Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective.

Crude oil moved back and forth in a very volatile manner yesterday, moving above $50 temporarily, only to decline and close the session back below $49. What can we infer from these moves?

The important thing about them is that the bears seem to have won the battle and hat crude oil was not able to hold the $50 level for any significant amount of time. Consequently, little changed and the outlook remains bearish.

Crude Oil’s Technical Picture

Let’s take a closer look at crude oil’s chart and find out (charts courtesy of http://stockcharts.com).

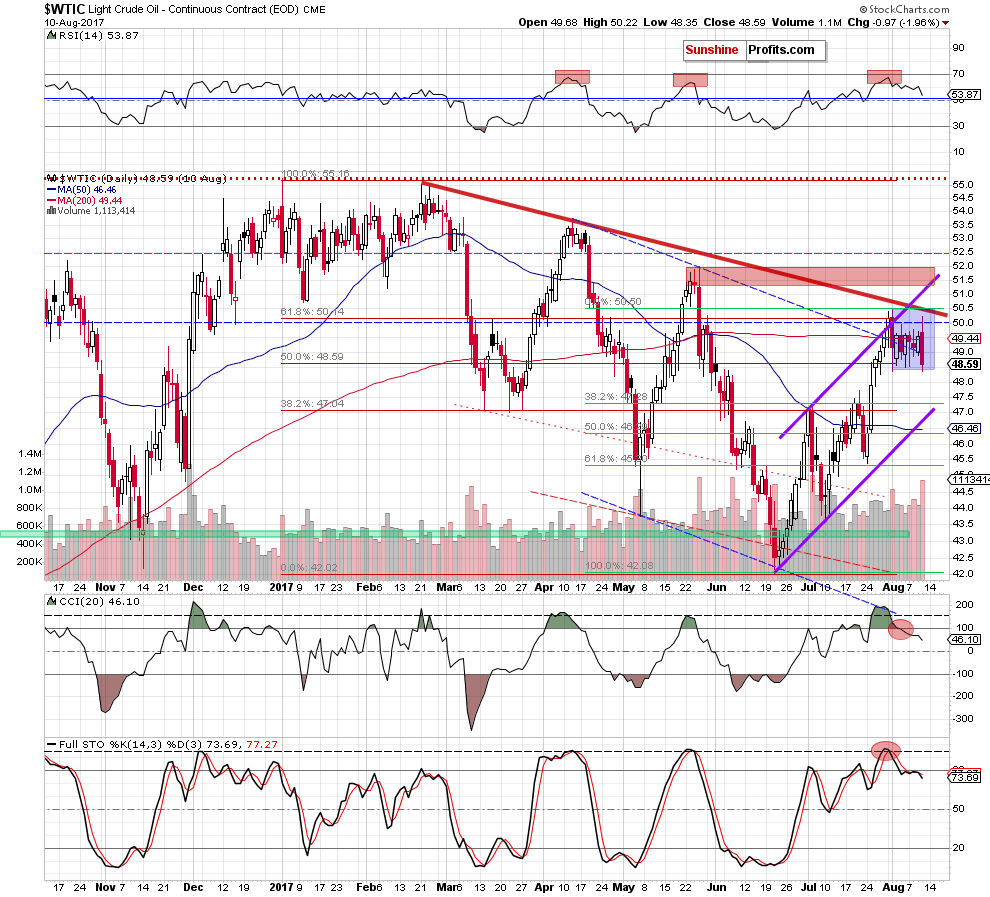

Crude oil still remains below the 61.8% Fibonacci retracement based on the February – June decline, so the June – July rally still seems to be just a counter-trend move within a bigger decline.

The sell signals from the CCI and Stochastic indicators remain in place, supporting lower crude oil prices in the following days and weeks.

Overall, yesterday’s session simply confirmed the bearish signals that we had seen earlier. Our previous comments regarding the downside targets remain up-to-date:

How low could the commodity go?

If light crude moves lower from current levels, the first downside target will be the last week low, which creates the lower border of the blue consolidation (at $48.37). If it is broken, the next downside target for bears will be around $47.25, where the 38.2% Fibonacci retracement based on the entire recent upward move is. However, taking into account all negative above-mentioned factors, we think that light crude will move even lower and test the lower border of the purple rising trend channel in the coming days (currently around $46.30). Please note that this area is also reinforced by the 50% Fibonacci retracement, which could pause for a bit further declines.

Summing up, short (already profitable) positions continue to be justified from the risk/reward perspective as crude oil remains under the 61.8% Fibonacci retracement (based on the entire 2017 downward move), the barrier of $50 and the previously-broken upper border of the purple rising trend channel. Additionally, yesterday’s failed attempt to move above $50 confirms that oil bears may indeed be strong enough to trigger further deterioration in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts