Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $63.30 and the next downside target at $56.13 is justified from the risk/reward perspective.

The closing days of last week haven't brought move movement in oil, and the start of this week doesn't look to be an exception. Yet, we are able to glean meaningful signs from the price action so far. Will the current downswing usher in lower oil prices?

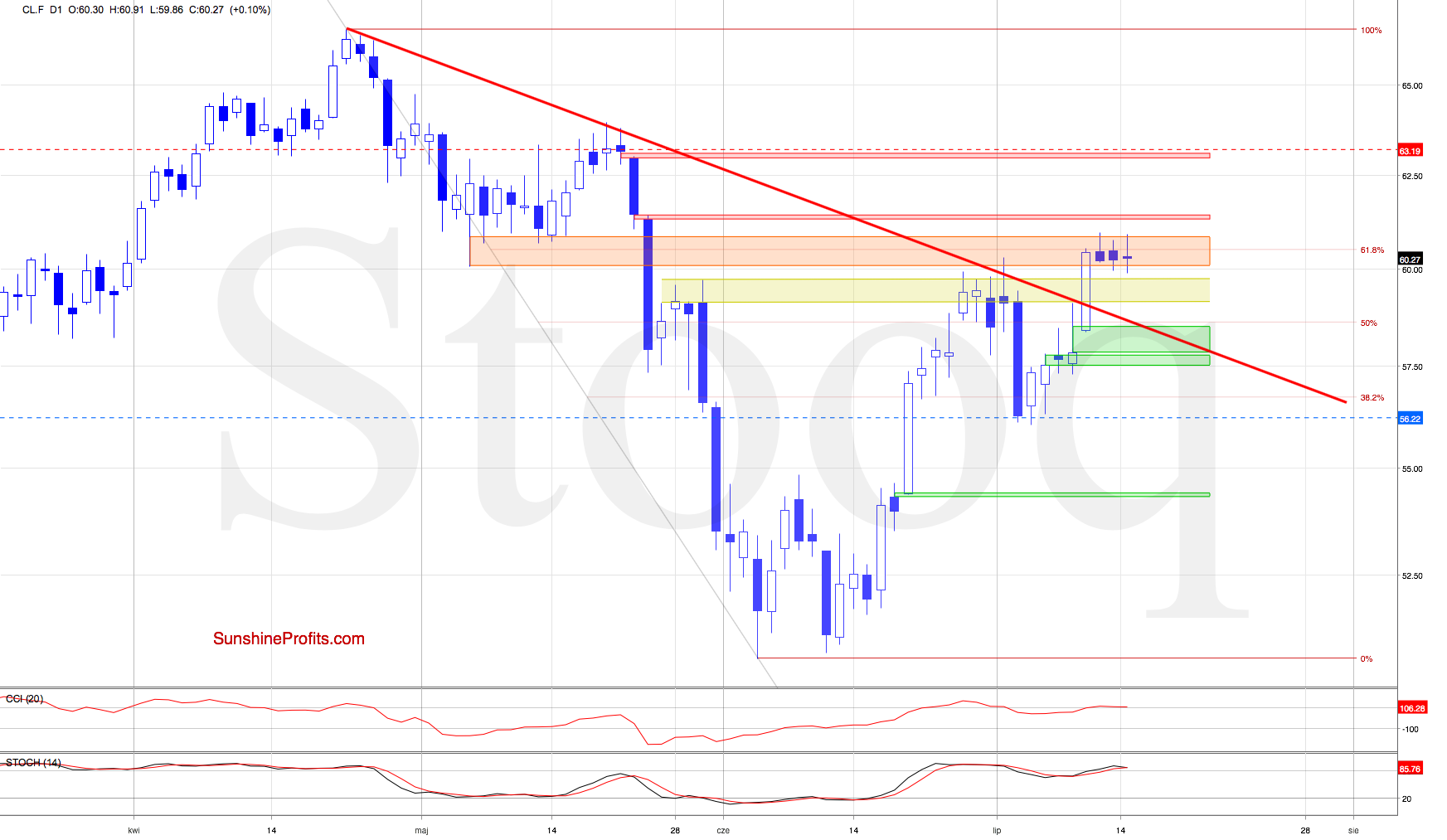

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ).

On Thursday and Friday, crude oil hasn't moved much. The price action so far today, is however more insightful - an upswing attempt testing the upper border of the orange resistance failed, and black gold reversed lower. It hints at the bears' readiness to test the bullish resolve.

As crude oil is still trading in a narrow range below the upper border of the orange zone and below the red gap, our Friday's observation remains up-to-date also today:

(...) the orange resistance zone and the 61.8% Fibonacci retracement continue to keep gains in check. Slightly above both of these obstacles, there is also the red gap serving as another block on the way to the north.

Taking all the above into account, the short position remains justified.

Summing up, despite the undecisive nature of recent days' trading, the oil outlook remains bearish. Oil has reached a strong combination of resistances (the red resistance zone and the 61.8% Fibonacci retracement) and the bulls appear to have run out of steam. There're bearish divergences between the CCI and oil prices, and between the Stochastic Oscillator and oil prices. The short position remains justified.

Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $63.30 and the next downside target at $56.13 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist