Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Crude oil hasn't closed higher yesterday and the previous series of rallies appears to face stiff headwinds. Is this it, or can the oil bulls pull a rabbit out of their hats? After all, they've reversed Monday's downswing already. Or does the prospect of wide spectrum U.S. - China uncertainties have the upper hand? It's making itself heard across the board and crude oil is no exception. Let's assess the technical picture now.

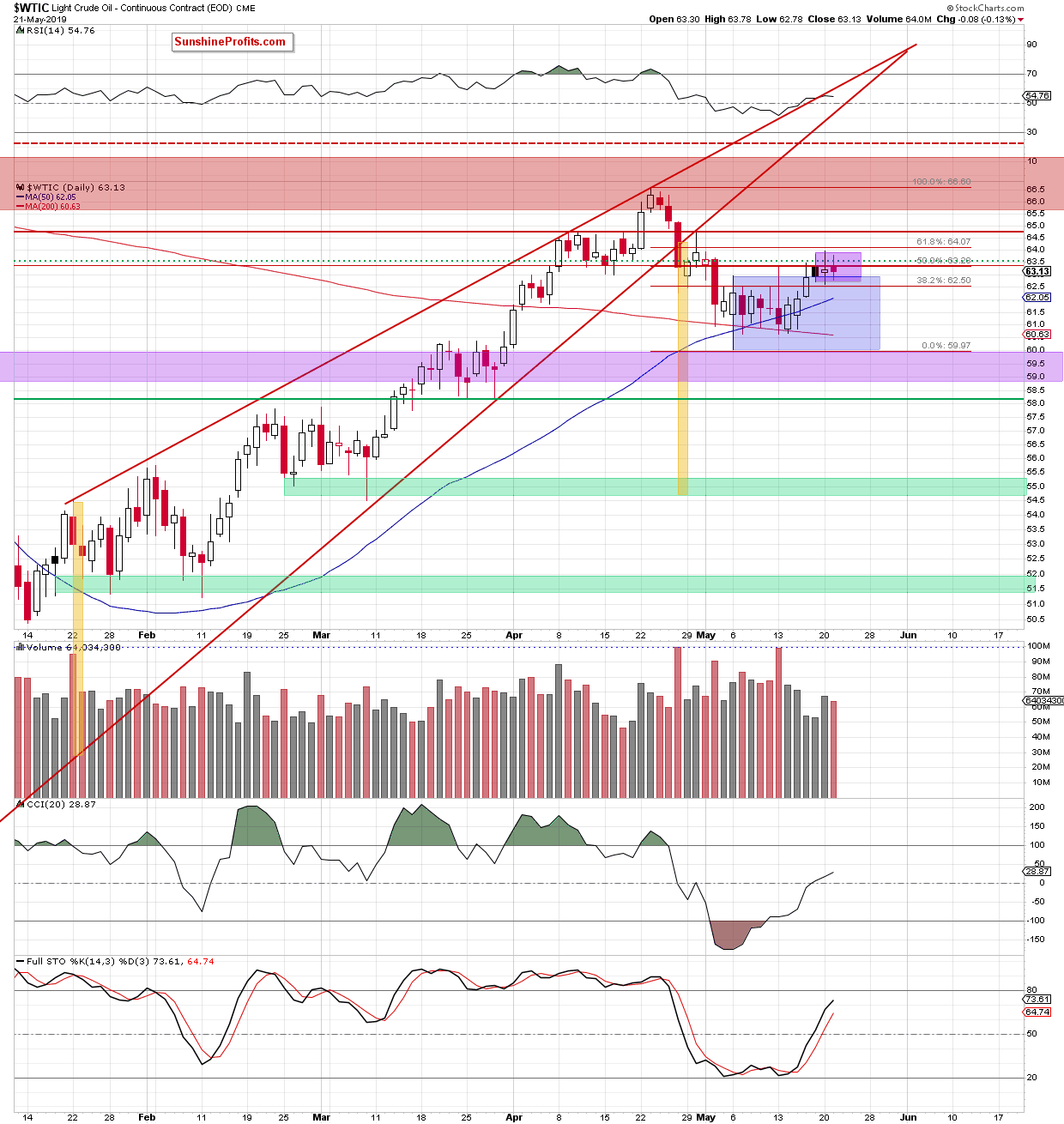

We'll take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Yesterday's crude oil trading was almost a mirror image of the Monday's session. While the bulls eked out minor gains on Monday, it was the bears who was stronger yesterday. The price closed down below the 50% Fibonacci retracement yet again. This has been the fourth unsuccessful attempt to overcome it in a row.

As we have pointed to in our yesterday Alert's title ("The Shifting Sands in the Oil Arena"), this suggests a bearish reversal of fortunes ahead. Indeed, at the moment of writing these words, black gold changes hands at around $62.20 which is back inside the blue consolidation.

Should the commodity keep moving lower from current levels, we're likely to see at least a test of the lower border of the blue consolidation. Such a move lower is supported by the unconvincingly low volume of the preceding upswing days.

Summing up, the outlook for oil remains bearish. Oil is still trading below the previously-broken red horizontal line and has had trouble overcoming the 50% Fibonacci retracement. Today, it appears to be rolling over and heading south. The weekly indicators still supports the downside move. The short position continues to be justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist