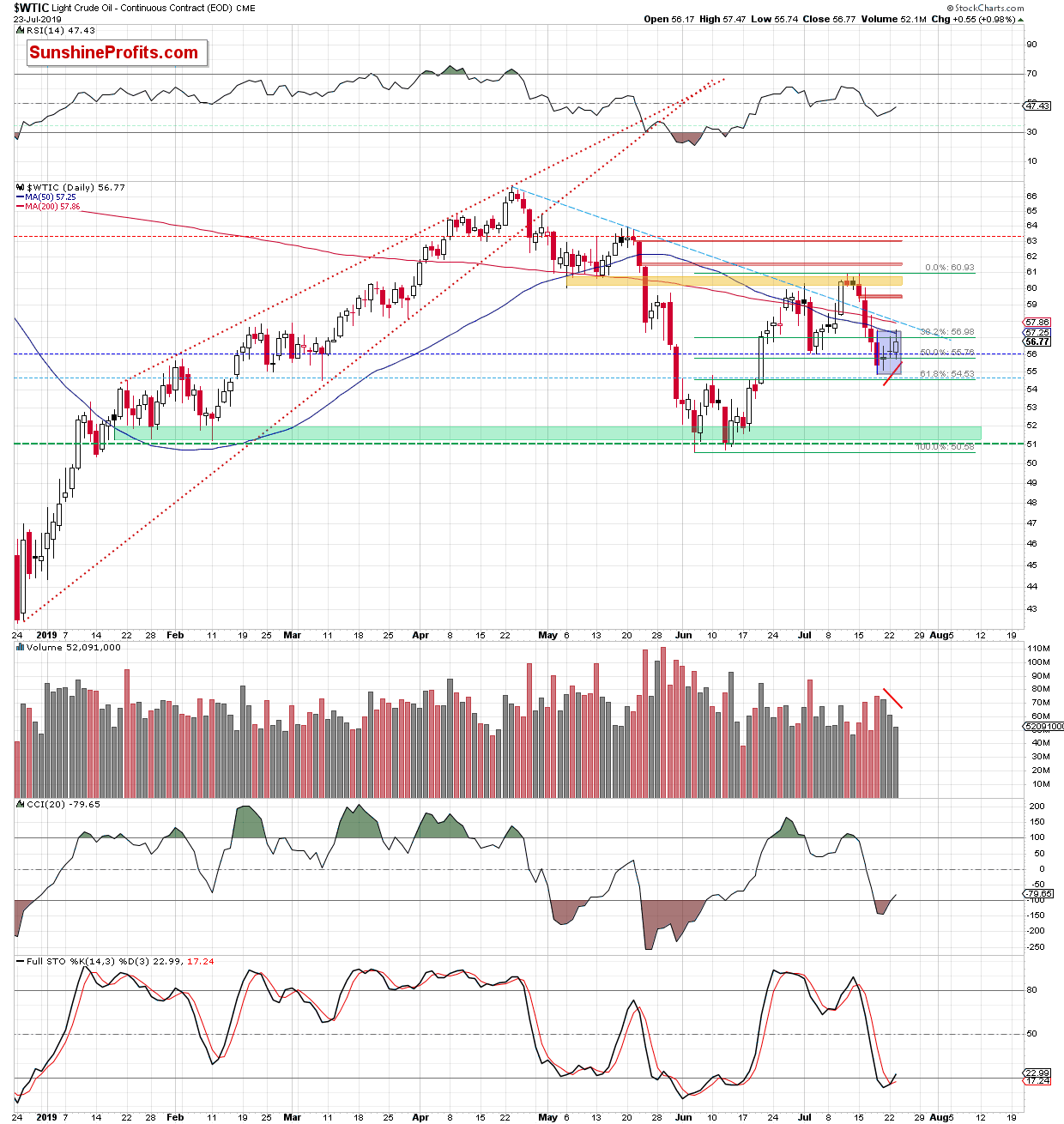

Yesterday's session brought us another day of higher prices, yet also of decreasing volume. This points to lower willingness of the bulls to push prices any further. It can be also seen in the previously-broken 50-day moving average stopping the buyers, and a daily close below these resistances.

Overall, the situation remains almost unchanged as the commodity is still trading inside the blue consolidation. Let's see the futures for more clues.

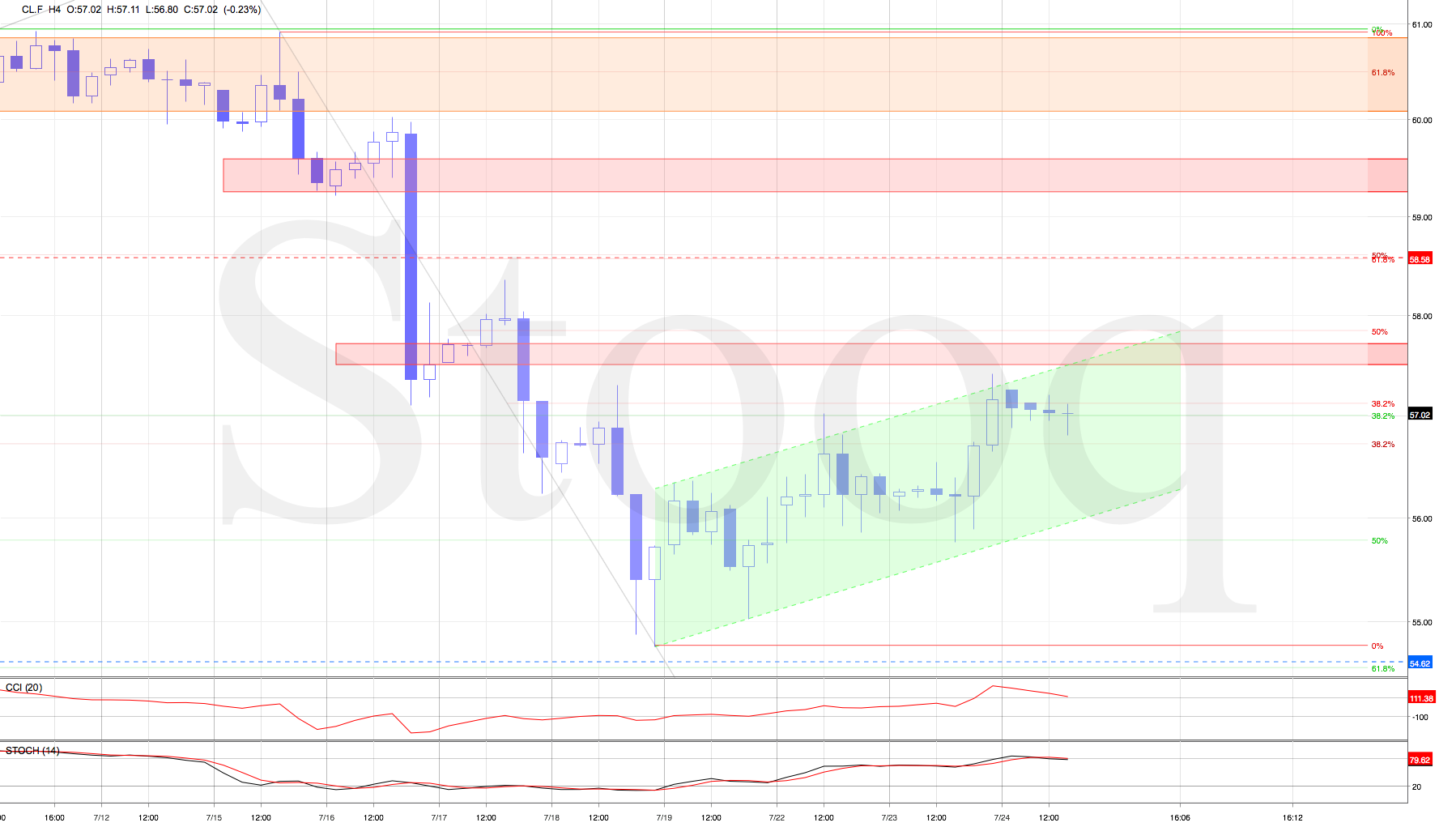

Crude oil futures opened the day with the green gap, but the bulls couldn't take black gold any higher as the proximity to the red gap and the declining red resistance line keeps further gains in check.

Additionally, the 4-hour chart below shows that the futures are still trading inside the very short-term rising green trend channel. While the bulls attempted a breakout above the upper border of the formation yesterday, their efforts have come to naught.

On top of that, crude oil futures invalidated also the earlier tiny breakout above the 38.2% Fibonacci retracement. This has also emboldened the bears.

Taking a closer look at the chart, we'll also see that the CCI and the Stochastic Oscillator rose to their overbought levels, suggesting that their sell signals and lower values of the commodity are just around the corner.

Let's recall our yesterday's commentary:

(...) How low could oil go? The next downside target for the bears will be around $54.58, which is where the 61.8% Fibonacci retracement is.

Summing up, despite the crude oil upswing earlier this week, its technical posture and volume comparison is deteriorating. The odds continue heavily favoring another move lower. Even the 4-hour chart reveals that the bulls aren't as strong as they appear to be. All the above factors support the bears and the short position remains justified.

Trading position (short-term; our opinion): Profitable short position with a stop-loss order at $58.57 and the exit target at $54.60 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist