Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-6,1 with $54.81 as a stop-loss and $65.50 as the initial price target.

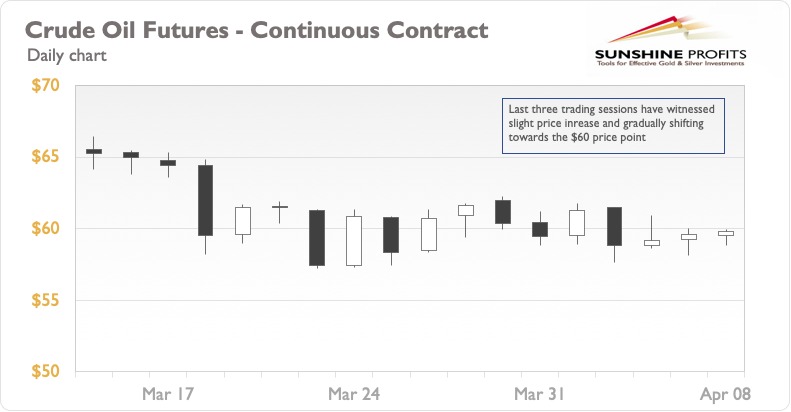

Oil has been hovering around the $60 level for approximately three weeks now and I expect it to display similar behavior for the nearest trading sessions. The reason for the black gold not moving definitively in either direction is a lack of consensus on future oil demand. While it is true that there is a strong third wave of Covid-19 cases across major economies which is resulting in lockdowns, the market is expecting it to be a short-term phenomenon. Therefore, there is a watch and wait position taken by players in the oil market which is keeping prices rangebound as seen from the chart below.

The high crude prices have prompted large oil exporters like India and China to look for alternative sources. India urged Saudi Arabia to boost oil production to soften prices but did so in vain. Saudi Arabia responded by increasing prices to be sold to Asian countries, mainly India. India then shifted a portion of its purchase from Saudi Arabia to the U.S., resulting in a less costly WTI, although with a longer shipping route. Since there are talks around lifting Iran sanctions, India is hoping to import a large amount of oil from Iran at lower prices. OPEC+ also scaled back on production cuts but it was not enough to lower the prices, which means that buying from non-OPEC+ members like India, China and African countries is a cost-effective way for the coming months.

This restructuring of the import-export mix may be bearish in the long-term but there are bullish implications for the short-term. Such major changes have risks involved, like a potential fall-out with Iran deal forcing India to buy oil at high prices from OPEC+. Geopolitical tensions also can play a role with the U.S. and India teaming up against China & Iran. Potential attacks on Saudi Arabian facilities by rebel groups also factor into the equation. All these risks are pointing towards higher chances of a sudden price rally in the coming days. In case there are stronger signals for demand recovery, then a price increase is much more likely.

To summarize, oil is keeping rangebound at $60 as expected. The breakout may happen in the coming days with a major geopolitical event/news like lifting of Iran sanctions OR a potential logistics disruption. I’m still betting on a long position based on risks involved which will push oil upwards.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist