Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Another movement up and down in oil. Recent days’ action feels like a seesaw. With no end in sight. Seemingly. Times like this try our patience. Armed with powerful analytical tools, we however assess the odds of the next move and plan accordingly. Not to be surprised by today’s slide and welcoming it as much as you do, it’s time to share today’s observations with you.

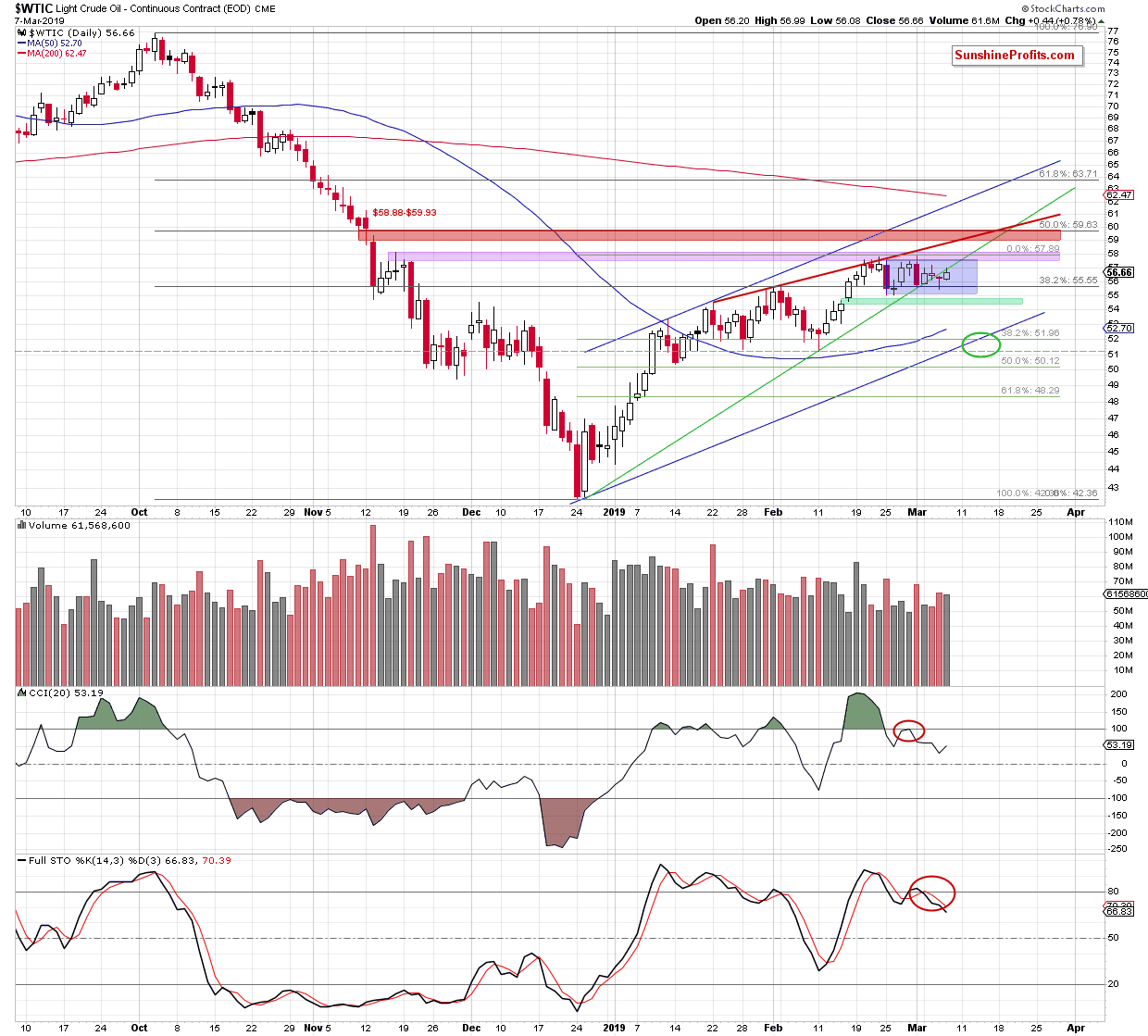

Let’s take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Yesterday, we wrote:

(…) Earlier today, crude oil futures moved a bit higher (they trade at around $56.80 currently), which suggests that we may first see a verification of yesterday’s breakdown below the rising green line before any serious move lower.

The oil market moved higher in line with our expectations. The move has however been nothing to write home about in terms of its implications. There was no green line breakdown invalidation and the bulls hesitated as evidenced by the not so insignificant upper knot. This is a bearish sign, a breakdown verification.

Additionally, daily indicators’ sell signals remain on the cards. Earlier today, oil price has been just plunging with no end in sight to currently trade at around $54.70 (a sizable decline of around 3.50% in the oil futures terms).

Summing up, our downside target marked with the green circle remains in play. The oil bears have so many factors on their side - recent tiny breakout invalidations, price trading beneath important resistances, the bearish volume implications and the bearish positioning of the daily indicators. And now also the breakdown below the rising green line that we expect to be confirmed shortly.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist