Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

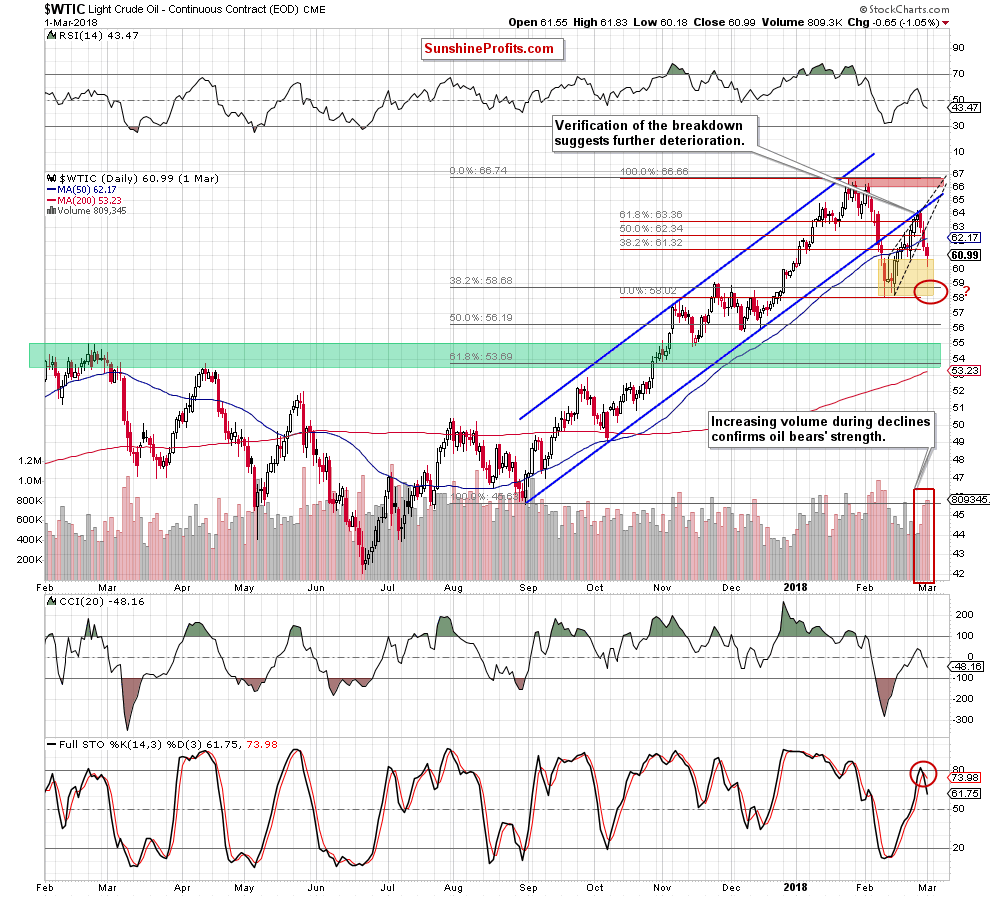

Verification of the breakdown, invalidation of the earlier breakout and higher volume during decline. In these three simple facts, we could summarize Thursday’s session. How do they present on the daily chart?

Let's check (charts courtesy of http://stockcharts.com).

Today’s Oil Trading Alert will be quite short, as crude oil remains on its way to our downside target marked with the red ellipse on the above chart.

Yesterday, light crude moved a bit higher after the market’s open (similarly to what we saw a day earlier), trying to touch the previously-broken 50-day moving average. Although oil bulls did what they could, the price stopped several cents below this resistance, exposing the buyers’ weakness.

Oil bears took advantage of this situation and pushed black gold lower, invalidating the earlier breakout above the 38.2% Fibonacci retracement. Despite the rebound, which we saw later in the day, the commodity closed Thursday’s session under this retracement, which together with the visibly higher volume that accompanied yesterday’s move and all negative factors about which we wrote in our last Oil Trading Alert doesn’t bode well for oil bulls.

Before we summarize today’s alert, let’s recall the quote from yesterday:

(…) the sellers gained new allies who can support their pro-decline scenario.

Who they are?

The first of them is the (…) fundamental picture of the oil market, which looks quite gloomy from the bulls’ point of view.

The second one is the verification of the breakdown under the lower border of the blue declining trend channel (we wrote about it in the summary of our yesterday’s alert), which negative impact on the price remains in the effect.

And speaking about the verification…. When we take a closer look at the daily chart, we also notice that thanks to yesterday’s upswing after the market’s open light crude also verified the earlier breakdown under the previously-broken 61.8% Fibonacci retracement, which gave oil bears another reason to act.

The third ally is an invalidation of the earlier breakout above the 50% retracement.

The fourth is the breakdown below the lower border of the very short-term black rising wedge (we marked it with the black dashed lines). This development suggest that the commodity will drop to (at least) the area where the size of the downward move will correspond to the height of the formation (…).

The fifth is an invalidation of the breakout above the 50-day moving average.

The sixth is the well known from our previous alerts volume. (…) it moved visibly higher during yesterday’s decline, confirming the engagement of the bears in the fight for lower prices of crude oil.

The seventh ally is the sell signal generated by the daily Stochastic Oscillator.

Summing up, short positions continued to be justified from the risk/reward perspective as crude oil extended losses on higher volume, invalidating additionally the earlier breakdown under the previously-broken 38.28% Fibonacci retracement. This suggests that the way to our downside target is open.

Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts