Trading position (short-term; our opinion): Long positions (with a stop-loss order at $40.40 and the upside target around $50)

On Thursday, crude oil wavered between small gains and losses, but finally closed the day slightly higher and gained 0.42%. Will we see higher prices of the black gold in the coming week?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

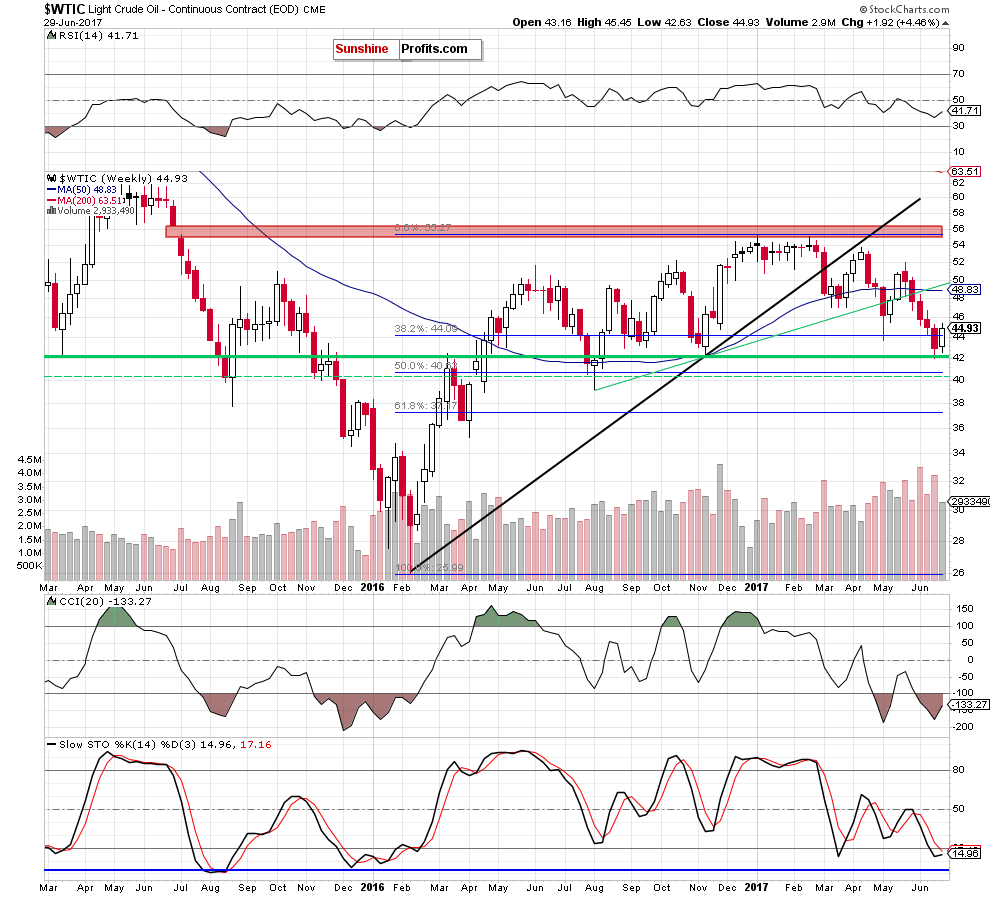

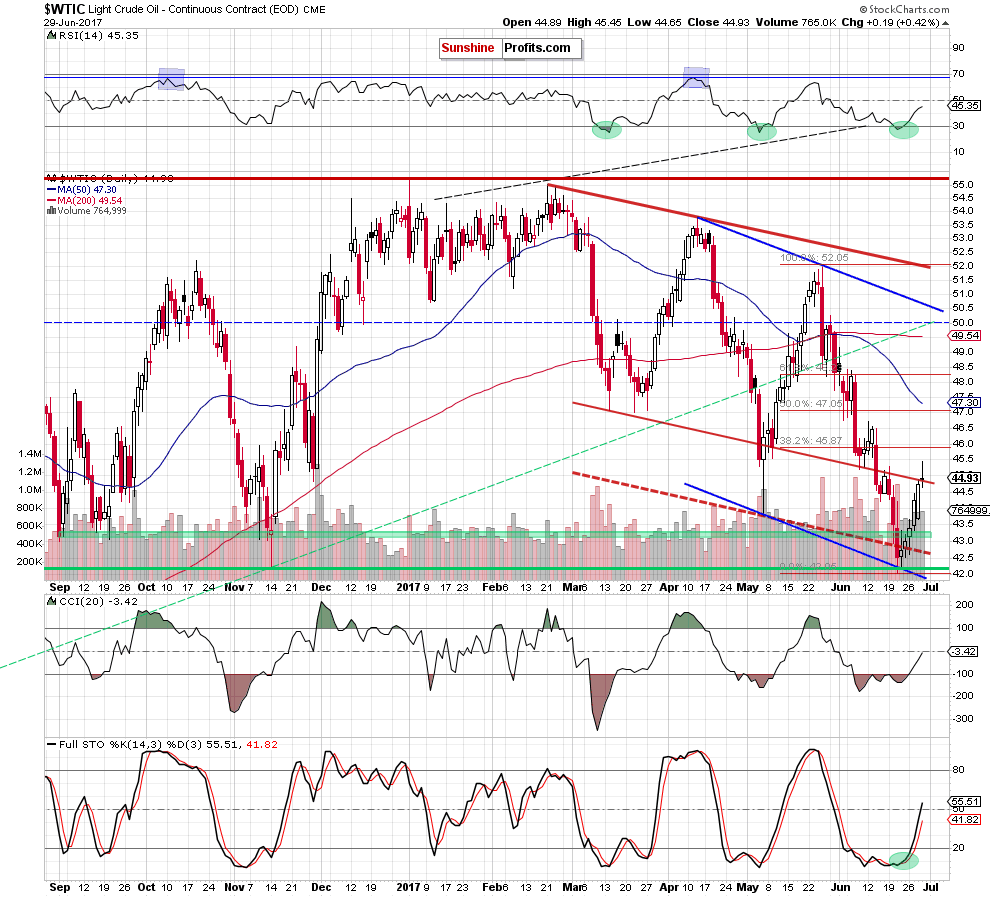

Looking at the daily chart, we see that crude oil moved higher and climbed above the lower border of the red declining trend channel. Although the black gold gave up some gains later in the day, light crude closed yesterday’s session slightly above this resistance line, invalidating the earlier breakdown. This is a positive development, which suggests higher prices in the coming day(s) – especially when we factor in the medium-term picture (an invalidation of the breakdown under the 38.2% Fibonacci retracement) and the buy signals generated by the indicators, which remain in place, supporting further improvement.

What’s next for Black Gold?

Nevertheless, in our opinion, such price action will be more likely and reliable if the black gold closes today’s session above the lower border of the red declining trend channel. In this case, we’ll see an increase to our yesterday’s upside targets:

(…) the next upside target for oil bulls will be around $46.50-$46.71, where the mid-June highs are. If this resistance is broken, we may see an increase to $48.20-$48.42 (early June highs) or even to the upper border of the blue declining trend channel (currently above the barrier of $50).

Summing up, long (already profitable) positions continue to be justified from the risk/reward perspective as crude oil closed the day above the previously-broken lower border of the red declining trend channel and invalidated the earlier breakdown, opening the way to higher levels.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: bullish

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at $40.40 and the upside target around $50) We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, there will be no regular Oil Trading Alert on Monday, but if the situation changes dramatically, we will send you a quick note with our latest analysis and thoughts on that matter.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts