Trading position (short-term; our opinion): No position in crude oil is justified from the risk/reward perspective.

We've just seen another week of higher prices in oil. But what about the long upper knot? Will the bulls successfully push prices higher this week? What is the evidence to the contrary? Either way, we have a strong plan to play the unfolding move. Let's see our presentation of it and benefit together.

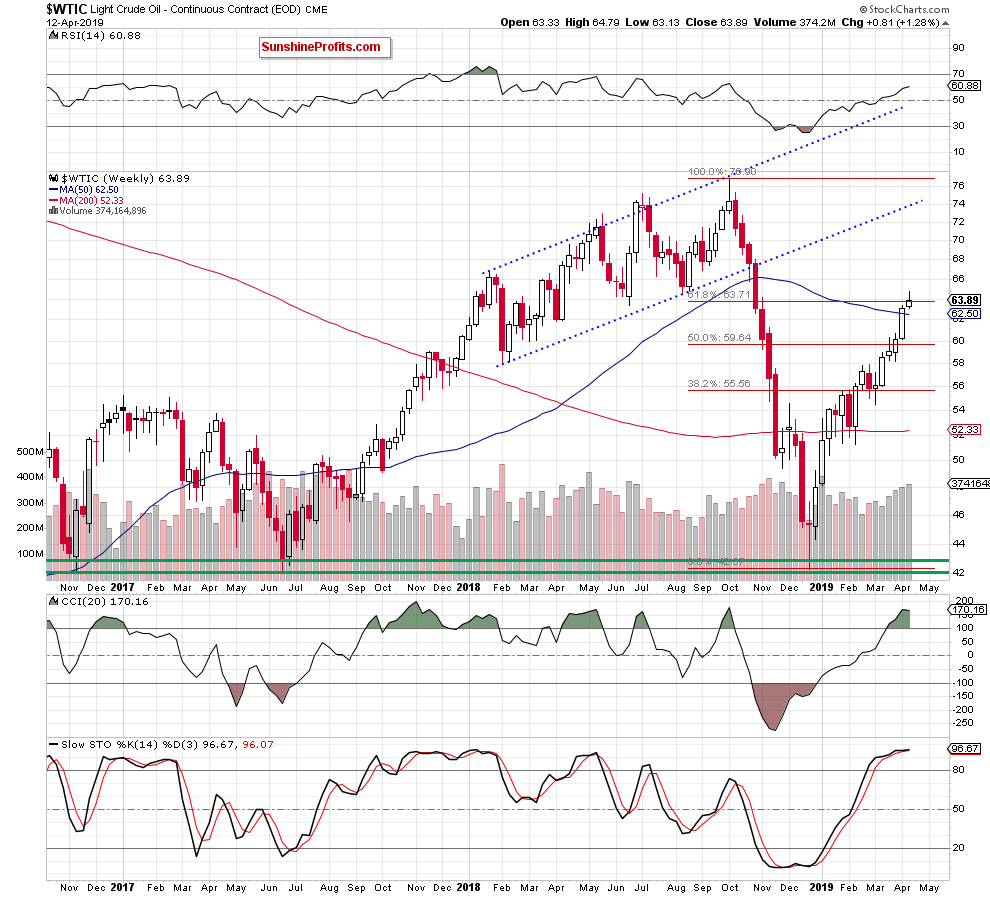

Let's start with the weekly chart below (charts courtesy of http://stockcharts.com).

Scoring another week of gains, crude oil hit a fresh peak in the previous week. It's also true however, that the commodity pulled back on Friday. It resulted in a close to the weekly session only slightly above the 61.8% Fibonacci retracement as evidenced by the longer upper shadow.

The CCI and the Stochastic Oscillator remain in their overbought areas, increasing the likelihood of seeing sell signals in the coming week(s).

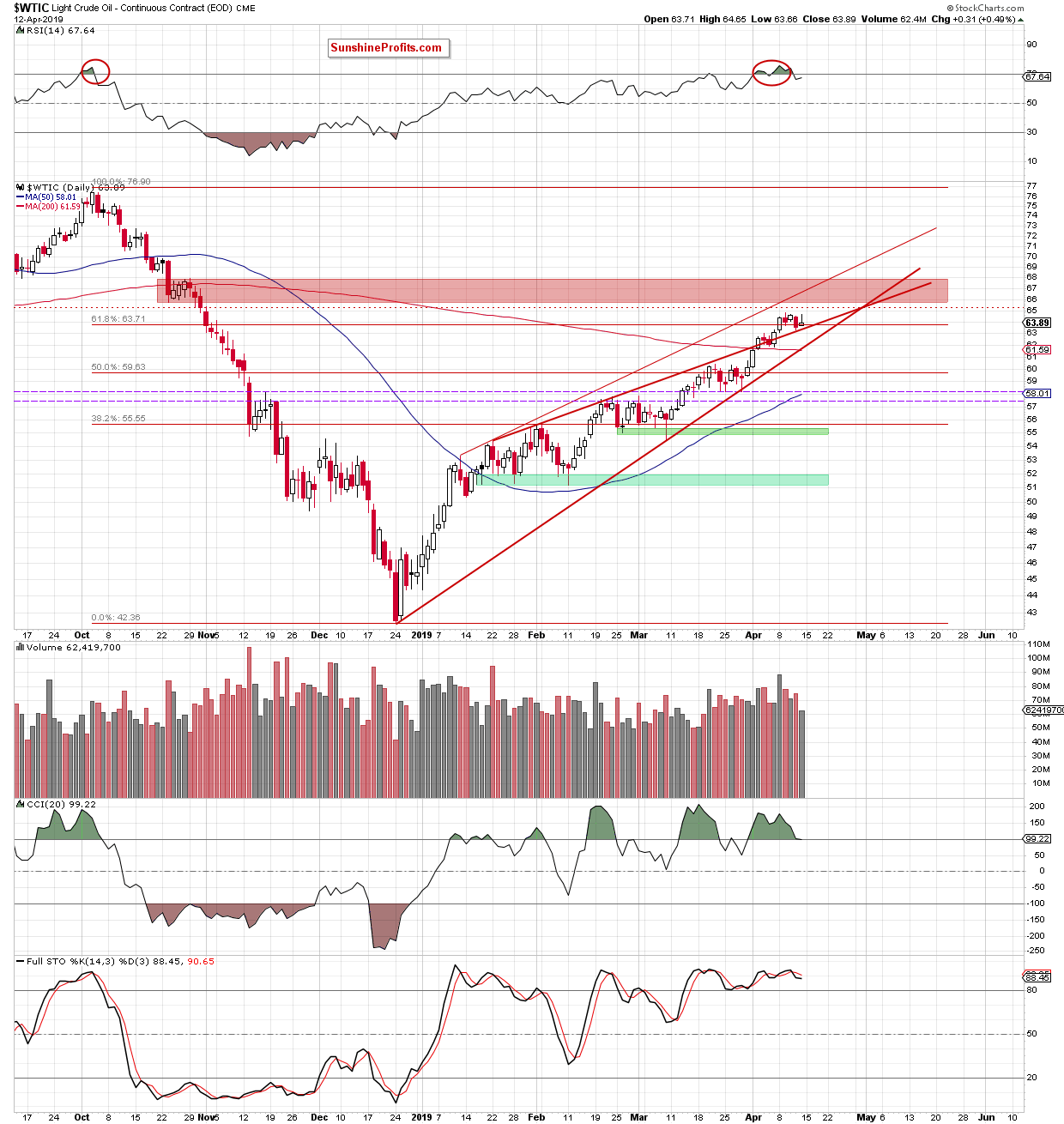

On the daily chart, we also see a candlestick with a longer upper shadow. It shows that oil bears are becoming more active in the area of recent highs. The volume of the mostly failed Friday's upswing was also visibly lower than during Thursday's decline.

Additionally, the sell signals generated by the daily indicators support the sellers. Therefore, should we see a daily close below the 61.8% Fibonacci retracement and the upper border of the red rising wedge, we'll likely open short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up, some valid question marks over the bullish case for oil have appeared. Should we see them reflected in a daily close below the 61.8% Fibonacci retracement and the upper border of the red rising wedge, we'll likely open short positions.

Trading position (short-term; our opinion): No position in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist