Trading position (short-term; our opinion): Long position in crude oil with target price at $54.48 and stop-loss at $49.87 is justified from the risk/reward perspective.

On Tuesday, crude oil gained over 3% and came back above $52, filling oil bulls with hope for higher prices of black gold. What adversities will the buyer have to overcome before we see the price of light crude higher?

Today’s alert is going to be quite short, because crude oil increased during yesterday’s session and came back above $52, erasing around 60% of the recent decline. Thanks to this move, the commodity climbed to the 50-day and the 200-week moving averages, but there was no breakout above these resistances, which means that the price of black gold is still trading in the red consolidation marked on the daily chart.

Therefore, we believe that the comments that we made yesterday remain up-to-date also today:

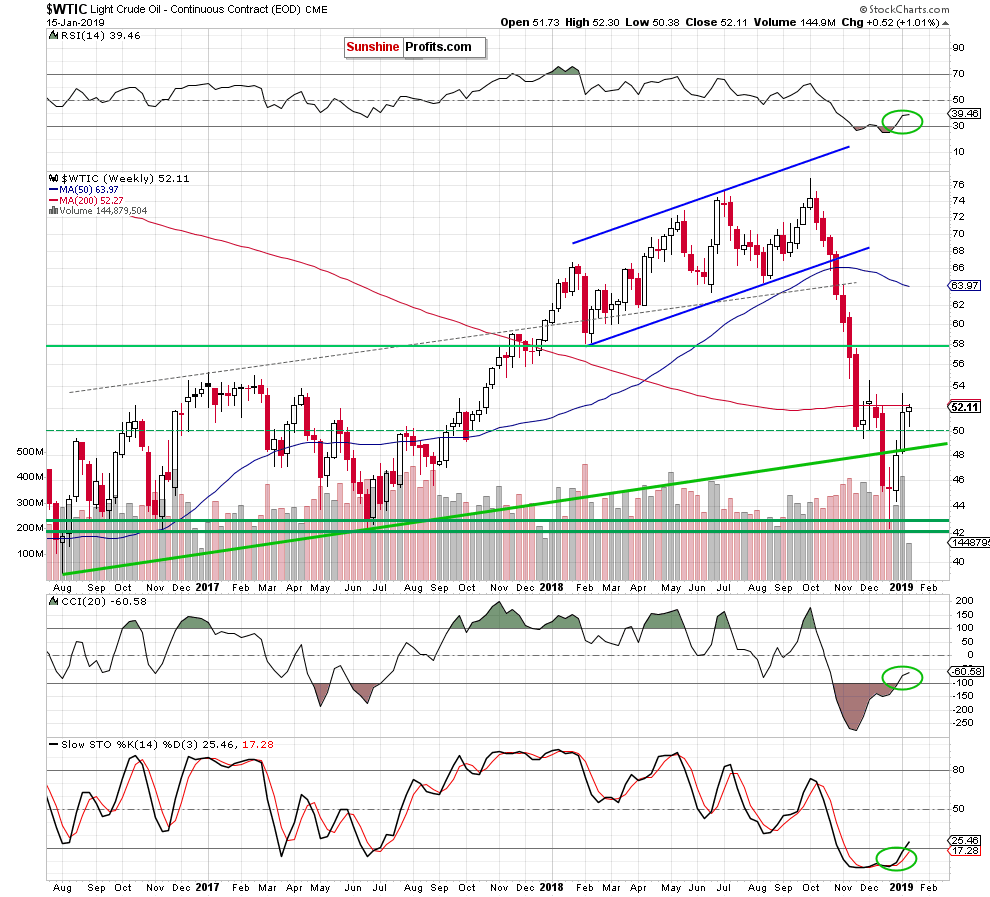

(…) the price of light crude remains above the long-term green line (it serves now as the nearest support) and the buy signals generated by the RSI, the CCI and the Stochastic Oscillator continue to support higher values of the commodity.

Additionally, when we take a closer look at the chart, we can notice two potential pro-bullish formations on the horizon. To see them more clearly, let's analyze the chart below (charts courtesy of http://stockcharts.com).

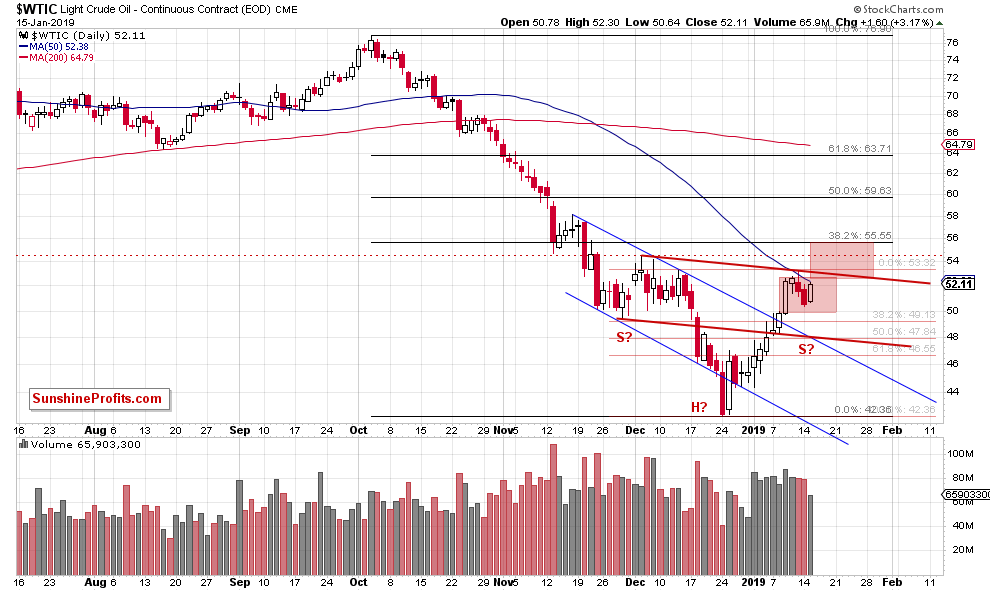

(…) the 50-day moving average triggered a pullback on Friday, which encouraged the sellers to act on the following session. Despite yesterday’s drop, light crude remains above $49.71, which marks the bottom line of the red consolidation seen on the daily chart.

Therefore, in our opinion, as long as there is no breakdown below this price another attempt to move higher is very likely – especially if we consider this consolidation as a small flag. Why? Because such a short-term consolidation phase often occurs during strong trends (we could observe an example of a similar formation during a strong downward move in mid-November). If this is the case, and the bulls take the next move to the north, we’ll see not only a test of the recent high, but also the red declining resistance line.

If the commodity breaks above them, the next upside target for the buyers will be around $55.45, where the size of the upward move will correspond to the height of the consolidation.

(…) before we summarize todays alert, we would like to draw your attention to the above-mentioned red declining resistance line based on the December and Friday peaks.

Why? Because from today’s point of view, it seems that the recent drops could be caused by the creation of the right arm of a potential reverse head and shoulders formation (yes, only potential, because until there is no breakout above the neck line of the pattern it can be considered only in this way).

If this is the case, we should also consider a short-lived pro-bearish scenario. What do we mean by that? If the situation develops in tune with this assumption, we’ll likely see a test of the late-November lows around $49.50 (which, in our opinion, may be the left arm of the formation) or even the lower red support line (parallel to the neck line and based on the above-mentioned potential left shoulder) in the following days.

At the moment of writing this alert, the aforementioned red line intersects the previously-broken upper border of the blue declining trend channel, which serves as an additional support in this area (around $48.10). However, taking into account the presence of the long-term green support line marked on the weekly chart, we think that the current correction will be stopped in this area (around $ 48.50).

Finishing today’s commentary, please keep in mind that this is only a potential scenario, the activation of which will become more possible only when the bulls show a visible weakness and fail to break through the abovementioned resistances.

Summing up, crude oil gained over 3% during yesterday’s session, but despite this improvement, the commodity is still trading inside the red consolidation, which means that as long as there is no breakout above the upper line of the formation (or a breakdown below the lower border) another bigger move is not likely to be seen. Nevertheless, taking into account earlier invalidations of the breakdowns and buy signals generated by the weekly indicators, we believe that higher prices of black gold are just around the corner and long positions continue to be justified from the risk/reward perspective.

Trading position (short-term; our opinion): Long position in crude oil with target price at $54.48 and stop-loss at $47.96 is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager