Trading position (short-term; our opinion): Full speculative short position in crude oil with a stop-loss order at $70.22 and the initial downside target at $60.12 is justified from the risk/reward perspective.

In the past few alerts, the detail that we have emphasized was the necessity to look at the volume for a confirmation of a certain move. The price moves may have been bullish, but the volume was weak, so the final implications were not bullish. Yesterday, crude oil finally rallied on strong volume – did the situation become bullish because of that?

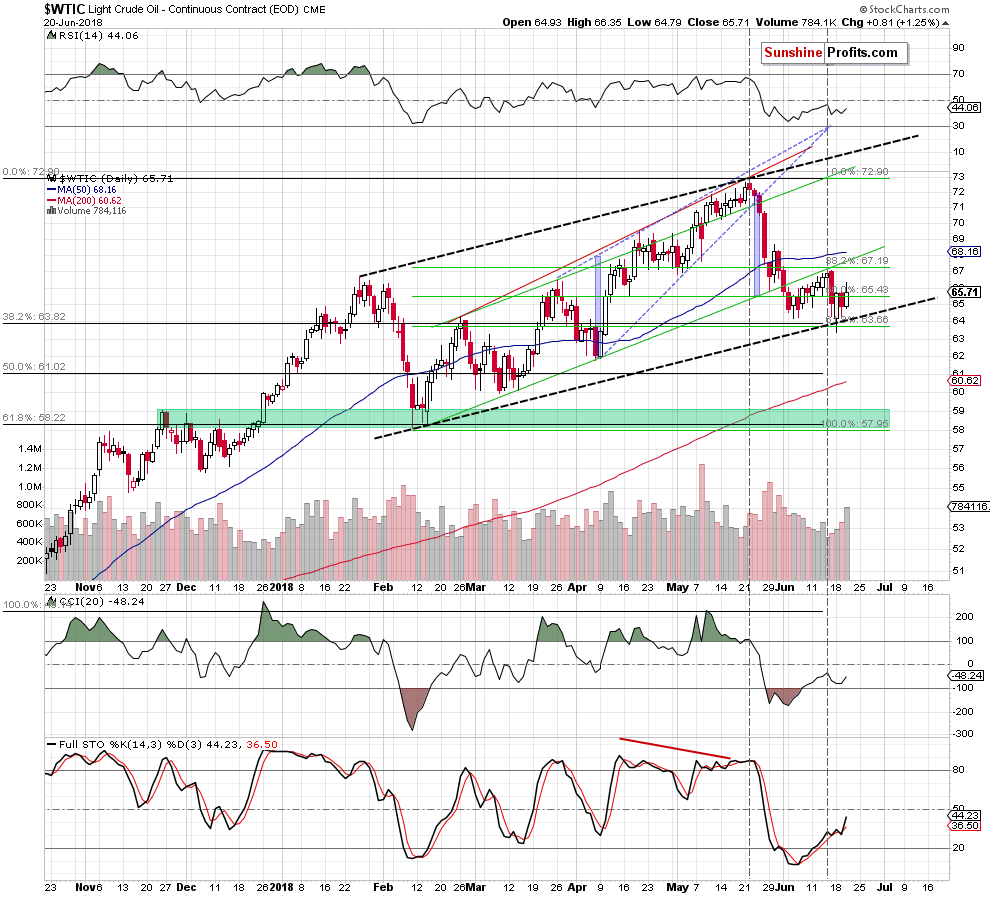

As surprising as it may appear, it wasn’t the case. The volume was significant, but the shape of intraday price action was bearish, so all the relatively big volume did was to confirm the bearish turnaround. Let’s take a look below for details (charts courtesy of http://stockcharts.com/).

As far as daily rallies are concerned, yesterday’s volume was the highest one in more than a month, so it seems bullish if you look at it and compare it to the change in the closing prices without considering the shape of the entire session.

After all, crude oil moved higher, so why would that be bearish? Because it reversed on an intraday basis. Crude oil didn’t erase its entire daily gains – it erased a bit less than a half. Yet, it doesn’t mean that the reversal was unimportant – it was, just as the volume confirms. According to the general rules of technical analysis, the entire session doesn’t have to be in the red for the reversal to be valid – it’s the shape of the session that matters.

Summing up, yesterday’s session was accompanied by significant volume, but it wasn’t bearish due to the reversal nature of the upswing confirmed by the shape of the daily candlestick pattern. It’s kind of ironic that for several days the bearish signs came from weak volume and when crude oil finally moved on high volume, the implications are still bearish, but that’s actually the case right now. It seems that lower, not higher prices of crude oil are to be expected in the next several days and weeks.

Trading position (short-term; our opinion): Full speculative short position in crude oil with a stop-loss order at $70.22 and the initial downside target at $60.12 is justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts