Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61 with $54.81 as a stop-loss and $65.50 as the initial price target.

It looks like the seas have calmed and the waves are no longer rocking the boat. So, what’s in store for crude?

On Monday (Apr. 12) I saw the signs of an oil price rally and wondered if an actual rally is around the corner. And indeed, prices have been on the rise and are up by more than 2% in today’s session (Apr. 14) as there are signals that demand is picking up. The overall tone for the crude oil market was colored bullish at the start of this week when, during an interview, Fed Chair Jerome Powell mentioned the U.S. economy being at an “inflection point”. We are now nearing $62 levels and I believe that the $65 level will be crossed soon in a stepwise and consistent fashion.

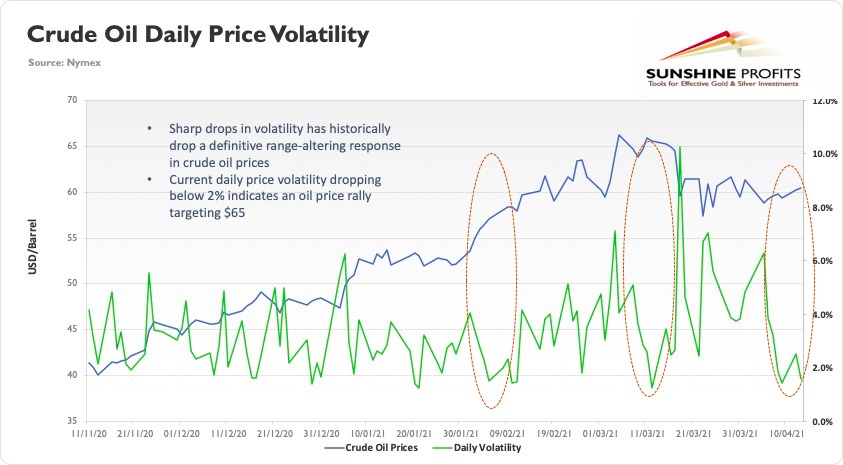

One interesting pattern to note is the sharp drop in volatility as seen from the chart below. The daily price volatility has dropped from 4-6% levels to 2% levels this week. When prices are not fluctuating, it means that the market is ready to move significantly in one direction and come out of its range-bound behavior. So, with the current trend of oil prices reacting more favorably to even a tiny bit of good news, it’s clear that optimism rules the day when it comes to the black gold.

News briefs such as the American Petroleum Institute’s (API) report on a higher-than-expected withdrawal from crude inventory and OPEC again forecasting a higher demand growth, have helped trigger the current stepwise price increase. Strong bearish factors such as a demand drop due to Covid-19 cases surging in India are pulling prices down, thereby indicating bullish sentiments in the market

Inflation is most likely just around the corner as we are experiencing a steep price rise in consumer goods, although that’s still not reflected by any alarming levels in official data. In the coming days, higher inflation will lead to a weakened dollar, which in turn will place further upward pressure on prices

To summarize, there is a high likelihood of oil prices breaking out of their range-bound behaviour and touching $65 levels by the end of April, as market sentiments are bullish. The market then needs to be re-examined at $65 levels from the lens of geopolitical developments in order to determine its further movements.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist