Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Oil has been consolidating for quite a few days recently. The Iran tensions haven't really helped support the price it seems. Is it that the U.S. - China trade war has the upper hand? Neither oil demand is projected to increase as rapidly as it had been estimated recently. Oil price appears confined both on the upside and on the downside these days. Let's examine the balance of forces between the bears and the bulls. What kind of chance do the bulls have keeping ground gained so far? How will that influence you?

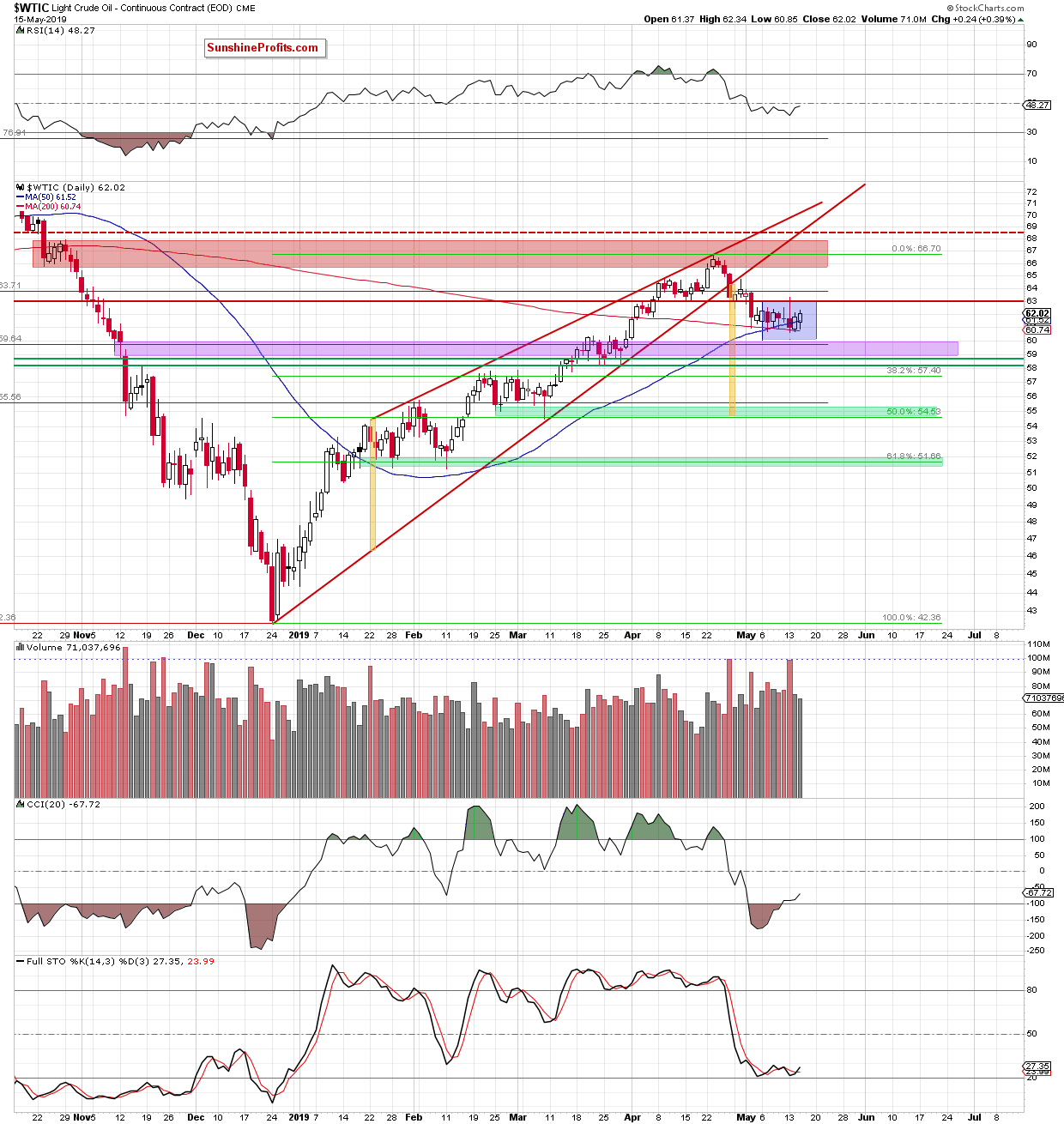

Let's take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Despite the earlier attempt to move lower, the crude oil price finished the day a bit higher yesterday. Black gold still trades inside the blue consolidation and below the previously-broken red horizontal line.

Yesterday's upswing was made on a slightly lower volume than the day before. The volume on down days remains overall higher than the volume on up days. It increases the probability of seeing another sellers' attack in the coming day(s).

However, as long as the commodity is trading inside the blue consolidation, a sizable move to the downside is questionable. The price simply has to break down first from this area between the previously-broken mid-April lows and the 200- and 50-days moving averages. The bears should also look to close the horizontal purple price gap.

Summing up, the outlook for oil remains bearish. Oil is still trading inside the blue consolidation and below the previously-broken red horizontal line. The daily volume comparison of last several trading days also favors the bears. Besides, the position of the weekly indicators supports the downside move. The bears however better flex their muscles as a sizable move to the downside requires the oil price to break down from the blue consolidation first. The short position continues to be justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist