Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

On Friday, black gold plunged only to make a comeback attempt. And today, it seems to be building on that and is currently trading at around its Thursday close. Is that the effect of Saudi Arabia pledging to extend its deep oil cuts? Let’s see how it all ties in with our oil market outlook – and with the decisions we make.

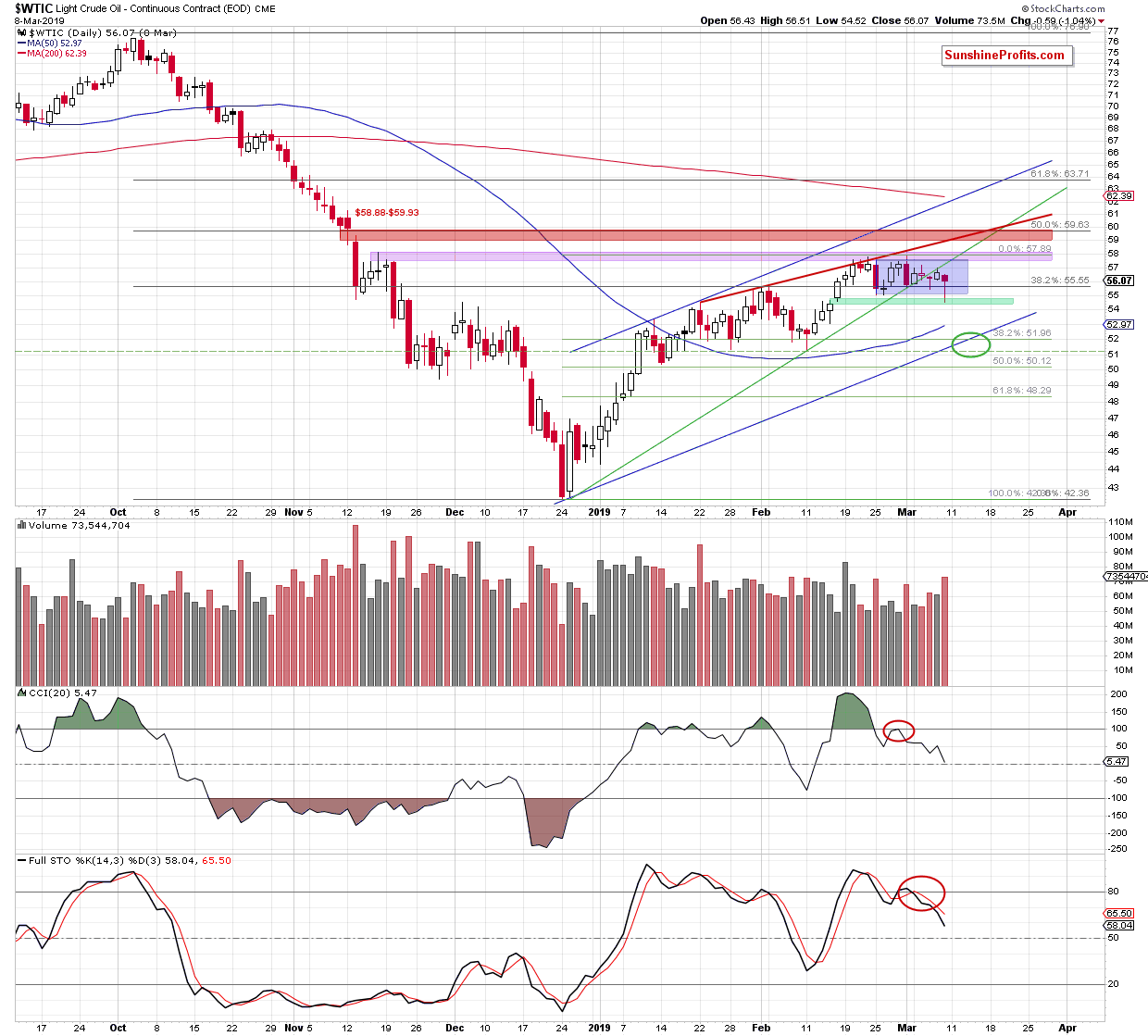

Let’s take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Yesterday, we wrote that:

(…) daily indicators’ sell signals remain on the cards. Earlier today, oil price has been just plunging with no end in sight to currently trade at around $54.70 (a sizable decline of around 3.50% in the oil futures terms).

And indeed, what a waterfall we have seen on Friday. Thursday’s verification of the earlier breakdown below the green line triggered such a deterioration that our first downside target (the price gap marked as the green support zone) has been reached.

This test encouraged the buyers to act, which resulted in a daily close above both the green support zone and the lower border of the blue consolidation. It means an invalidation of the tiny intraday breakdown below it.

Such price action suggests that the bulls will be active in this area and another attempt to move higher (and one more verification of the breakdown below the green rising support line) can’t be ruled out. Indeed, black gold is trading modestly higher today, at around $56.60 at the moment of writing these words.

However, the sell signals remain on the cards, which suggests that lower prices of black gold are still ahead. It’s also supported by the now confirmed breakdown below the green rising support line that we finished our up-to-date Friday’s summary with:

Summing up, our downside target marked with the green circle remains in play. The oil bears have so many factors on their side - recent tiny breakout invalidations, price trading beneath important resistances, the bearish volume implications and the bearish positioning of the daily indicators. And now also the breakdown below the rising green line that we expect to be confirmed shortly.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist