Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective.

Yesterday’s price action didn’t change much for the crude oil’s outlook as the implications of the important huge-volume session remain in place. So, what’s likely to be seen in the coming days?

Well, just as we explained in yesterday’s alert, a move lower seems to be in the cards. Let’s take a look at the charts for details (charts courtesy of http://stockcharts.com).

Since so little changed yesterday, practically everything that we wrote yesterday remains up-to-date:

Nothing really changed as crude oil didn’t close back below even the higher border of the price gap (…)

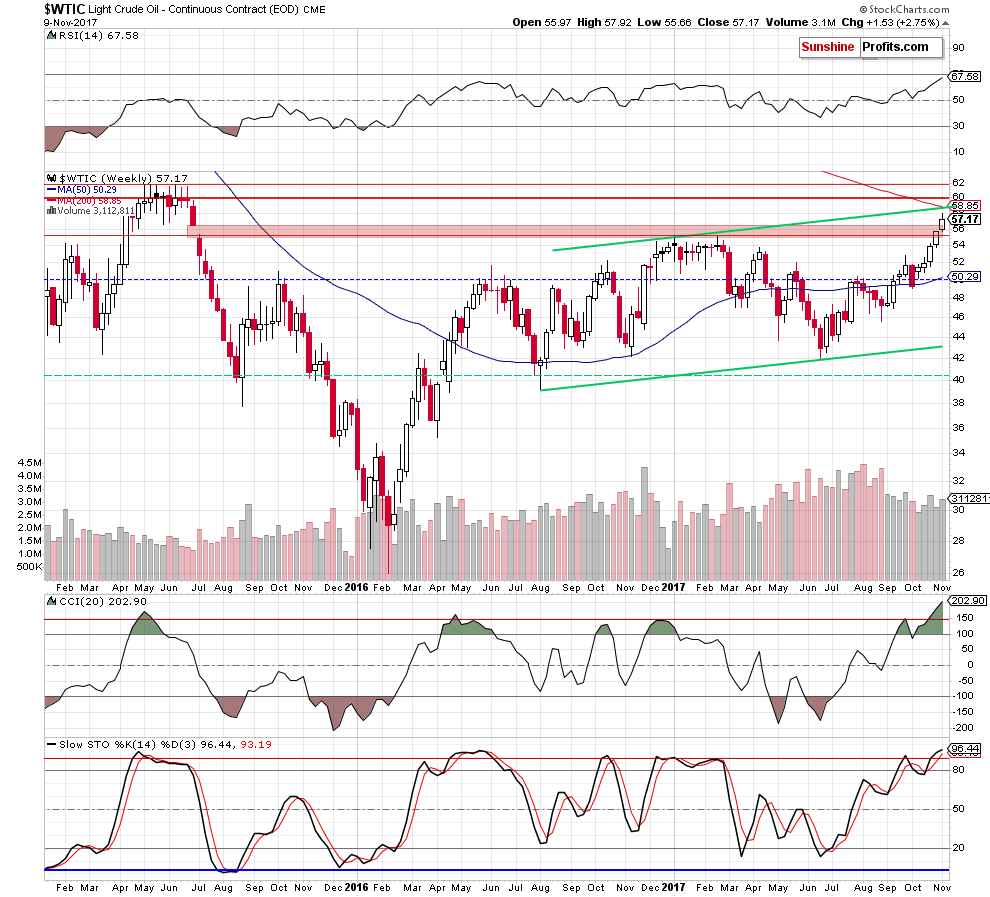

The mentioned price gap is marked with the red rectangle and it’s clearly visible that the price of crude oil closed above it. This makes higher prices much more likely in the short term. So, the question becomes, what’s the next stop and will it be the final one for some time (in terms of months). There are a few candidates for the next turnaround price and they are all close to the $60 level.

The resistance is provided by the upper border of the rising trend channel (marked in green) and the 200-week moving average coincide at about $59. The 2015 highs in terms of weekly closing prices provide the target at about $60 and the same highs, but in intraday terms point to $62 as important resistance.

Naturally, the above is not enough to indicate that the top is in – something else suggests that.

The indicators have been showing that the situation is very overbought for some time now, so that’s not the thing that changed yesterday. The thing that did, was the size of the volume that accompanied crude oil’s breakout above the Monday high and the subsequent invalidation thereof.

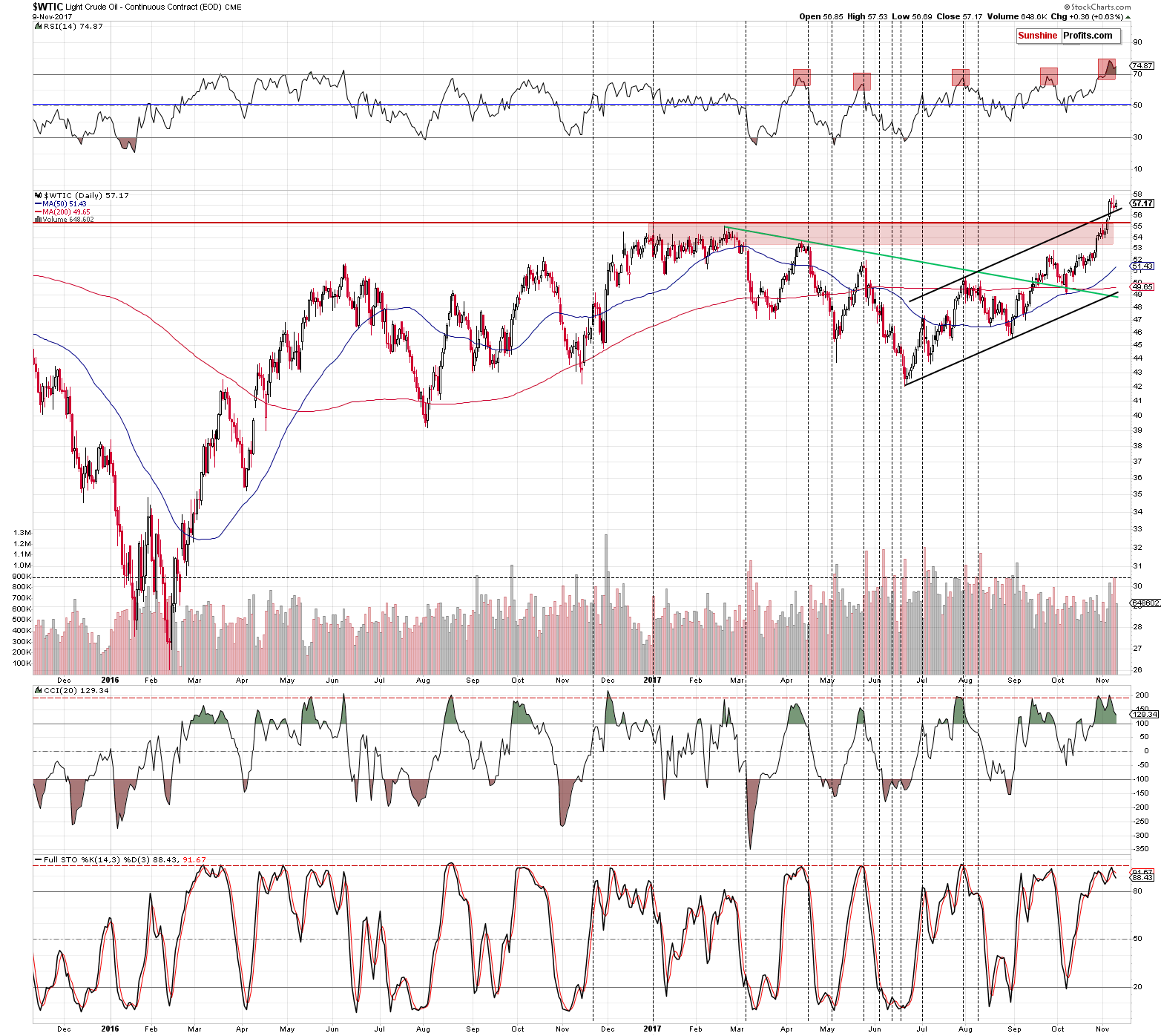

Reversals on huge volume are bearish on their own, but in this case, it seems that there is something else that comes into play – the analogy to the previous huge-volume sessions, during which crude oil declined.

We marked the volume level with the horizontal dashed line and we marked the similar sessions with vertical dashed lines. As you can see, practically all similar cases were followed by declines, either immediately or after some time. Given the situation in the indicators and the news-based nature of Monday’s rally it seems that a reversal is more likely than a prolonged consolidation.

Consequently, it seems that small short positions in crude oil are now justified from the risk to reward point of view. Why only small (half of the regular position)? Because, after all, crude oil is still above the rising trend channel and the 2017 highs. Invalidation of this breakout would serve as a bearish confirmation.

Crude oil moved a bit higher yesterday and both: the price move and the corresponding volume level were relatively small. This means that most likely it’s not an important reversal to the upside, but simply a pause. Consequently, all the above-mentioned implications of the huge-volume reversal remain up-to-date and thus we can summarize the situation just as we did yesterday:

Summing up, while it’s still possible that crude oil could move a bit higher before it tops, based on [recent] huge-volume reversal, the decline in the short term became much more likely and it seems that it’s likely enough to justify opening small short positions.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts