Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Periods of relative calm are succeeded by periods of decisive price moves. We have just seen one in the crude oil market and you were prepared in advance. What does the oil chart say now? Do the bulls have an ace up their sleeves, or are they done and out?

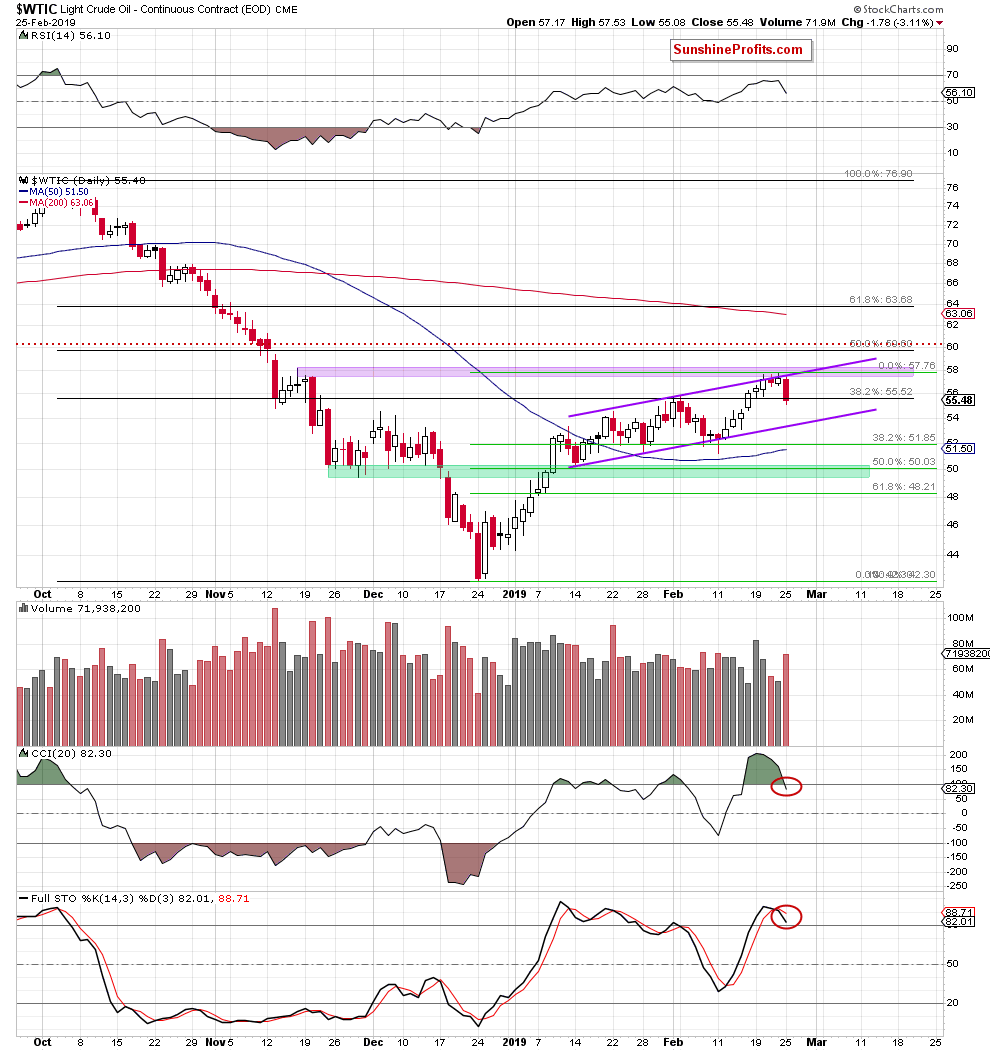

Let’s examine the chart below (chart courtesy of http://stockcharts.com).

Examining the daily chart, we see that the hesitation of previous days has ended yesterday. After the third unsuccessful attempt of the bulls to break above the upper border of the purple rising trend channel and the purple resistance zone based on the mid-November peaks, black gold headed straight south.

Our assumptions were validated:

(...) There is a visibly bearish disconnect building between the oil price and the CCI leaving its strongly trending readings, which reinforces the probability of the former moving lower in the very near future. Stochastic Oscillator concurs and generated its own sell signal on Friday. RSI’s ascent has also slowed down lately and looks ready to roll over.

Thanks to yesterday’s drop, the commodity slipped below the 38.2% Fibonacci retracement, invalidating the earlier breakout above this resistance. Importantly, the volume accompanying yesterday’s decline increased and this provides an important clue as to the strength of bears involvement. The implications stretch beyond yesterday’s session only. Additionally, CCI and Stochastics generated their own sell signals which reinforces the bearish outlook.

As we wrote on Thursday, all the above suggest that:

(...) the first downside target would be the lower border of the purple rising trend channel (currently at around $53.20).

Our yesterday’s summary remains up-to-date also today:

(...) Summing up, short positions continue to be justified from the risk/reward perspective as oil bulls apparently have serious problems breaking above the nearest short-term resistances. Additionally, the volume and the current position of the daily indicators favor the sellers and another move to the downside this week.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist