Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full short position in crude oil with $28.12 as the initial target price, and $51.13 as the stop loss level is justified from the risk to reward point of view.

The price of oil rose today, buoyed by the news of OPEC+ members agreeing on Tuesday (Jan. 5) to keep production steady for the months of February and March, with Saudi Arabia saying it would make further voluntary cuts. Iran’s seizure of a South Korean oil tanker was also partly responsible for the increase.

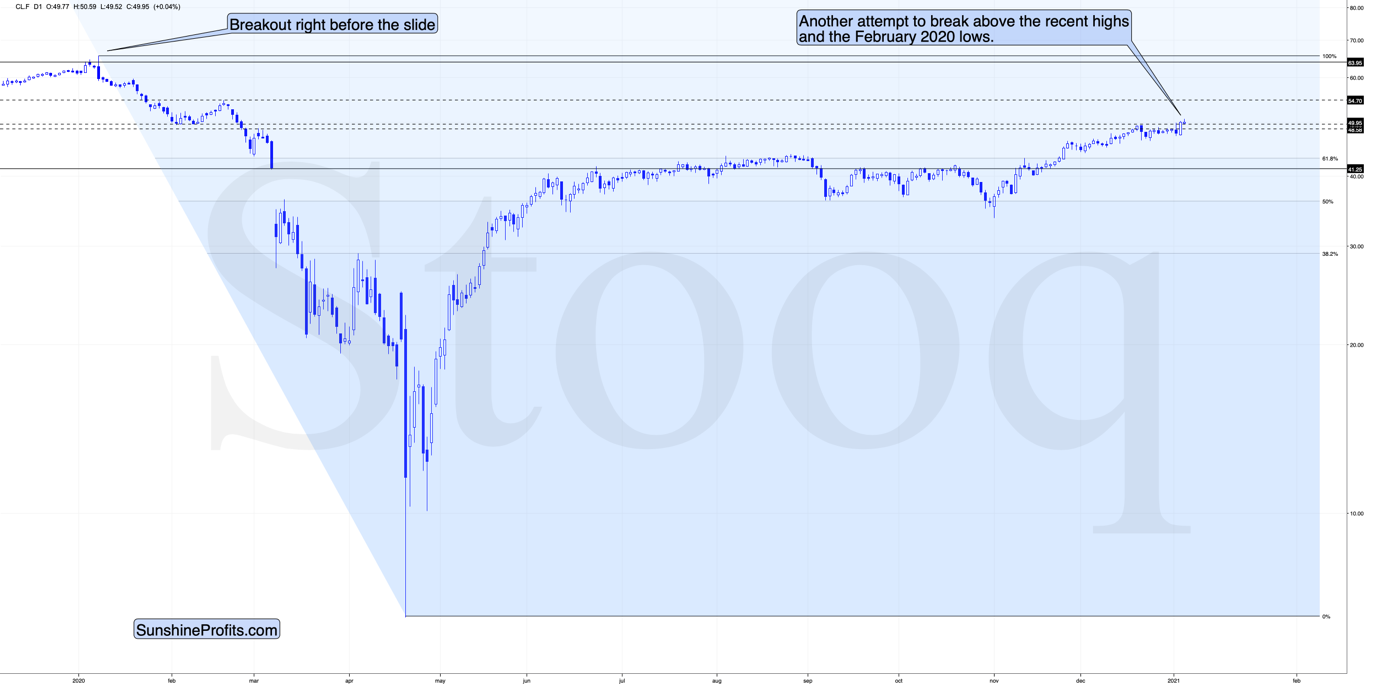

However, even though oil may have its upticks in January, as evidenced by this week’s gains, the overall trend still points to the downside. For now, concerns surrounding more severe coronavirus lockdowns and curbed demand remain valid. Most importantly – from the very short-term point of view – the breakout above the recent highs and the February 2020 lows remains unconfirmed.

From the long-term point of view, we see that on the first session of the year (Jan. 4), crude oil bounced off the resistance created by the February 2020 lows and then declined back below the late-2020 highs. In today’s and yesterday’s (Jan. 5) pre-market trading we see another attempt of black gold to “take out” these levels. The subtle reversal that we see in today’s pre-market trading suggests that it may not take long before crude oil slides.

The invalidation of the breakout would be bearish not only because of the invalidation per se, but rather because it would make the situation similar to how the previous year started.

Crude oil failed to break above the previous high in early January 2020 as well. The Jan 8, 2020 decline was more dramatic, but the January 4, 2021 slide is very visible too.

The decline that we witnessed back in 2020 was not very volatile at first, but it quickly became very volatile.

The previous indications coming from the analysis of the USD Index also remain up-to-date:

Why would crude oil be likely to top and slide? For instance, because the USD Index has been moving in the opposite direction to crude oil, and the former is currently already extremely oversold. Whether or not the USDX has already bottomed is not clear. It seems that waiting for a bearish confirmation from crude oil and – ideally – a bullish confirmation from the USD Index is currently a good idea from the risk to reward point of view. The confirmation in crude oil could come in the form of a daily reversal (perhaps a “shooting star” candlestick) during which it would touch one of its above-mentioned resistance levels.

To summarize, it seems that crude oil might have just topped or that it’s very close to an important top, and thus I think that a short position in it is currently justified from the risk to reward point of view.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full short position in crude oil with $28.12 as the initial target price, and $51.13 as the stop loss level is justified from the risk to reward point of view.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief