Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Wednesday, black gold lost 0.55% after the EIA report showed that crude oil inventories increased for the first time in five weeks. As a result, light crude slipped to the May peak, but then rebounded. Is this a verification of the earlier breakout or the first step to lower prices?

Although the EIA report showed that gasoline inventories fell by 5.5 million barrels, easily beating expectations for a decline of 17,000 barrels and distillate supplies dropped by 5.2 million barrels, the data also showed that crude oil stockpiles rose by 856,000 barrels, missing analysts' expectations for a decline of 2.6 million barrels and marking the first increase in five weeks. Additionally, domestic production rebounded by 1.1 million barrels per day, which affected negatively investors’ sentiment. In these circumstances, crude oil moved a bit lower, but will oil bears manage to push the commodity lower in the coming days?

Crude Oil’s Technical Picture

Let’s examine the technical picture of the commodity and try to find out what we can expect in the near future (charts courtesy of http://stockcharts.com).

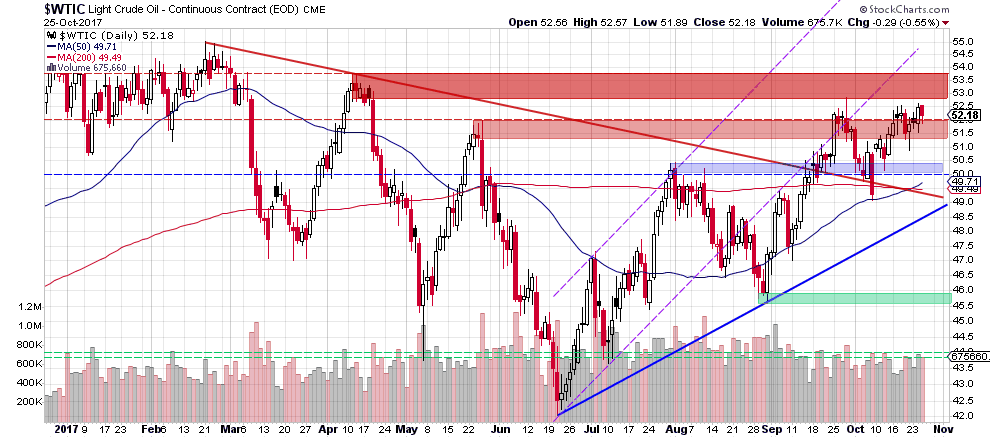

Yesterday, crude oil moved lower and tested the May high and the upper border of the red zone. On one hand such price action could be a verification of the earlier breakout above this area, however, even if this is the case and crude oil increases once again, we believe that the space for gains is limited and lower prices of black gold are ahead of us.

Why? We think that the best answer to this question will be quotes from our last alert:

(…) will oil bulls manage to push the price of the commodity higher in the coming days?

In our opinion, it is quite doubtful, because there were similar situations in the previous weeks. As you see, despite earlier improvements, all attempts to move higher failed and black gold declined in the following days.

Why oil bulls have so many problems with this area? In our opinion, the answer to this question is on the medium-term chart below.

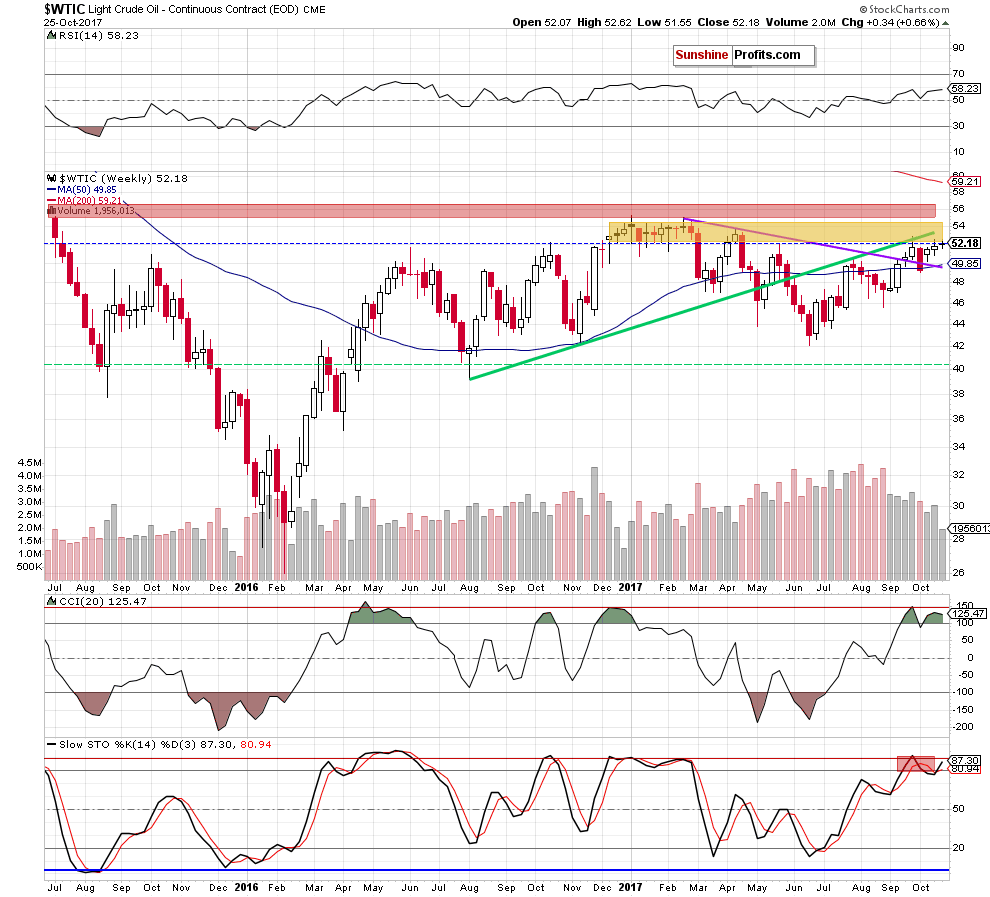

As you see on the weekly chart, the commodity increased once again to the yellow resistance zone, which is the major resistance since the beginning of the year. This area successfully stopped oil bulls in February, April, May and also in September, which means that as long as there is no breakout above it, the way to the higher prices will be closed and another reversal is just a matter of time.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil is still trading under the major resistance area, which successfully stopped increases many times earlier this year.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts