Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): No positions in crude oil are currently justified from the risk to reward point of view.

Last Friday (Jan. 8) saw oil hit its highest level in nearly a year, supported by the news that Saudi Arabia would further cut output. However, further coronavirus restrictions and lockdowns are causing concerns. Oil prices did rise in early trading today (Jan. 12) and the teeter-totter continues between optimistic reopening hopes and a grim coronavirus reality. Therefore, our analysis and trading positions remain unchanged from last Friday.

Last Thursday (Jan. 7), I began the Oil Trading Alert with the following:

In today’s pre-market trading, crude oil moved higher once again after having rallied yesterday (Jan. 6). And both moves higher took place despite a relatively bullish action in the USD Index. As unlikely as it appeared to be, it seems that crude oil might actually move higher in the short term. The breakout above the mid-December highs is almost confirmed, but the relative strength vs. the U.S. dollar serves as a bullish confirmation.

What does it mean? It means that crude oil could still decline in the medium term, especially if the general stock market falls, but that it might do so only after moving temporarily higher.

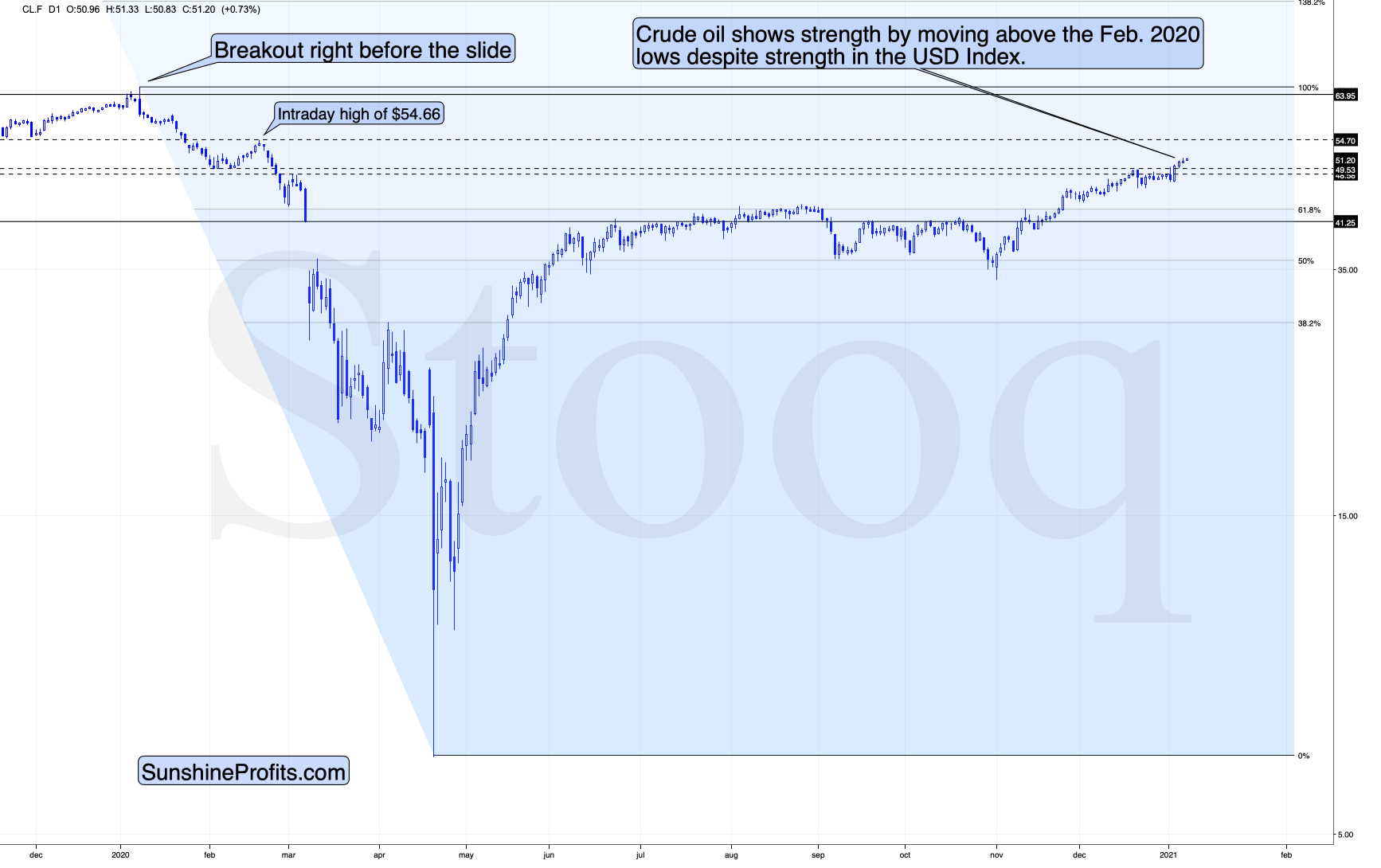

Indeed, crude oil didn’t decline on January 7. Conversely, it ended the session higher, and it also moved higher in Friday’s trading. This means that the scenario in which crude oil moves higher (to about $54.66 or so) has become a bit more probable. It’s not probable enough to open a long position, though.

As you can see on the above chart, the next resistance is provided by the March 2020 high – at $54.66.

It might be tempting to hold on to a short position at this time, but we think it would be better to close it and plan to re-enter at higher price levels. Some might consider going long, but the recently positive correlation with the USD Index (despite the last few days) prevents me from suggesting that.

If the USD Index soars shortly, crude oil is likely to fall, and while this might happen only after crude oil rallies above $54, it might also top at lower prices. Given the USDX factor, it seems better to prepare for re-opening the short position instead of opening a long one. Naturally, if crude oil rallies past $54.66 and it does so despite rallying USDX, the outlook might change, and we would strongly consider long positions in this case.

To summarize, it seems that crude oil might move temporarily higher before turning south again. Consequently, it seems that staying on the sidelines for now is justified from the risk to reward point of view.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): No positions in crude oil are currently justified from the risk to reward point of view.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief