Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

It can't be denied that the bulls moved prices higher yesterday, but how far have they made it? Does it really change anything, is the short-term outlook any clearer now?

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

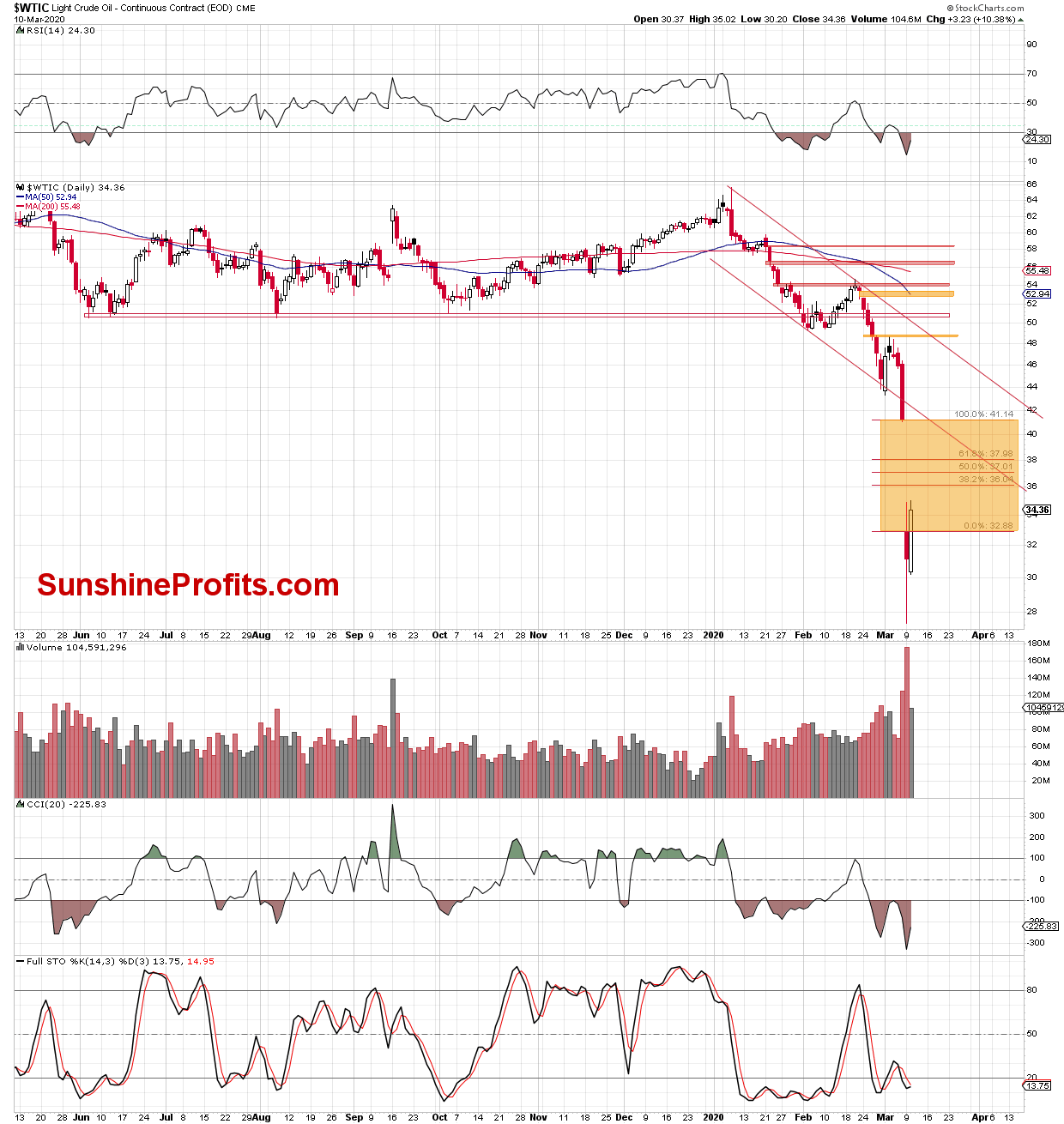

The daily chart reveals that oil moved higher during yesterday's session, erasing over 10% of the recent sharp declines. Despite this increase, the price of black gold didn't close the day above yesterday's high, and is still trading well below the upper border of the huge orange gap created on Monday. Both of these factors don't really confirm the bulls' strength.

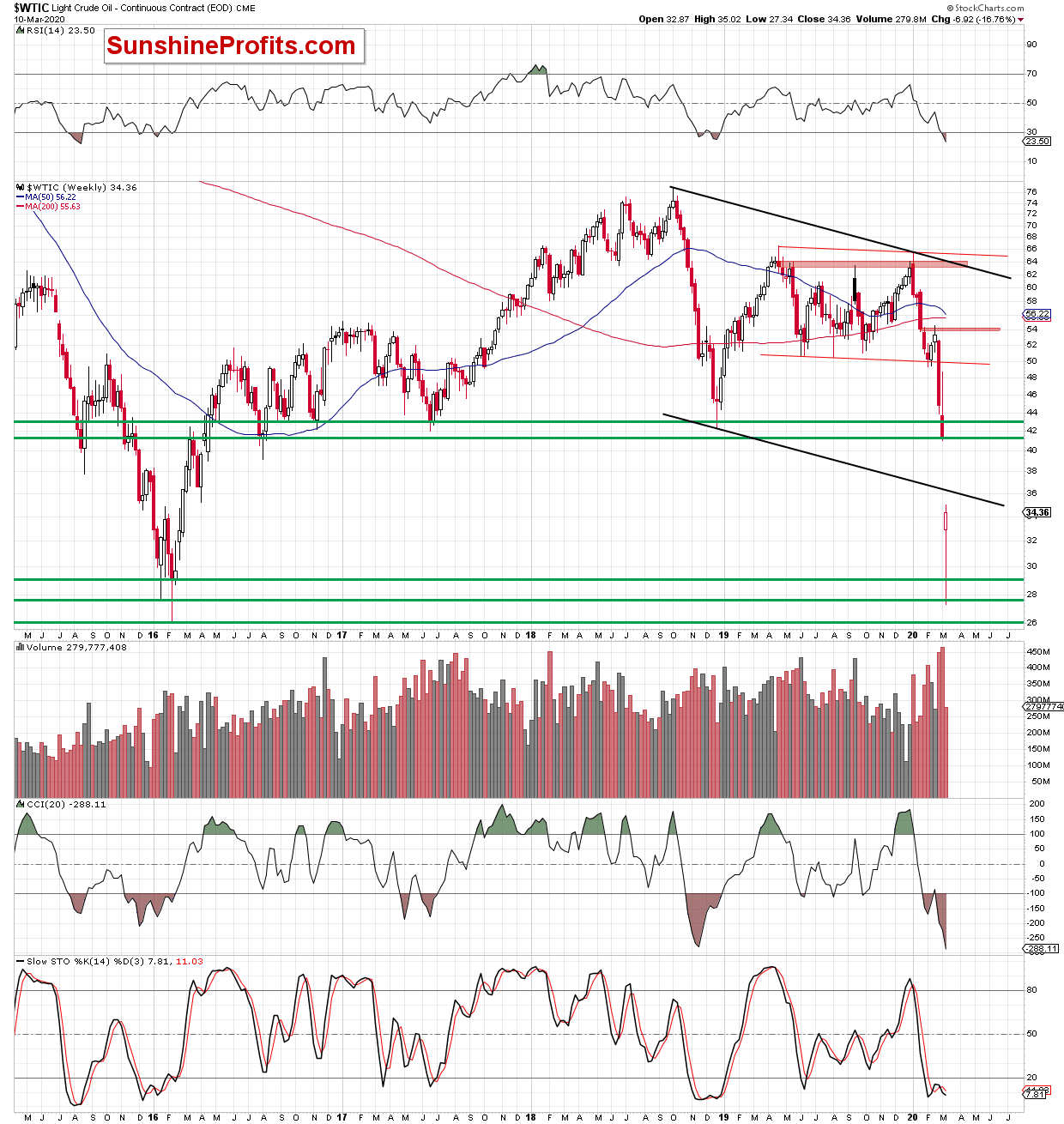

Let's zoom out and examine the weekly picture. Although light crude rebounded in recent days, the commodity still trades below the lower border of the black declining trend channel on the below chart.

How did all these factors affect investors' moods earlier today? Let's check the oil futures chart to find out.

Here, we see that the futures extended gains earlier today and climbed to the 38.2% Fibonacci retracement that is based on the orange resistance gap. As it turned out, this resistance was strong enough to stop the bulls, which triggered a pullback and a comeback to levels around yesterday's close in the following hours.

What does it mean for the futures and the commodity itself?

In our opinion, further deterioration coupled with at least a retest of the psychological level of $30 may be just around the corner. Nevertheless, before we see such price action another attempts to move higher can't be ruled out - especially when we take into account today's EIA report, which could increase volatility in the oil market later in the day.

How high could the futures go if the EIA positively surprise market participants? For example, what if it showed a smaller increase in crude oil stocks compared to yesterday's API report, which said that crude inventories rose by 6.4 million barrels in the week to March 6 to 453 million barrels, missing analysts' expectations for a build of 2.3 million barrels?

We are of the opinion that the quote from our yesterday's Alert will be the best answer to this question:

(...) the buyers may try to push the futures higher.

Should we see such price action, we can expect a dead cat bounce pattern - a small, short-lived recovery in the price, which could take crude oil futures to the 50% ($37.09) or even the 61.8% ($38.07) Fibonacci retracement (based on the gap range) in the following day(s). At this point, it is also worth noting that the greater the decline, the greater the rebound we can expect, which means that an attempt to close the orange gap cannot be ruled out.

Nevertheless, if today's report confirms a bigger-than-expected increase in black gold inventories with simultaneously disappointing data on gasoline and distillate stocks, the bearish scenario will be likely in play.

Summing up, the situation continues to be too unclear to justify any trading positions at this time. The profits that we took off the table recently were huge, but given this kind of volatility, it might be easy to erase them if one is not careful. And we care about your capital too much to put it at risk during unclear times, and that means that capital preservation rules right now. Naturally, we'll keep you informed should the outlook clarify.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager