Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective.

On Friday, black gold increased above $57, but did this move change anything in the short-term perspective? Is it possible that the commodity will extend gains in the coming days?

Crude Oil’s Technical Picture

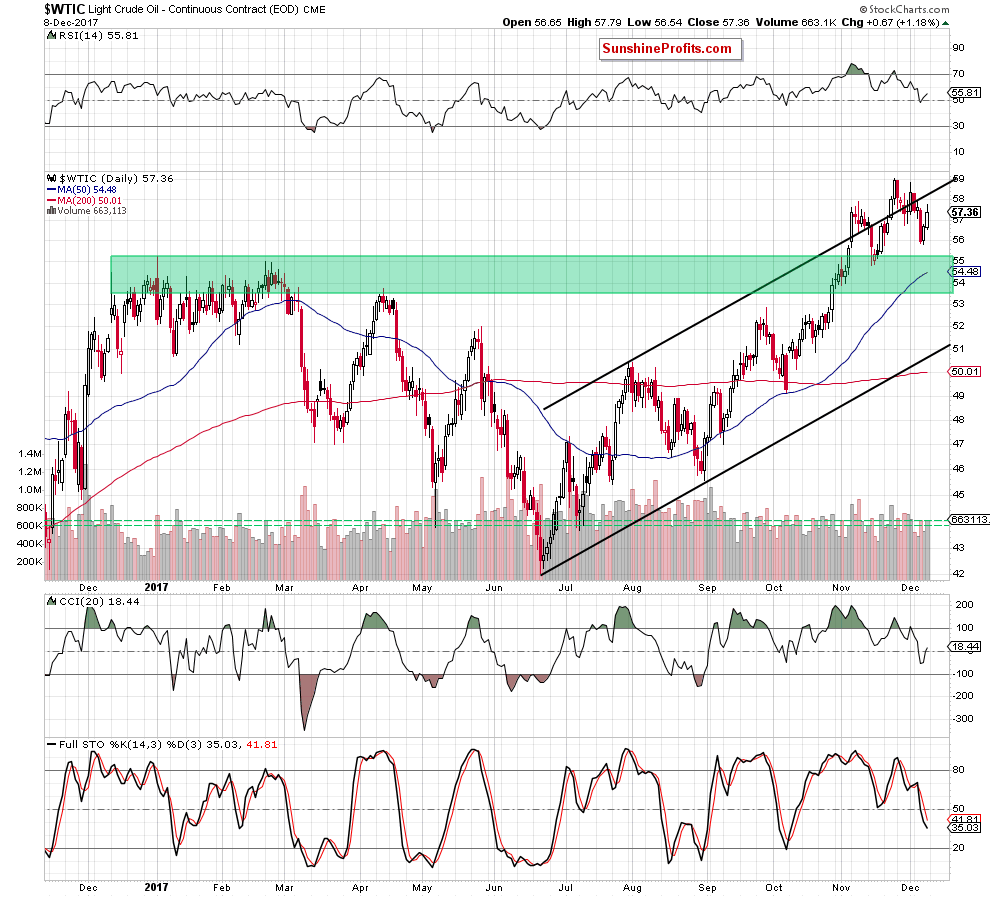

Before we answer these questions, let’s examine the technical picture of crude oil (charts courtesy of http://stockcharts.com).

On Friday, we wrote the following:

(…) in the pre-market trading, crude oil futures extended yesterday’s gains, which suggests that crude oil will likely follow them later in the day (similarly to what we saw many times in the past). Therefore, if oil bulls push the price of light crude higher, we can see an increase even to around $58, where the above-mentioned upper line of the trend channel currently is.

From today’s point of view, we see that the situation developed in tune with our assumptions and black gold moved higher on Friday. The size of volume was bigger than day earlier, which suggests that we’ll see one more upswing and a test of the above-mentioned upside target in the near future.

Will such price action change anything? We think that the best answer to this question will be the quote from our last alert:

(…) In our opinion, it won’t, because as long as black gold is trading under the upper line of the above-mentioned formation all upswings should be considered as nothing more than verifications of the Monday breakout. In other words, short positions continue to be justified from the risk/reward perspective.

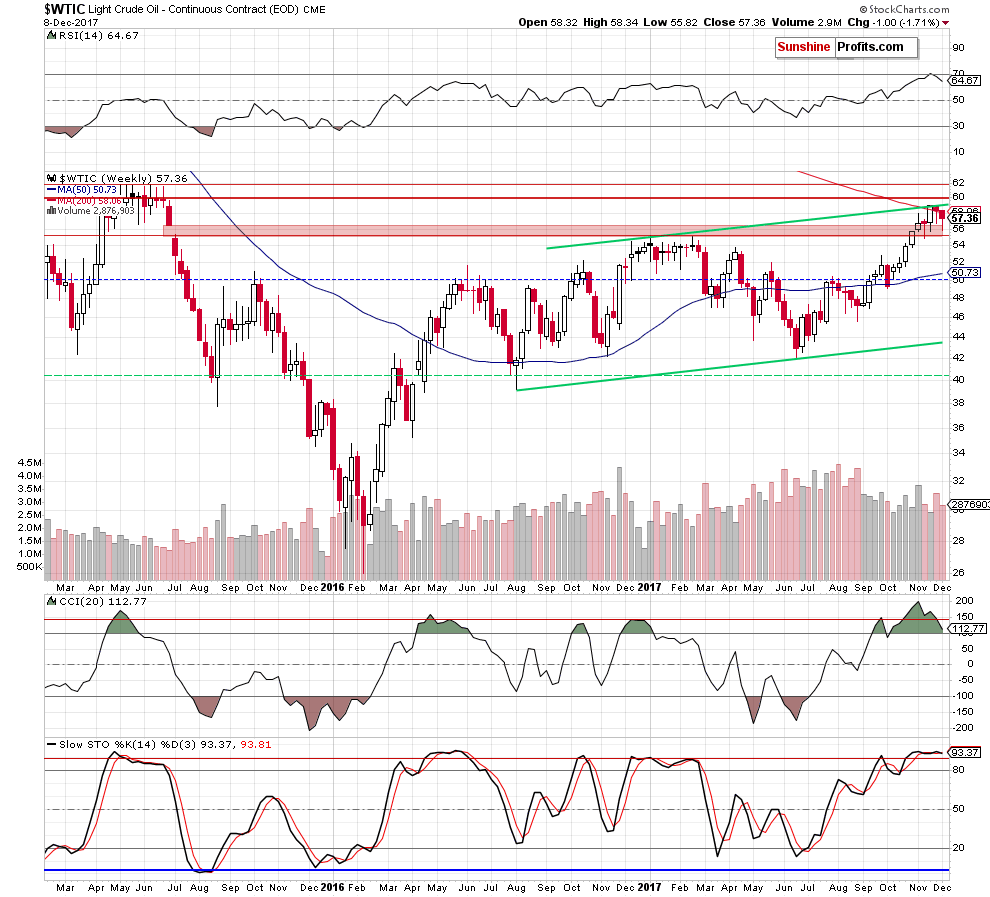

Before we summarize today’s alert, let’s take a closer look at the medium-term chart.

From the broader perspective, we see that although crude oil rebounded, black gold closed the previous week under the 200-week moving average, invalidating the earlier breakout. In our opinion, it is a bearish development – especially when we factor in the current position of the indicators.

As you see, the sell signals generated by the RSI and the Stochastic Oscillator remain in cards, supporting oil bears, while the CCI is getting closer to doing the same. Therefore, even if light crude moves a bit higher from current levels, the space for increases is limited and another move to the downside is very likely in the coming week.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil remains under the upper line of the black rising trend channel and invalidated the earlier breakout above the 200-week moving average. Additionally, the sell signals generated by the weekly and daily indicators increase the probability of further declines in the coming week(s).

Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts