Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $60.55 and the next downside target at $54.47 is justified from the risk/reward perspective.

Oil has truly plunged on Tuesday, yet it looks to have caught a bid since. Is this a dead cat bounce, or there is more to the story? Better to take a look at the charts and read the tape of previous sessions to see the odds of any upcoming moves. We have done that and you'll find below how it all squares with our open position.

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

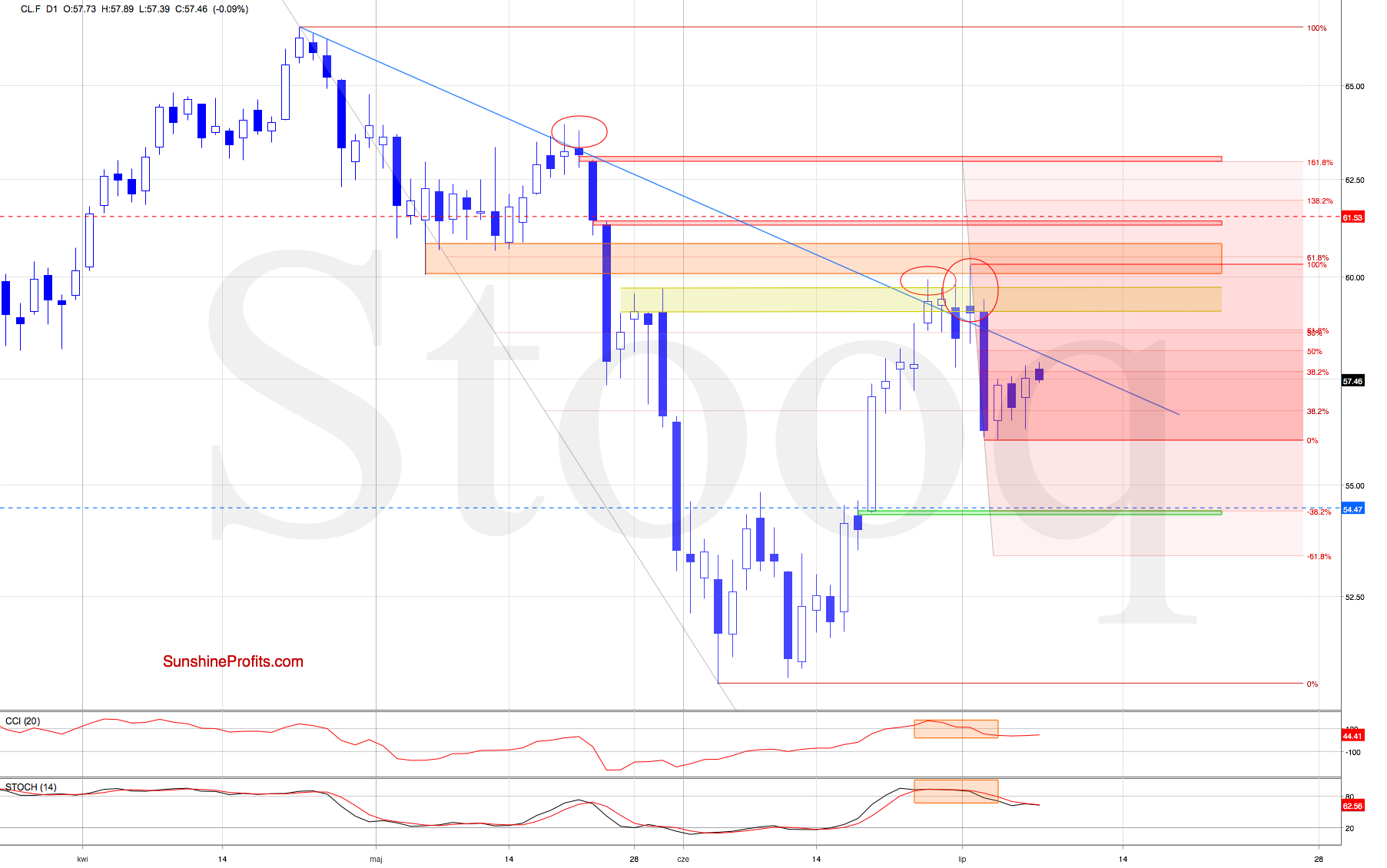

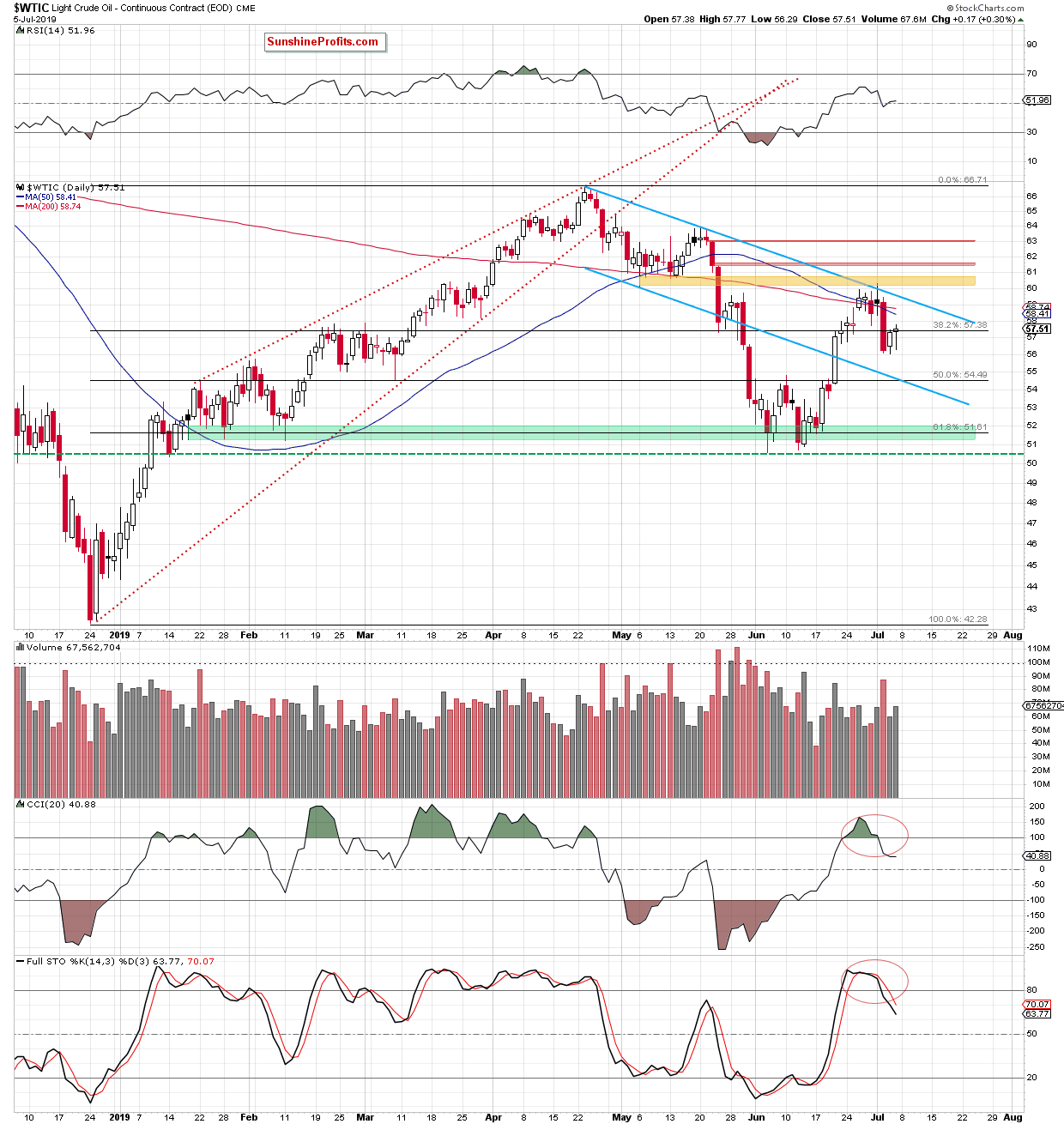

Crude oil futures bounced from its Friday's lows, and climbed to the 38.2% Fibonacci retracement that's based on the recent downward move. Although the commodity moved above it, this improvement proved only temporary and crude oil futures finished Friday's session below this resistance.

Earlier today, the bulls tried to go north once again, but the above-mentioned resistance stopped them again, triggering a pullback. As a result, black gold invalidated its earlier breakout for the second time in a row, which suggests that further deterioration may be just around the corner. This is especially the case when we factor in the sell signals generated by the daily indicators.

If the bears show up with force on the trading floor today, we'll likely see a realization of our Wednesday's scenario soon:

(...) Should the situation develops in tune with our assumptions, black gold is likely to extend losses and test the previously-broken lower border of the blue declining trend channel (currently at around $54.70), or even drop to the 61.8% Fibonacci retracement in the following days.

Summing up, after Tuesday's plunge, oil price has stabilized and ended Friday's session modestly higher. The important thing however is that no nearby resistances have been bested, and neither today have the bulls had success in doing so. Instead, black gold appears to be ready to roll over and decline. The daily indicators' sell signals support the bears, and our profitable short position remains justified. As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $60.55 and the next downside target at $54.47 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist