Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Thursday, crude oil lost 1.11% and invalidated the earlier breakout above the long-term resistance line, the previous highs and the lower border of the rising trend channel. Will these negative events trigger further deterioration in the coming week?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts below and find out (charts courtesy of http://stockcharts.com).

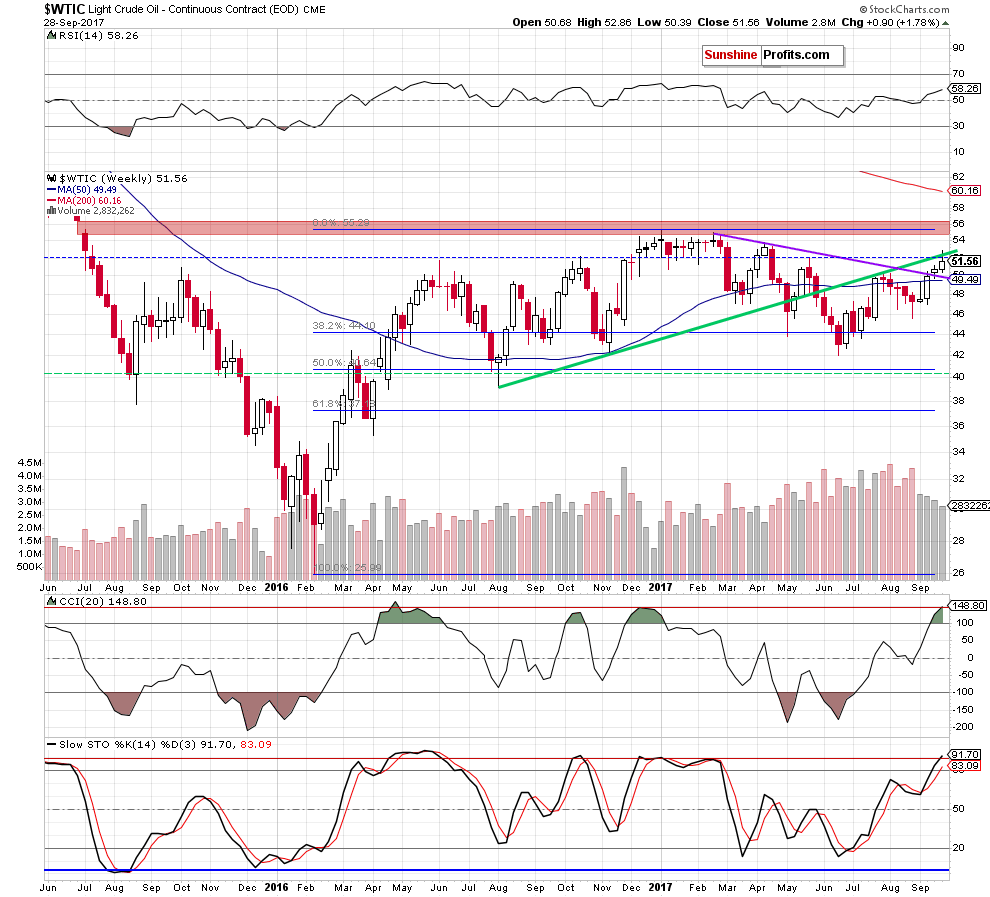

The first thing that catches the eye on the medium-term chart is an invalidation of the breakout above the long-term green resistance line. Additionally, thanks to yesterday’s drop the commodity slipped under the previously-broken May peak (marked with the blue horizontal dashed line), invalidating the earlier tiny breakout, which is a negative development. Nevertheless, these events will turn into bearish if we see a weekly closure below them later in the day.

Having said the above, let’s check what we can infer from the very short-term chart.

On Tuesday, we wrote the following:

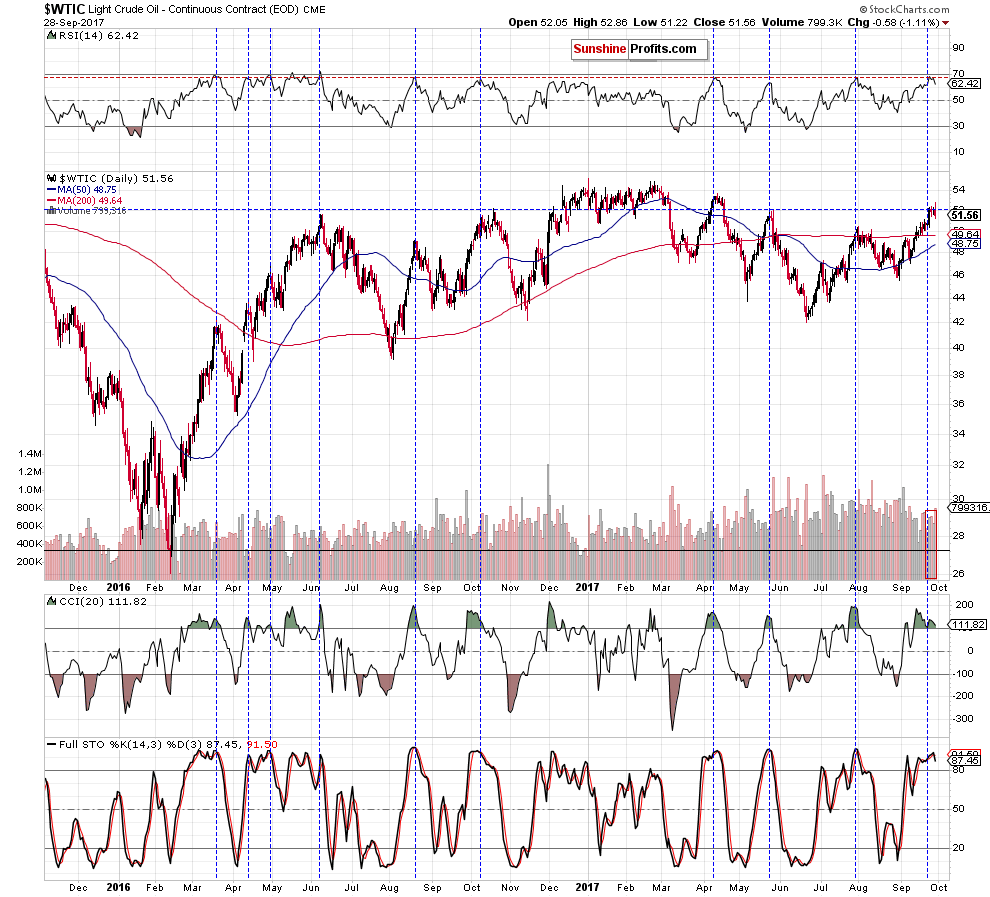

(…) almost all RSI increases to around 70 since the beginning of 2016 have resulted in reversals in the following days (we marked then with blue vertical, dashed lines), which increases the probability that the history will repeat itself once again and crude oil will decline in very near future.

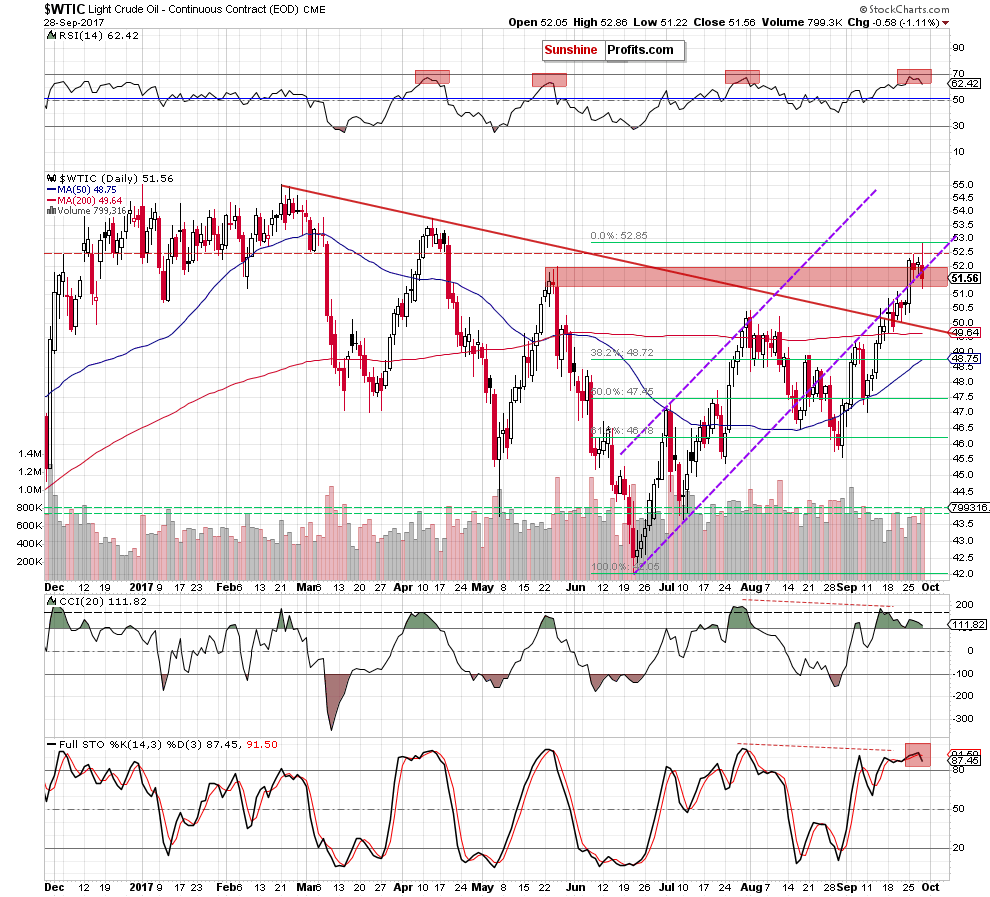

From today’s point of view, we see that the situation developed in tune with the above scenario and crude oil pulled back yesterday. As a result, light crude slipped not only below the previous highs, but also declined under the previously-broken lower border of the purple rising trend channel, which doesn’t bode well for oil bulls.

Why? Thanks to Thursday drop the commodity invalidated four earlier breakouts, which together with the current position of the daily indicators (the Stochastic Oscillator generated a sell signal, while the CCI is very close to doing the same) and higher volume (compared to earlier increases) during yesterday decline suggests further deterioration in the coming week.

If this is the case and crude oil declines from current levels, the initial downside target for oil bears will be around $49.85, where the previously-broken red declining line (which serves as the nearest support) is. If it’s broken, we’ll likely see a drop to the 38.2% Fibonacci retracement based on the June-September upward move (around $48.72) in the following days.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil invalidated the earlier breakouts on higher volume, which together with the current position of the indictors suggests lower prices of light crude in the coming week.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts