Trading position (short-term; our opinion): Full speculative short position in crude oil with a stop-loss order at $70.22 and the initial downside target at $60.12 is justified from the risk/reward perspective.

Friday’s rally took black gold to the levels that we saw at the end of the previous month, but is the road to the north wide open?

Let’s take a closer look at the chart below (charts courtesy of http://stockcharts.com).

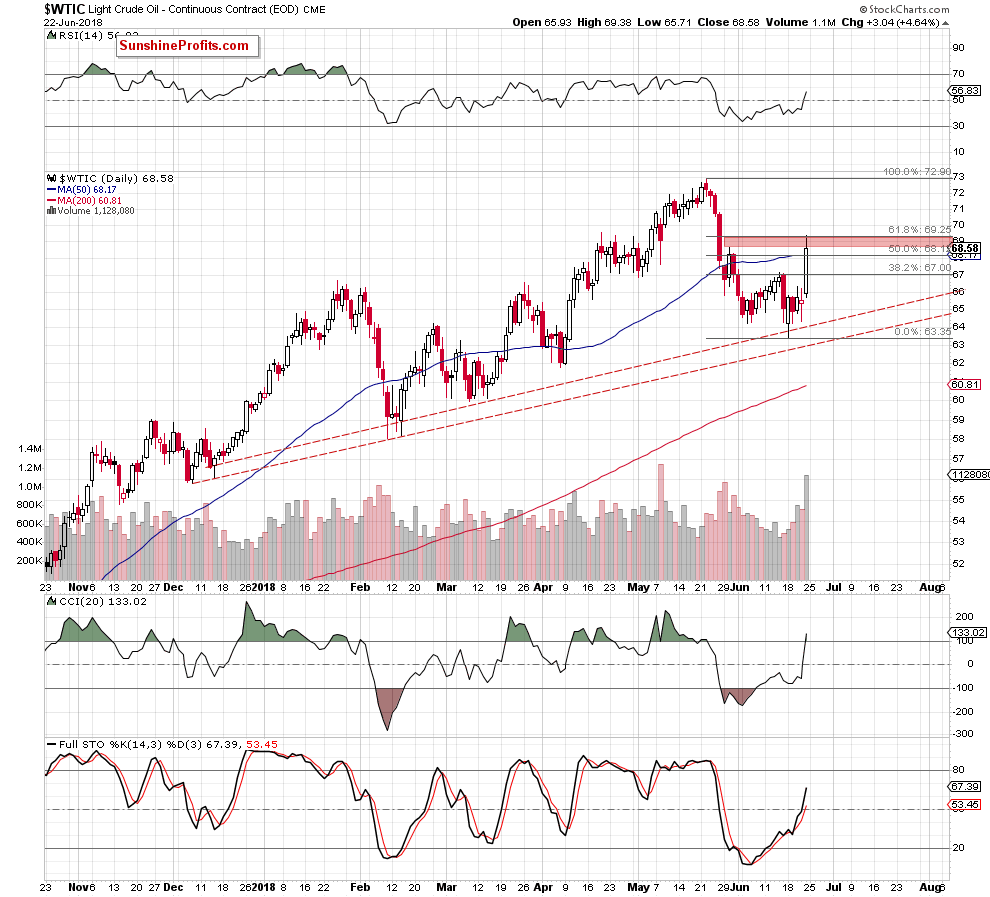

The first thing that catches the eye on the daily chart is a sharp move to the upside, which took crude oil not only above the mid-June high, but also above the 38.2% and the 50% Fibonacci retracements.

At the first sight, from the technical point of view, this is a bullish sign, which should translate into further rally. But will we see such price action in the coming days? Unfortunately (for the bulls) we have some doubts about it. Why?

As you see, Friday’s upswing materialized on significant volume, but it seems to us that it does not reflect the real strength of the bulls but only the exaggerated reaction of the buyers to Friday's news (after the OPEC agreed on a small increase in production).

Additionally, black gold closed the previous week under the red resistance zone (created by the May 30 high and the 61.8% Fibonacci retracement), which suggests that as long as there is no successful breakout above it reversal and lower prices of the commodity are very likely.

If this is the case and crude oil moves lower from current levels, we’ll likely see a comeback to around $64.14, where the upper red dashed support line (based on daily openings) currently is. An additional signal favoring this theory will also be a significant reduction in volume during today's session and increased activity of the supply side in the following days.

Nevertheless, if we see a breakout and a daily closure above the red zone, we’ll consider closing short positions. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): Full speculative short position in crude oil with a stop-loss order at $70.22 and the initial downside target at $60.12 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts