Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view.

After oil futures retested the $10 mark, they've rebounded, and they even managed to rally above $15. Have we just seen THE bottom in crude oil?

In short, it's too early to say so. The situation in the futures market still seems too murky for us to open a new trading position, but it might indicate that something is about to clear up soon.

Why?

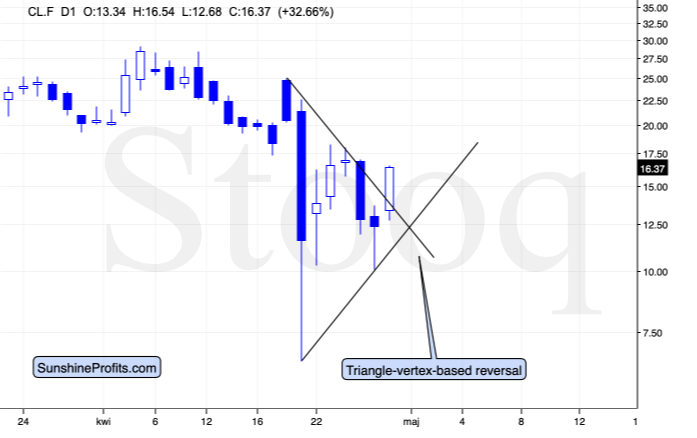

Because tomorrow or on Monday, we have a triangle-vertex based reversal. This means that we might see either a local top or a local bottom shortly. If that happens after a decisive move in any direction, and is accompanied by some kind of a reversal sign (for instance in the form of a shooting star candlestick or any other kind of reliable candlestick pattern), we might open a trading position. It seems too early to do so right now.

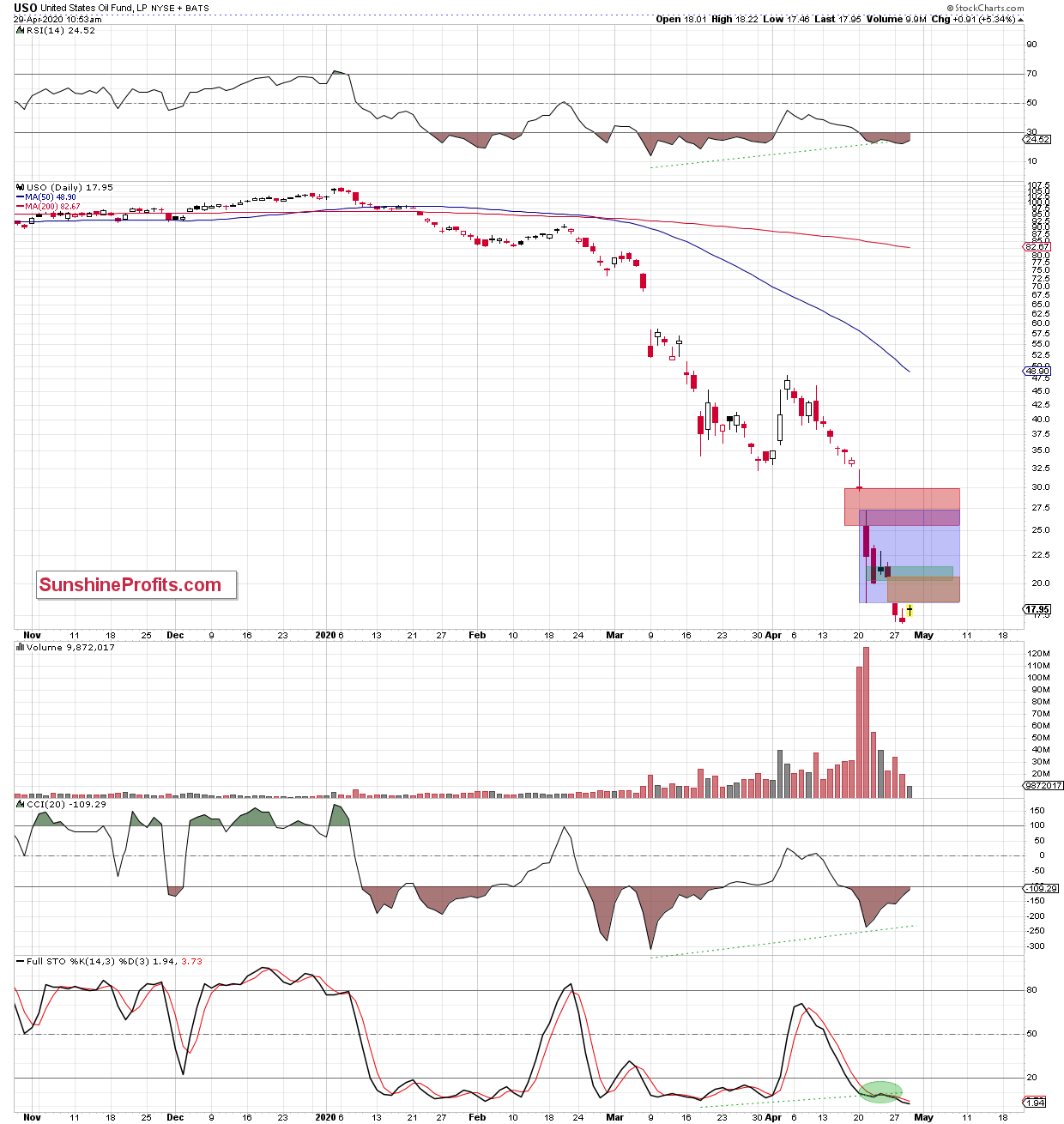

Having said that, let's check the USO ETF charts (charts courtesy of www.stockcharts.com ).

In short, our yesterday's comments remain up-to-date, as the ETF remains below the red price gap:

(...) The first things that catch the eye on the daily chart, are yesterday's orange bearish gap and the breakdown below the lower border of the blue consolidation.

As you can see, the ETF opened on Monday with another big gap, which encouraged the sellers to push prices lower in the following hours. Despite the tiny rebound before the closing bell, the USO finished the day below the lower border of the blue consolidation. This suggests that further deterioration may be just around the corner.

Should it be the case and the ETF extends losses from here, the first downside target for the bears would be around 1.1, which is where the size of the downward move will correspond to the height of the blue consolidation.

In other words, another move to the downside is still possible and a fresh low (maybe even around $4-5.6), is a strong possibility.

On a side note, please note that the prices on the above chart were adjusted because of the 1:8 reverse split.

Summing up, the bottom in the USO ETF might not be in just yet, and the situation in crude oil futures remains too chaotic to open a trading position with any degree of confidence in a profitable outcome. The situation might clarify as early as tomorrow or on Monday, as that's where we have the next triangle-vertex-based reversal in case of crude oil futures. As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager