Trading position (short-term; our opinion): Short position with the binding profit-take level of $43.12 and the stop-loss level of $56.11.

Oil has taken a beating in recent sessions, leaving many to wonder where the slide stops. But wait, black gold has rebounded on Friday off the daily lows. Is it a harbinger of more to come?

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

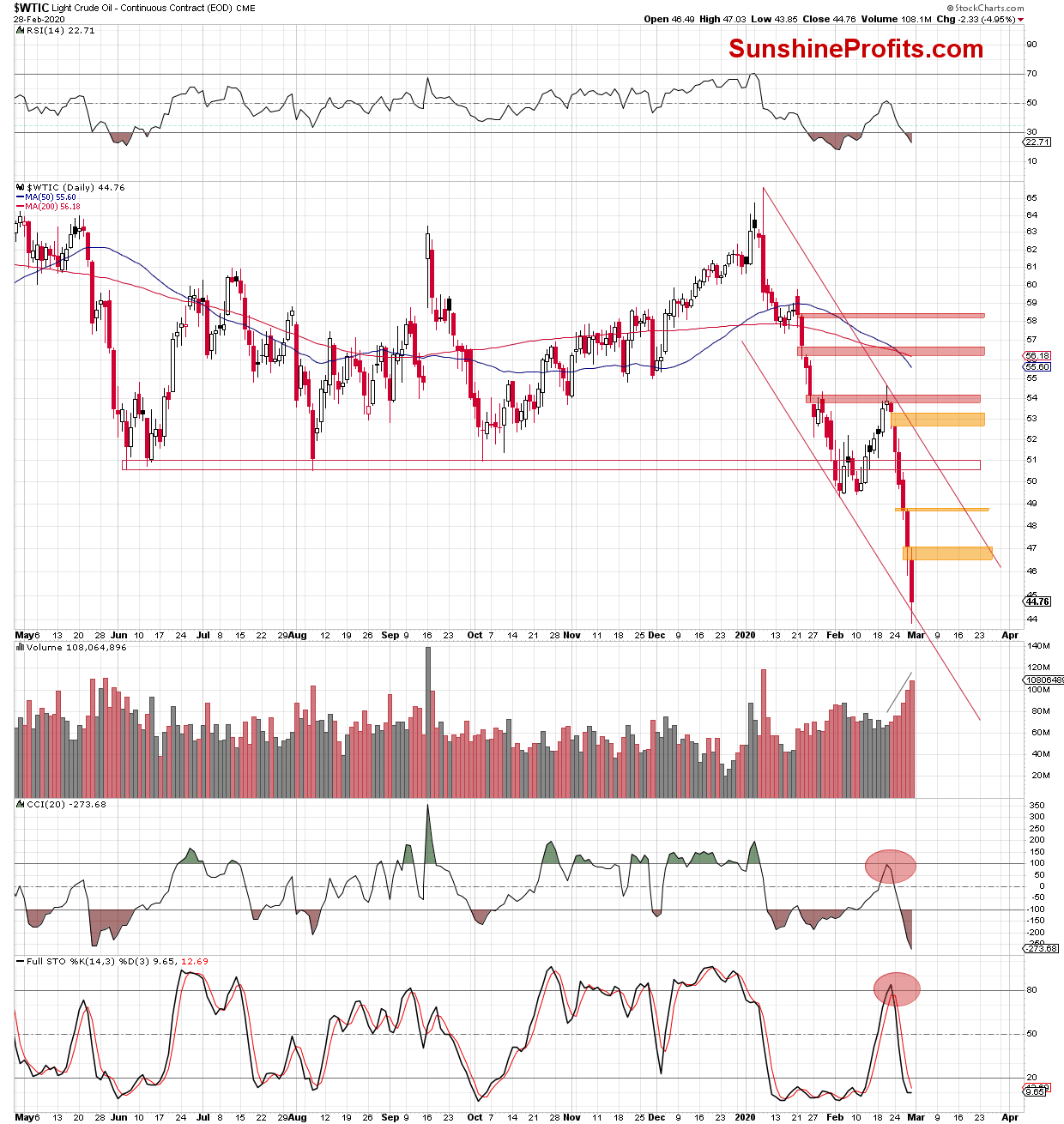

Looking at the daily chart, we see that crude oil opened Friday's session with another bearish orange gap. As the bulls failed to close it, further deterioration followed.

Thanks to this drop, the commodity lost almost 5%, making our short position even more profitable (as a reminder, we opened it when crude oil was trading at about $51.50, so this position is over $6 "in the green").

As you see, Friday's decline took light crude to the lower border of the declining red trend channel. This has triggered a modest rebound before the session close.

How did this price action reflect in today's crude oil futures?

The daily chart above shows that the futures opened the week with another bearish gap. Similarly to what we saw during Friday's session, the bulls pushed prices higher in the following hours, which closed the gap as black gold climbed to the orange gap created at the beginning of Friday.

This is a positive development for the bulls - but only at first glance. The above-mentioned gap stopped the buyers and triggered a pullback. This doesn't bode well for higher values of the futures and crude oil later today.

Additionally, the volume of Friday's session was significant, confirming the bears' strength. This suggests that the decline is not over yet - especially when we factor in the Elliott Waves Theory and the long-term picture below.

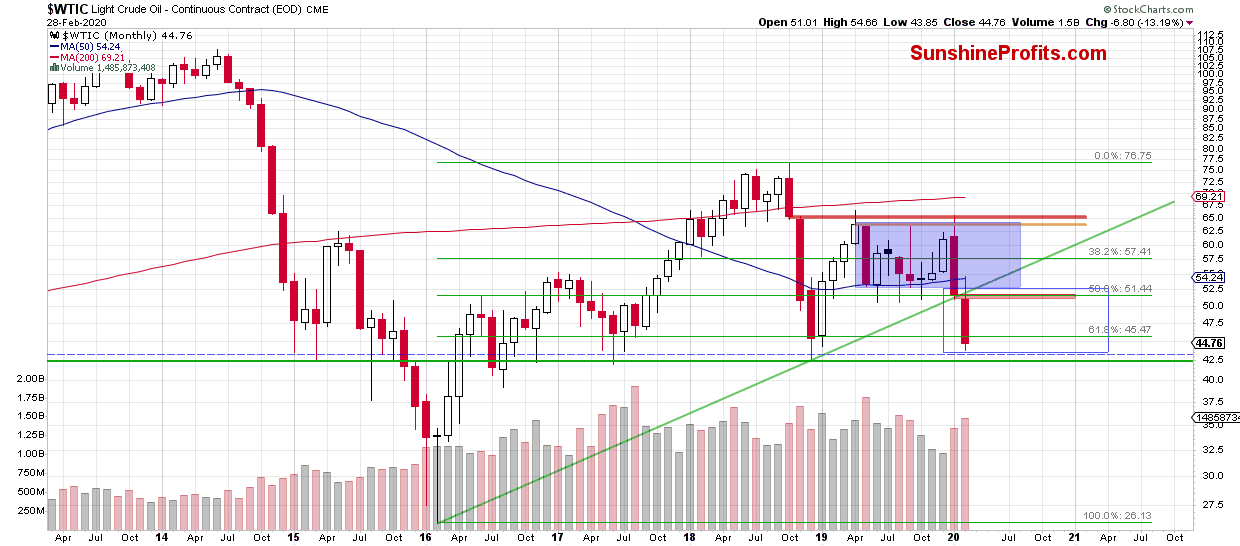

We see that February's downswing took the commodity not only below the long-term green support line, but also below the lower border of the blue consolidation.

What does it mean for the price of black gold?

In our opinion, the commodity could move even lower and drop to around $42.20, where the size of the downward move would correspond to the height of the consolidation. Additionally, there is also the December 2018 low slightly above this level, which increases the likelihood that we'll see a test of this support in the coming week.

Being conservative in terms of money management, we are keeping our profit-take level somewhat above the mentioned price level so as to maximize the odds of exiting the trade before the rebound takes place.

Summing up, it seems that the final bottom for this short-term decline is not yet in, and that we might see even lower crude oil prices in the following days and/or hours.

Trading position (short-term; our opinion): Short position with the binding profit-take level of $43.12 and the stop-loss level of $56.11.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager