Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Today's session in oil is far from being calm. It has brought us a spurt higher from the resting pad at the support. Now that trade uncertainty is creeping into the marketplace, where does that leave the prospects for oil? High time to consult the charts: what has changed and what has not.

Let's take a closer look at the chart below (charts courtesy of http://stockcharts.com).

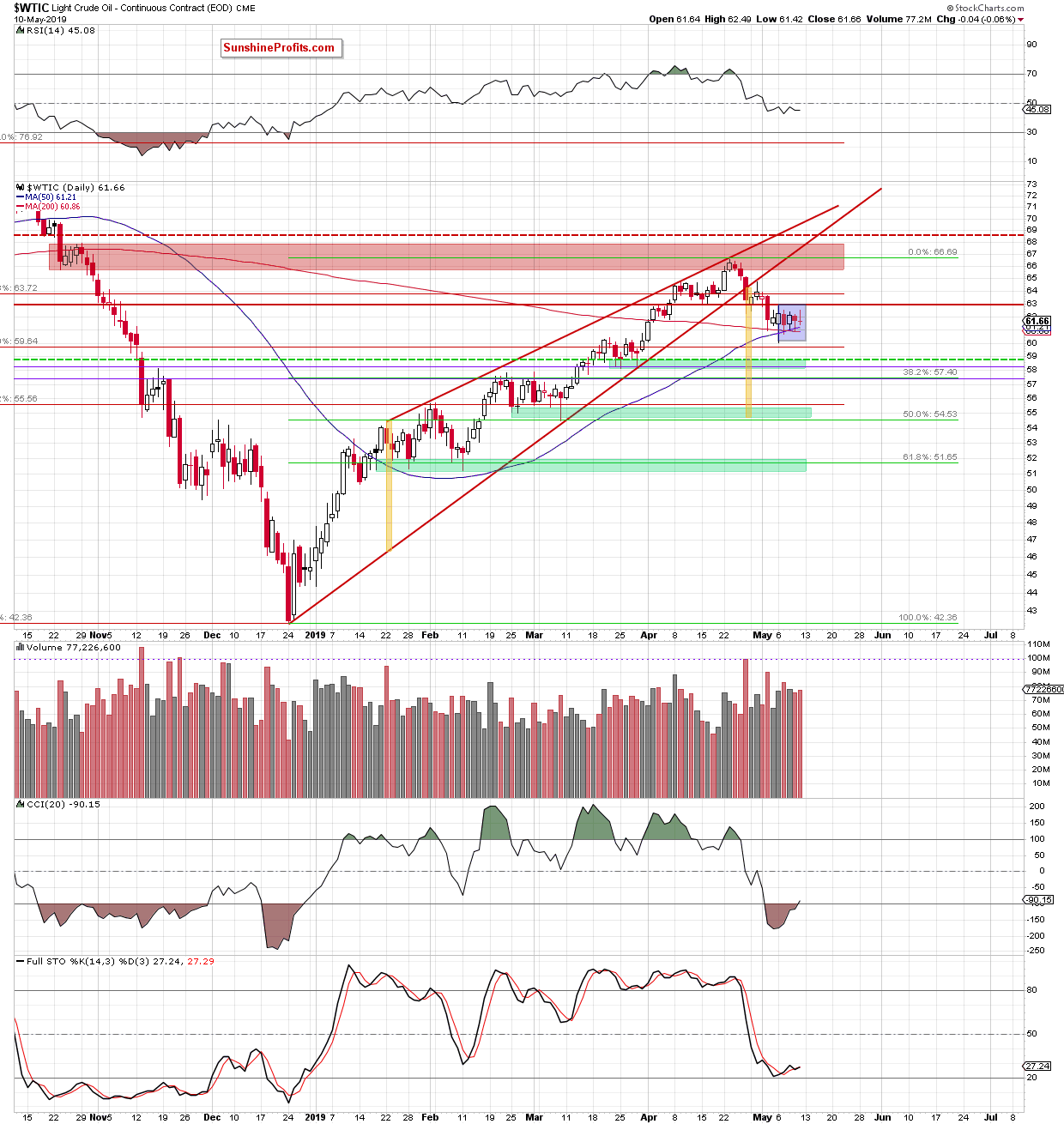

The daily chart has remained practically unchanged after Friday's session. It shows crude oil still trading inside the blue consolidation. Even today's upswing in response to the U.S.-China latest spat hasn't managed to break above it as black gold changes hands at around $62.90 currently. That's still between the previously-broken mid-April lows and the 200- and 50-days moving averages.

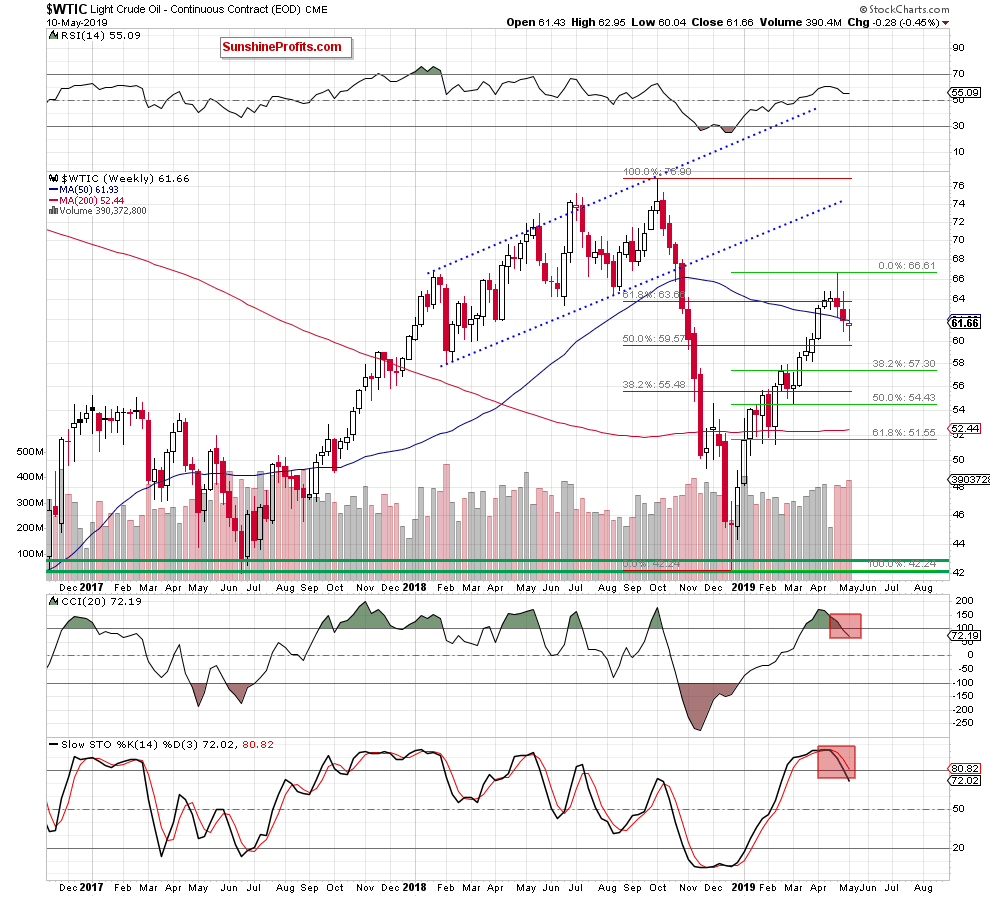

Let's examine the weekly chart for more clues. The commodity has closed the week below the 50-week moving average and it did that on higher volume than the volume that marked the preceding week. Combined with the sell signals of the weekly indicators, it suggests that another attempt to move lower may be just around the corner.

Summing up, today's news-driven upswing notwithstanding, the outlook for oil remains bearish and the bears look to be holding the upper hand. Oil has recently verified the breakdown below the red horizontal resistance line that's based on mid-April lows and keeps trading below it. The short position continues to be justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist