Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Tuesday, crude oil moved sharply lower after news that OPEC rose by 90,000 barrels a day in July despite the deal to cut production. In this environment, light crude lost 2%, slipping under important resistances and the barrier of $50. What does it mean for the black gold?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

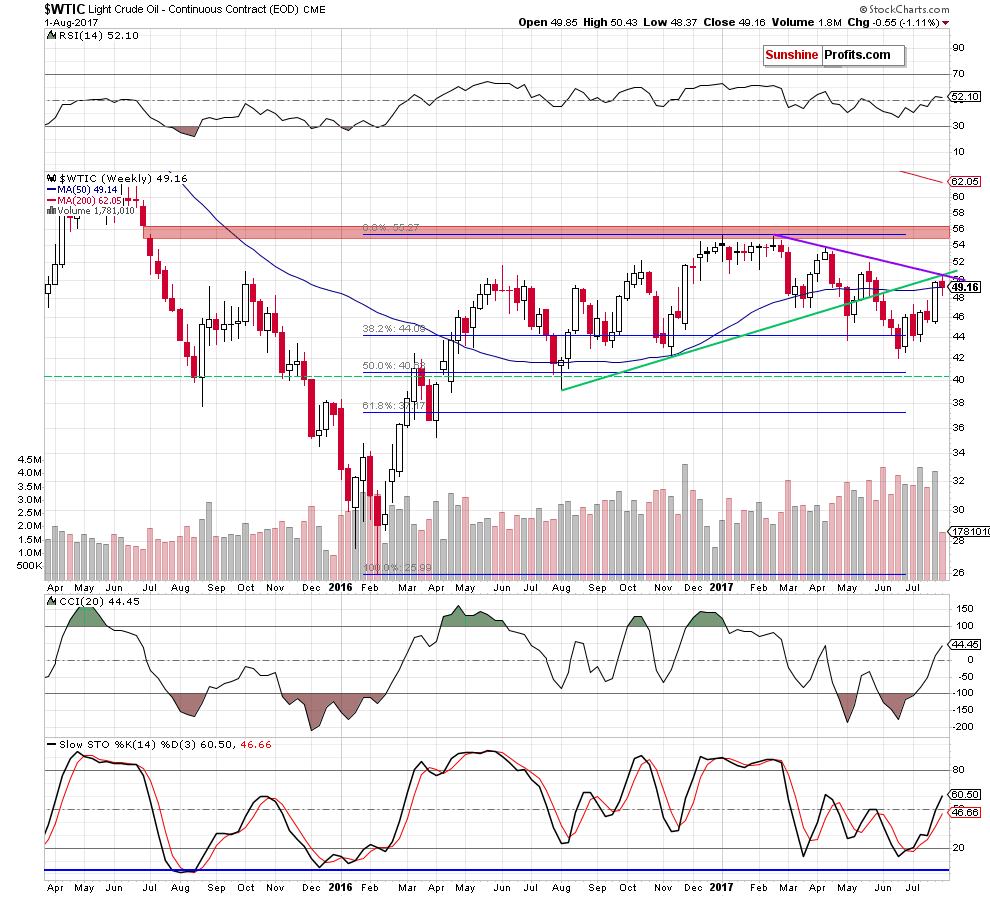

(…) Thanks to yesterday’s increase the commodity also tested the 61.8% Fibonacci retracement based on the entire 2017 downward move. Despite this improvement, light crude closed yesterday’s session under the abovementioned retracement, which means an invalidation of the earlier small breakout. Additionally, Monday’s increase didn’t materialize on significant volume, which increases the probability of reversal in the very near future.

On top of that, the black gold increased to (…) the purple resistance line based on the previous highs. (…) in this area is also the previously-broken medium-term green line based on the August and November lows, which suggests that the recent rebound could be a verification of the earlier breakdown. If this is the case, and we see a reversal in this zone, it will be a strong bearish factor, which could push the black gold to (at least) 2017 lows in the coming weeks.

This scenario is also reinforced by the current situation in the oil-to-gold ratio (more about this issue you could read in our Monday's alert).

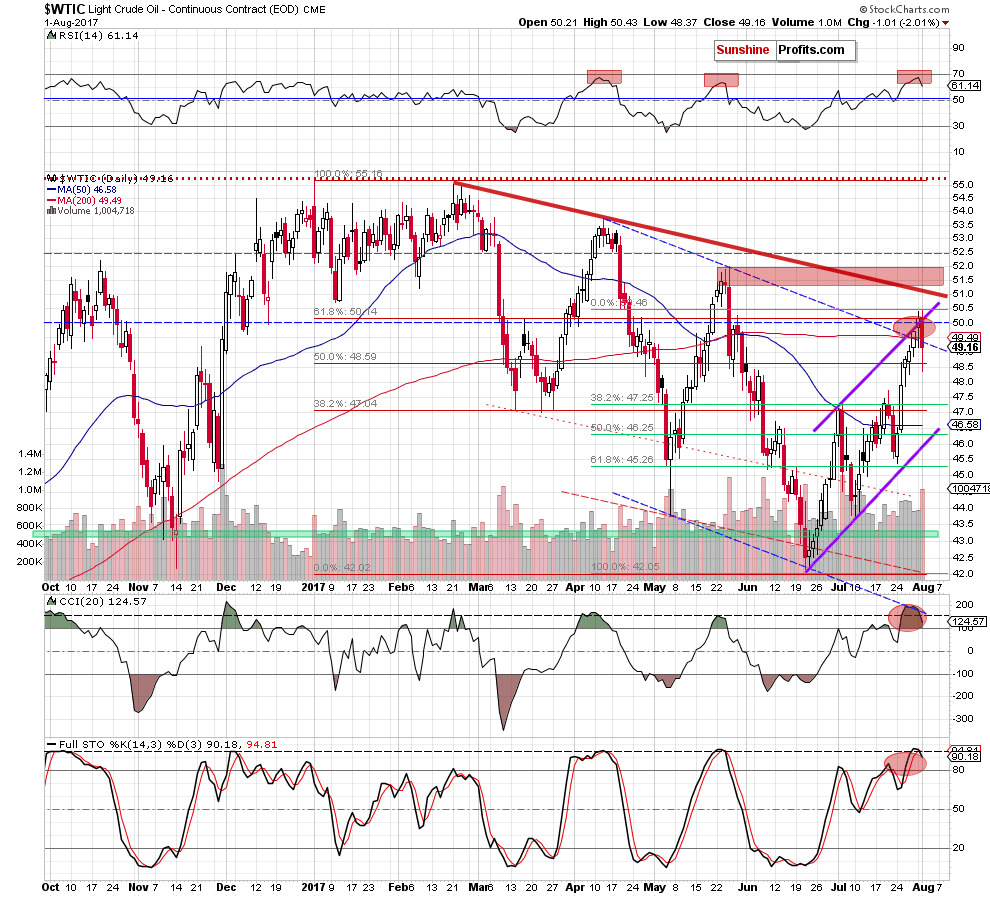

Looking at the charts from today’s point of view, we see that the situation developed in line with our assumptions as crude oil reversed and declined yesterday. Thanks to Tuesday’s price action, light crude slipped not only below the 61.8% Fibonacci retracement (based on the entire 2017 downward move) once again, but also dropped under the barrier of $50 and the previously-broken upper border of the purple rising trend channel, invalidating all the earlier breakouts. This negative development encouraged oil bears to act and resulted in a decline below the upper border of the blue declining trend channel (marked with the blue dashed lines) and the previously-broken 200-day moving average. Additionally, the commodity closed yesterday’s session below these levels, invalidating the breakouts also above these lines.

What’s next for the black gold?

Taking into account yesterday’s price action and all invalidations of the breakouts, we believe that oil bears received many very important reasons to act, which should result in further deterioration in the coming days – especially when we factor in the sell signal generated by the Stochastic Oscillator and the size of volume, which accompanied Tuesday decline (it was significant compared to what we saw during previous increases).

How low could the commodity go?

In our opinion, the first downside target for bears will be around $47.25, where the 38.2% Fibonacci retracement based on the entire recent upward move is. However, taking into account all negative above-mentioned factors, we think that light crude will test the lower border of the purple rising trend channel in the coming days (currently around $46.16). Please note that this area is also reinforced by the 50% Fibonacci retracement, which could pause for a bit further declines.

Finishing today’s Oil Trading Alert, we would like to point out to one more bearish factor. Yesterday, after the market’s closure, the American Petroleum Institute reported that crude oil inventories rose by 1.8 million barrels in the week ending July 28 to 488.8 million. This news pushed crude oil futures lower earlier today, which suggests that if they extend losses in the following hours, the price of light crude will follow them after the market’s open – similarly to what we saw in the past. Additionally, if today’s government data confirms an increase in crude oil inventories, we’ll likely see another sharp move to the downside later in the day.

Summing up, short (already profitable) positions continue to be justified from the risk/reward perspective as crude oil invalidated the earlier breakouts above the 61.8% Fibonacci retracement (based on the entire 2017 downward move), the barrier of $50, the previously-broken upper border of the purple rising trend channel, the upper line of the blue declining trend channel (marked with the blue dashed lines) and the 200-day moving average. Additionally, yesterday’s move materialized on significant volume (compared to what we saw during previous increases), which confirms that oil bears became stronger and suggests further deterioration in the coming days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

On an administrative note, there will be no regular Oil Trading Alert on Thursday and Friday, but if the situation changes dramatically, we will send you a quick note with our latest analysis and thoughts on that matter.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts