Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Oil bulls managed to retrace some of their Monday's losses yesterday. At first sight, the oil market may look calm and uneventful. But first appearances can be deceiving. And costly. Both in life and in trading. Let's take a look at what the charts are telling us. Especially the volume speaks... volumes. Much to the support of our open position. Precisely. Let's dive in.

Let's take a closer look at the chart below (charts courtesy of http://stockcharts.com).

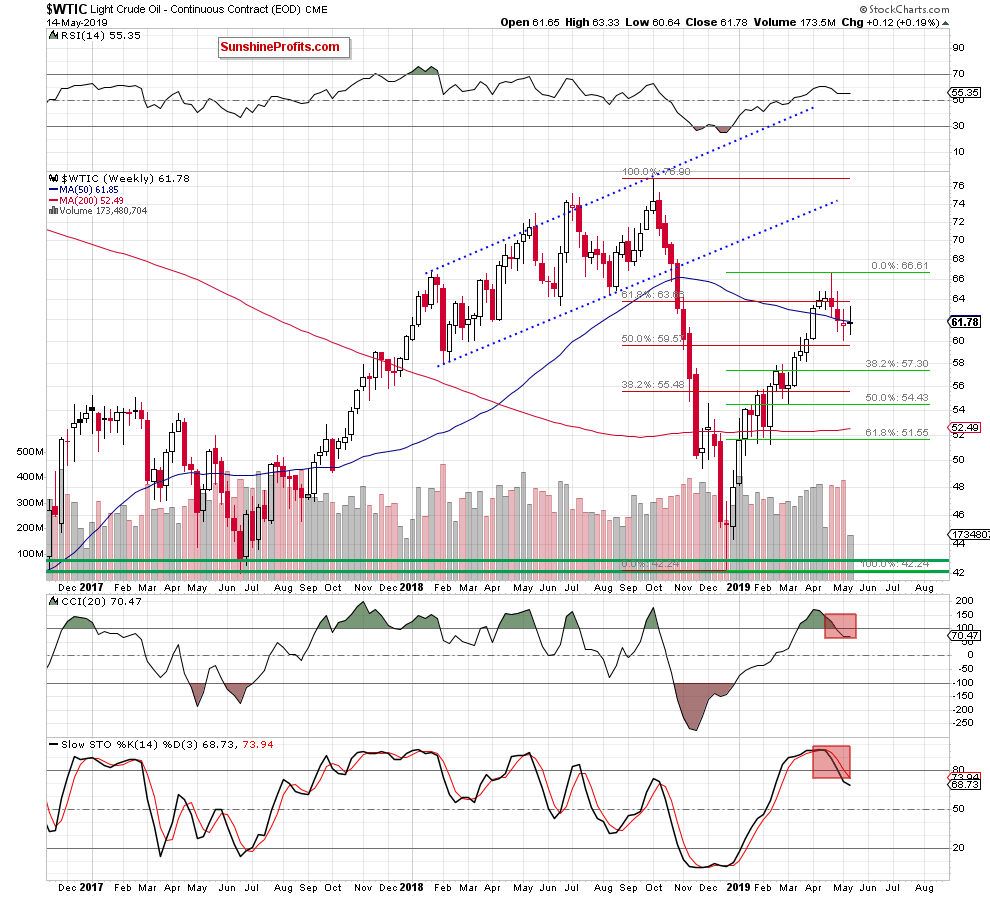

The weekly chart shows that this week, crude oil has gone pretty much nowhere. Both the moves up and down have been rejected so far. The weekly indicators remain on their sell signals however, favoring the bears.

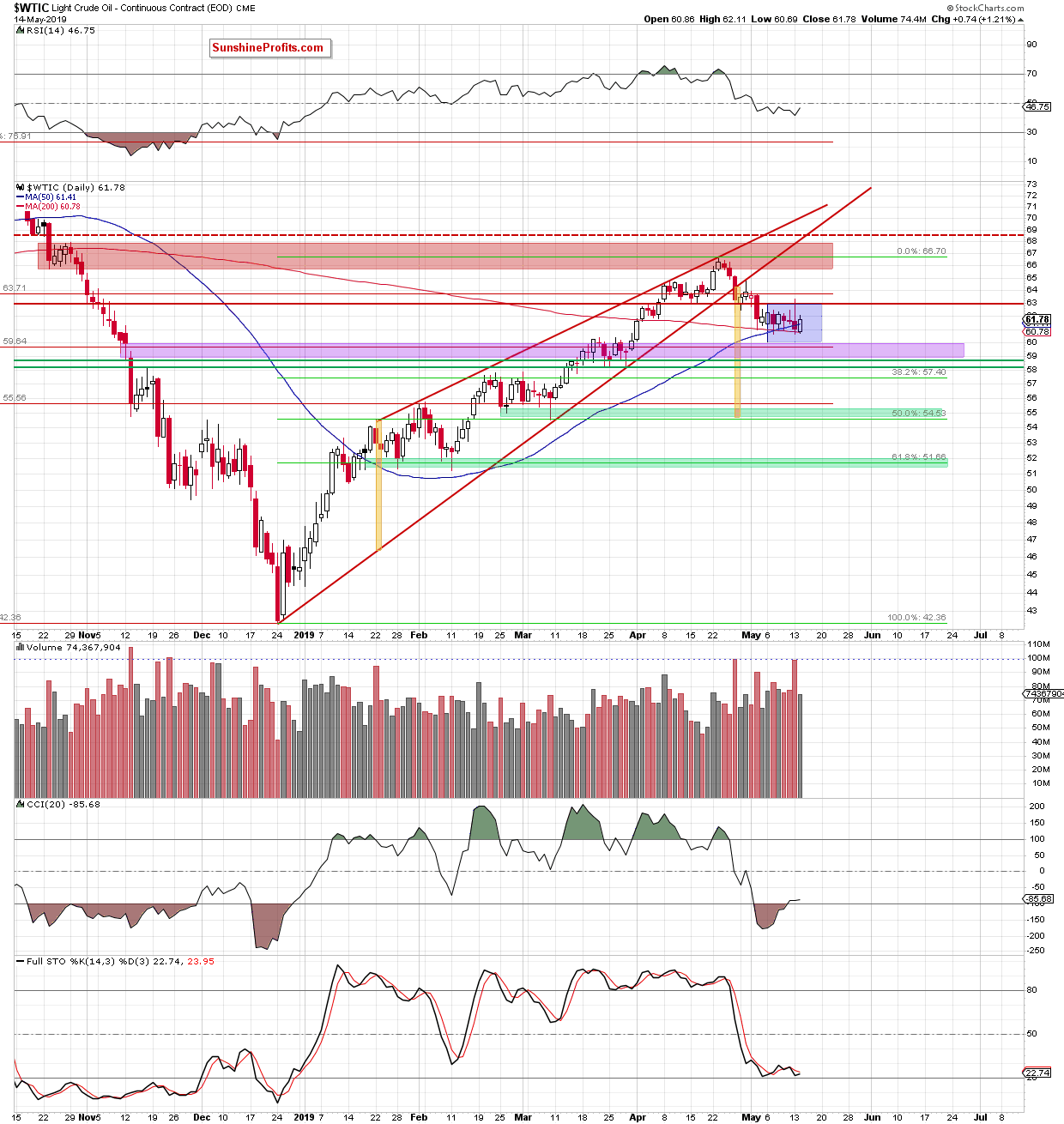

On the daily chart, we see crude oil still trading inside the blue consolidation. It means that our yesterday's observation remains up-to-date also today:

(...) Crude oil moved sharply higher in yesterday's early U.S. trading, but the resistance area created by the mid-April lows stopped the buyers. The price reversed sharply lower.

This looks like another verification of the earlier breakdown below this support-turned-resistance. It suggests deterioration in the coming days, today's modest upswing notwithstanding.

Crude oil actually didn't even manage to approach the red horizontal resistance and has already turned lower earlier today. At the moment of writing these words, it's trading at around $61.15.

Let's examine one more insightful clue: the volume. Namely, we'll compare the volume of yesterday's upswing to the preceding downswing aka reversal. It's beyond comparison at first glance, empowering the bears.

Nonetheless, lower oil values will be more likely and reliable only if black gold drops below the lower border of the blue consolidation and closes the day beneath it. To do so, the bears have to break below both the 50- and 200-day moving averages and also close the horizontal purple price gap.

Summing up, the outlook for oil remains bearish. Oil has given up most of its yesterday's gains and appears to be taking a breather before the next move lower. For now, it is still trading inside the blue consolidation. The bears look to be holding the upper hand however, as the red horizontal resistance line (it's based on mid-April lows) has reliably kept Monday's gains in check. The volume comparison of last two trading days also favors the bears. Besides, the position of the weekly indicators supports the downside move. The short position continues to be justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist