Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, oil bulls took control after the market’s open, which resulted in a climb to an intraday high of $64.88. Will we see a double top formation or rather further rally after today’s EIA weekly report on inventories?

Before we know the answer to this question, let’s take a look at the charts below (charts courtesy of http://stockcharts.com) and find out what are they saying.

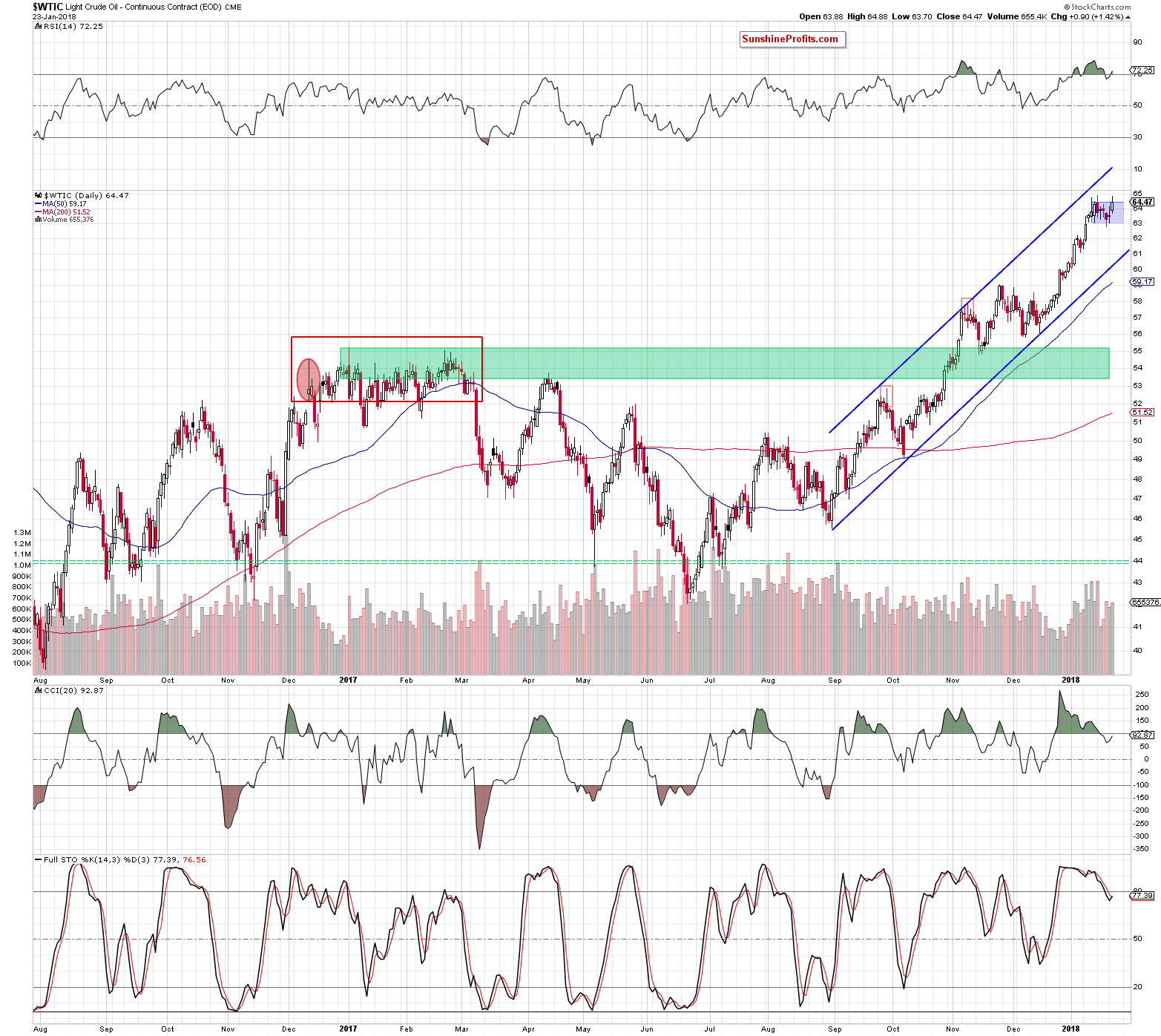

Looking at the daily chart, we see that after several days in uncertainty, oil bulls decided to push the price of crude oil higher. As we mentioned earlier, thanks to this upswing, light crude almost touched the January 16 high of $64.89, which could trigger a post double top formation decline in the following days.

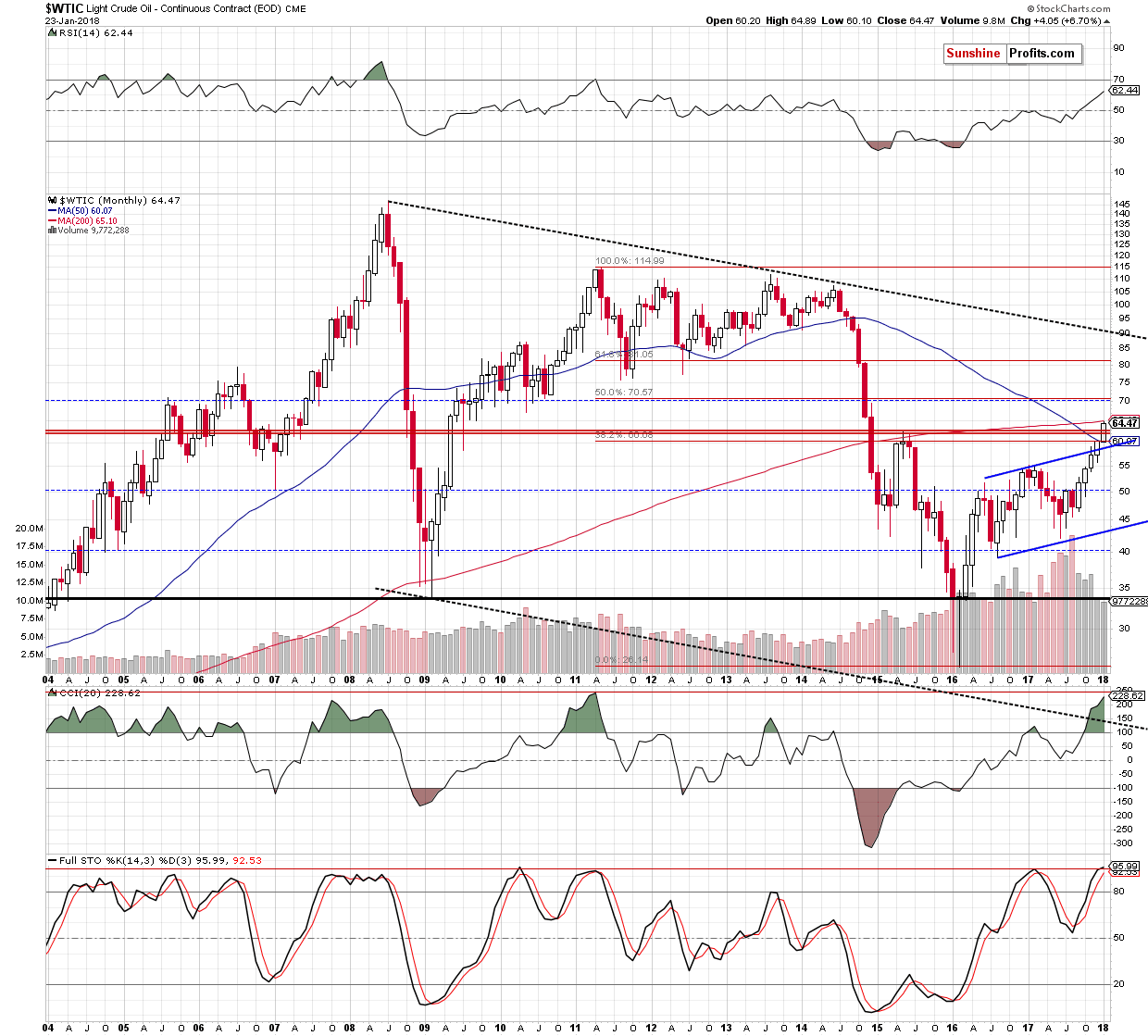

Nevertheless, please keep in mind that volume, which accompanied yesterday’s move was quite big, which together with a buy signal generated by the Stochastic Oscillator suggests that one more upswing and a test of the 200-month moving average seen on the long-term chart below can’t be ruled out.

Finishing today’s alert, we would also like to add that after yesterday’s market closure the American Petroleum Institute reported that crude inventories rose by 4.8 million barrels in the previous week, which was the first increase after nine weeks of drawdowns. Additionally, gasoline stocks rose by 4.1 million barrels, which doesn’t look bullish.

Nevertheless, despite the data, crude oil futures didn’t move sharply lower in the following hours. Instead, they remain in a consolidation slightly below yesterday’s peak, which means that investors are waiting for today’s government report before opening any sizable positions.

What does it mean to us? Consequently, we will continue to monitor the market later in the day and if we see a reliable show of oil bears strength, we’ll consider opening small short positions.

As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts