Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

A provocative question surely. Crude oil seems to be building on yesterday’s gains today. Was the Saudi Arabia pledge a game changer? The clues keep mounting. We invite you to our assessment of all the technicals that we see in the oil market now.

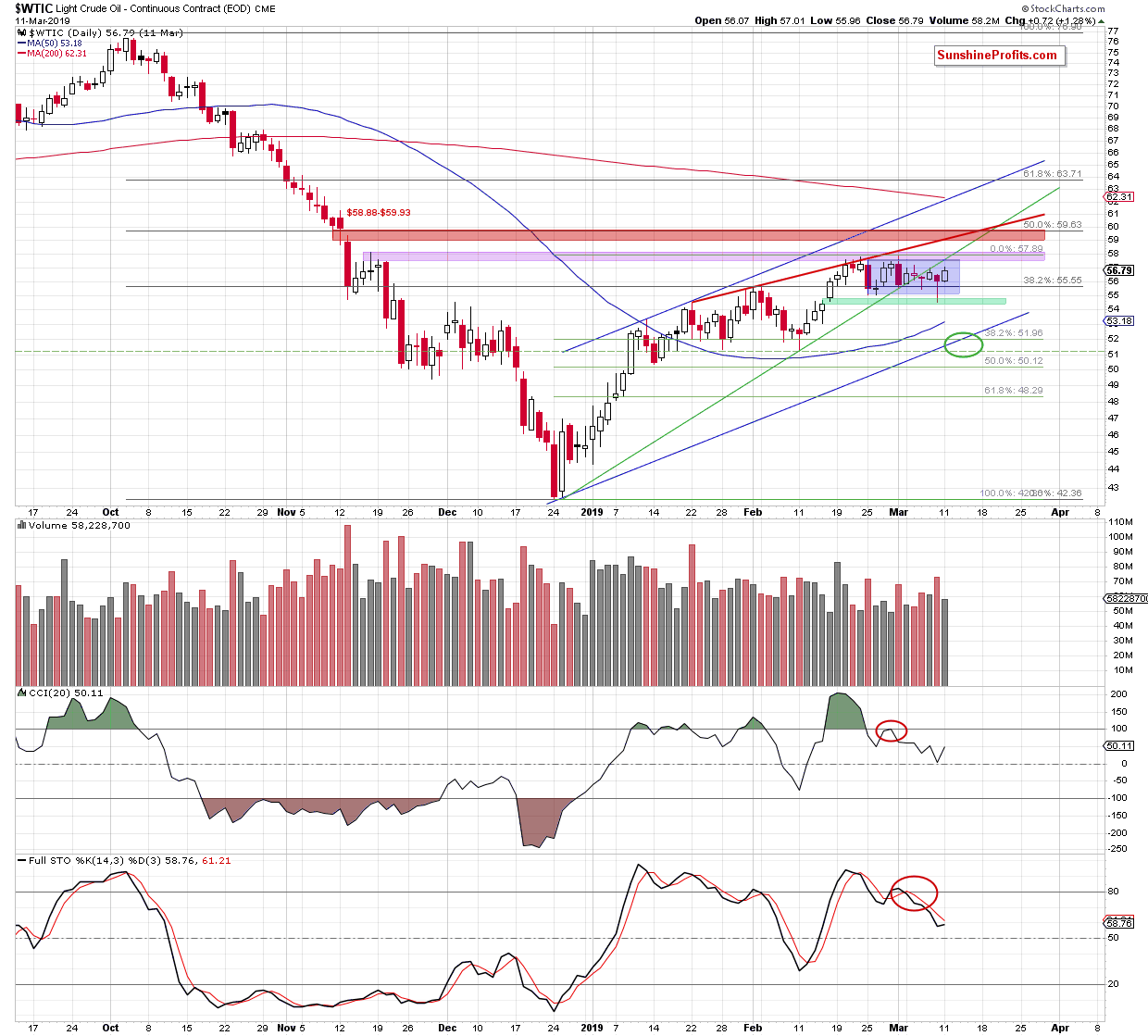

Let’s take a closer look at the chart below (chart courtesy of http://stockcharts.com).

We’ll start with our yesterday’s observation regarding the green support zone that marks the price gap we witnessed in mid-February. Namely, that the green support zone:

(…) encouraged the buyers to act, which resulted in a daily close above both the green support zone and the lower border of the blue consolidation. It means an invalidation of the tiny intraday breakdown below it.

This remains up-to-date also today. Again, it suggests that the oil bulls will be active in this zone and we can’t rule out yet another move higher. One more verification of the breakdown below the rising green support line isn’t out of the question. Indeed, at the moment of writing these words, crude oil is trading at around $57.40.

Quoting yet again our yesterday’s alert:

(…) the sell signals remain on the cards, which suggests that lower prices of black gold are still ahead. It’s also supported by the now confirmed breakdown below the green rising support line.

One more word about volume. Please note that yesterday’s upswing was marked by lower volume than the preceding decline. We have seen this factor at play quite a few times not long ago. This preceded the forthcoming declining sessions both this and previous month.

Summing up, our downside target marked with the green circle remains in play. The oil bears have so many factors on their side – the late-Feb tiny breakout invalidations, price trading beneath important resistances, confirmed breakdown below the rising green support line and the overall bearish volume implications. The daily indicators haven’t issued any buy signals yet.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist