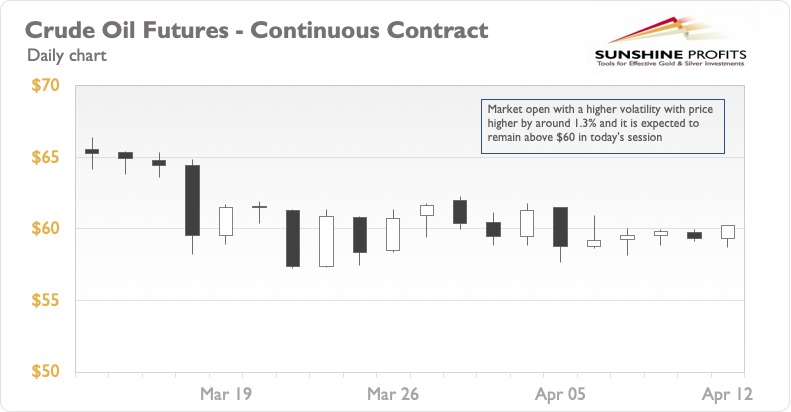

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-6,1 with $54.81 as a stop-loss and $65.50 as the initial price target.

Oil has shown a higher volatility and an upward direction in today’s (Apr. 12) session. This definitive movement is driven by an optimistic economic outlook based on U.S. Federal Reserve Chairman Jerome Powell’s interview with CBS 60 Minutes that aired last Sunday (Apr. 11). Powell believes that the U.S. economy is at an “inflection point”, which means there can be a sharp rise in economic activity in the coming months. Also, with a higher likelihood of stable interest rates throughout the year, industrial production will get a boost to manufacture more as the cost of production will be favorable due to low interest rates.

On the demand front, sluggishness due to lockdowns (especially in Europe), and news of the UK relaxing its lockdown, has been taken as a positive sign by the market, resulting in a sharp increase of 1.3% in oil prices during the current session (Apr. 12).

The rise of the dollar is reversing, with the greenback further slipping towards a three-week low level. The USD’s price at the moment of writing stands at 92.11. A weaker dollar means higher prices for crude oil and it is important to watch out for U.S. inflation data in the coming days as inflation will determine the further movement of the U.S. dollar

Oil market sentiments for this week appear to be bullish and driven by signals of economic recovery and a weaker dollar. On the geopolitical front, OPEC+ is keeping oil supply quite restricted and the current supply restructuring efforts by India and China may not be sufficient in moving the prices lower.

To summarize, an oil rally seems more likely than ever now as the market is responding very favorably to any hint of economic recovery. It may be a longer wait, but the larger trend of an oil price rally in the coming days seems more certain. It’s still better for booking profits at $65 levels though, as the market is dynamic and trading positions need to be re-examined more frequently.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist