Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): No positions are justified from the risk to reward point of view. It would be prudent to wait for the market to find its support for the next rally. $60 is most likely to be a solid base, however, that needs to be confirmed during the next few trading sessions.

A massive sell-off on Thursday (Mar. 18) led to oil witnessing one of its sharpest falls in many months and crossing below the $60/barrel support point. The interesting point to note here is that there was no major trigger for this fall, other than loss aversion, which just shows that the market is at a point of high volatility and can swing big towards either side. The key question to ask now is whether this is a sign of bearish days in oil to come or is it a temporary over-reaction to concerns over a stronger dollar and sluggish demand.

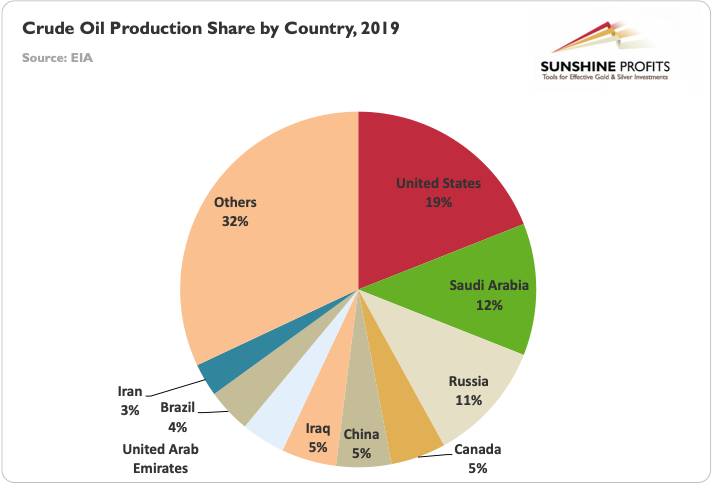

Oil supplies still remain in a deficit and are one of the key reasons for the oil rally during the past few months. Production cuts by OPEC (led by Saudi Arabia), resulted in a restricted supply of crude oil when Asian economies (mainly India & China) opened up and the demand for crude oil started approaching pre-pandemic levels.

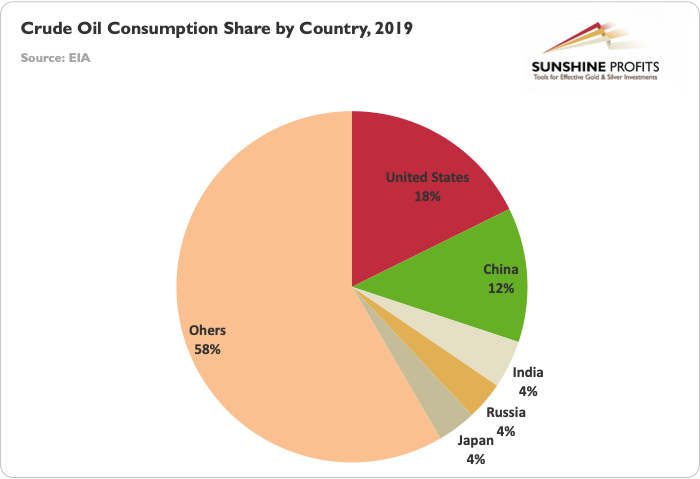

The higher crude oil bill for Asian countries is not doing any good here, as their industries depend upon keeping the costs of production to be cost-competitive. Hence, China is now buying a larger share of its oil from Iran rather than Saudi Arabia. Similarly, India has decided to look to the U.S. for its supply, even though the shipping routes may be longer. These recent developments shaped the market sentiments sufficiently enough for oil’s resistance to be in the $65-70 levels, at least for the near term.

The fundamentals still favor a high price, as production is still lower compared to demand and the current high inventory levels are due to refinery shutdowns in the U.S. last month due to severe winter weather in Texas and other neighboring states. But as I mentioned in my previous analysis, the market is at a precipice and is poised to sway in either direction – as there are robust reasons for both an up and down in the market.

The trigger for a mass sell-off was the dollar strengthening on Thursday (Mar. 18) from 2-week low as the benchmark US 10-year Treasury yield rose to 1.74% for the first time since January 2020. The other influential supporting points include an influential IEA report which did not support a sustained oil rally. Investors took it as a key signal to book profits for now, as future movement remains unclear.

Demand is also an area of concern, especially now, when European countries are banning some vaccines and further lockdowns can slow down the opening up of economies. However, major consumers including the U.S., China and India are still pulling strong demands and will continue to shape the market fundamentals as before.

The Federal Reserve, during its meeting on March 17, decided to keep the interest rate unchanged and improved its economic forecast. This good news for the oil market should have resulted in a price increase. But as we see from chart below that did not happen, and in fact prices dropped slightly.

In all probability, this news delayed the massive sell-off by just one day, as the market has been in a bearish mode since last Friday (Mar. 12). After a long rally lasting more than three months, there is always skepticism on whether this upside will continue, even though the fundamentals say so.

I don’t think this fall is a sign of bearish days to come in the oil market. The $60/barrel is a strong support and while oil will still remain volatile, I am bullish for at least the next three months. Having said that, one must also consider that right now the market is over-reacting to unfavorable new information, but this is likely a short term (2-3 weeks) trend.

This week has seen a lot of action and it is still better to wait and let the market digest the new information before jumping in. I will remain on the sidelines for this week and will enter the market early next week, most likely in long positions. The exact entry points and targets will be more certain then from the risk-reward point of view.

To summarize, there is skepticism as the crude rally has continued for over three months and investors are preferring to book profits this week amidst several developments in the market. U.S. interest rates remain unchanged, and a better economic outlook and stronger Asian demand failed to take oil to the $70 mark. Instead, the market reacted sharply to a stronger dollar and an IEA report, leading to Thursday’s fall in prices. It would be wise to stay on the sidelines this week in order to better assess the extent of skepticism in investors, and to find a better entry point into the market. For the long term, when more demand comes online, we will see higher price points in the black gold.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): No positions are justified from the risk to reward point of view. It would be prudent to wait for the market to find its support for the next rally. $60 is most likely to be a solid base, however, that needs to be confirmed during the next few trading sessions.

Thank you,

Nishant Jain, MBA, CPSM

Oil Trading Strategist