Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $51.16 is justified from the risk/reward perspective.

The days of the oil upswing look to be numbered. The bulls have been unable to break above nearest resistances. Certainly, global growth uncertainties as reflected in tiny oil demand growth have taken their toll. Will the historic Japan-Iran meeting come to the bulls' rescue? Judging the outlook in its entirety, we've just made a decision to open a new trading position. Let's jump right into the details.

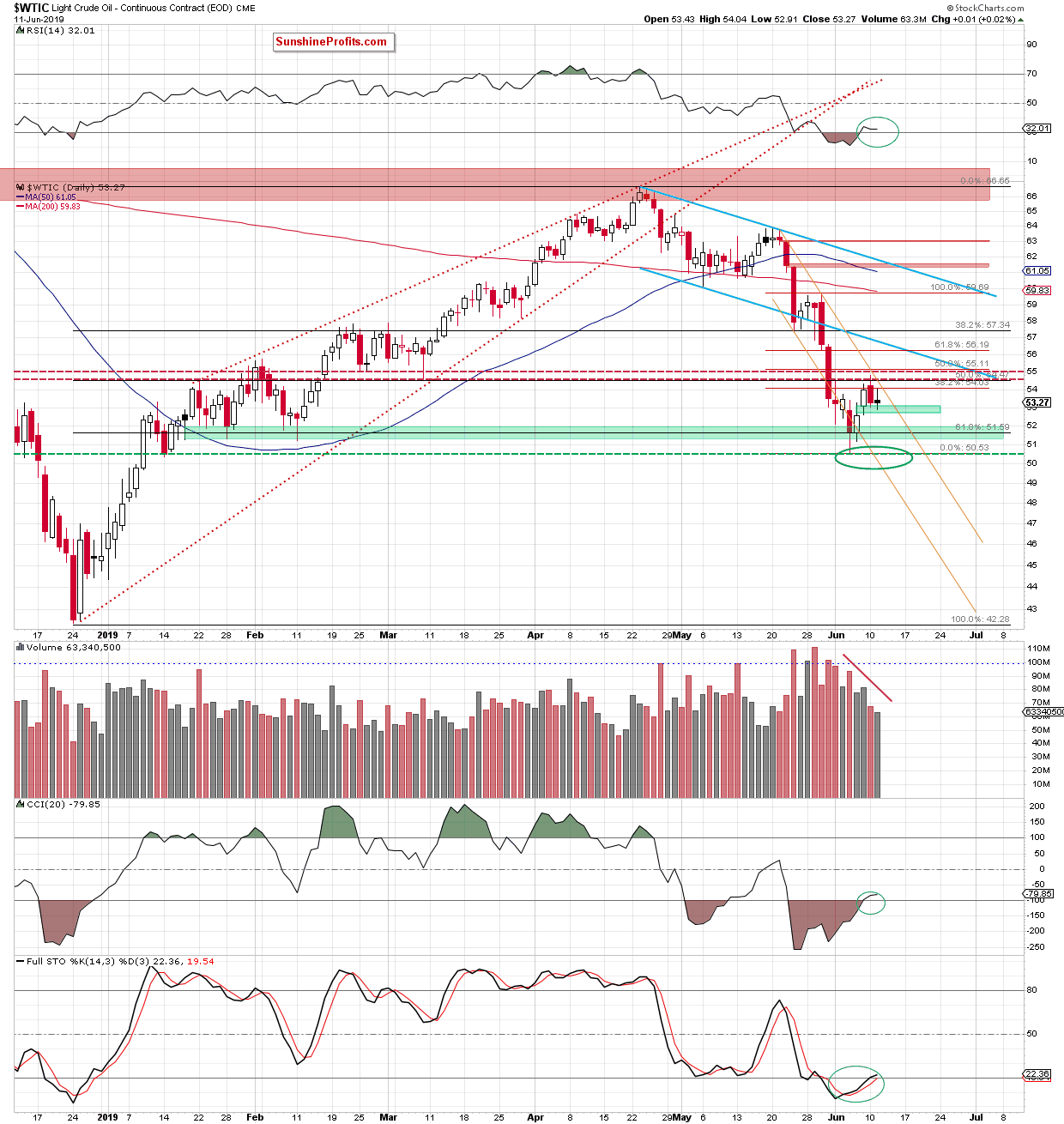

Let's take a closer look at the chart below (chart courtesy of http://stockcharts.com)..

Earlier on Monday, crude oil has verified its earlier breakdown below the late-February and early-March lows. The bulls have been unable to hold on to their gains above the early-June highs, and the oil price has sharply reversed lower.

Yesterday's session brought us both a downside and upside action: a test of the green support and another failed attempt to move higher. Light crude trades not only below the 38.2% Fibonacci retracement (Monday's action means invalidation of the earlier tiny intraday breakout above it), but also inside the declining orange trend channel. These factors increase the probability of another move to the downside in the coming days.

We also see progressively decreasing volume on recent upswings, subtly suggesting that the power of the bulls isn't what it's made to look like. The volume picture simply doesn't support the bullish case. The bulls have issues breaking above the nearest resistances, making us think that a test of the last week's low or even a fresh June low may be just around the corner.

Taking all the above into account, re-opening short positions is justified from the risk/reward perspective. All details below.

Summing up, the upswing originating in the second half of previous week has been giving way to a renewed push lower. Declining volume of recent upswings shows decreasing participation of the bulls. Despite any attempts to push the price higher, oil is still trading below the 38.2% Fibonacci retracement and inside the declining orange trend channel. The chart deterioration coupled with today's downside momentum justifies opening a short position.

Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $51.16 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist